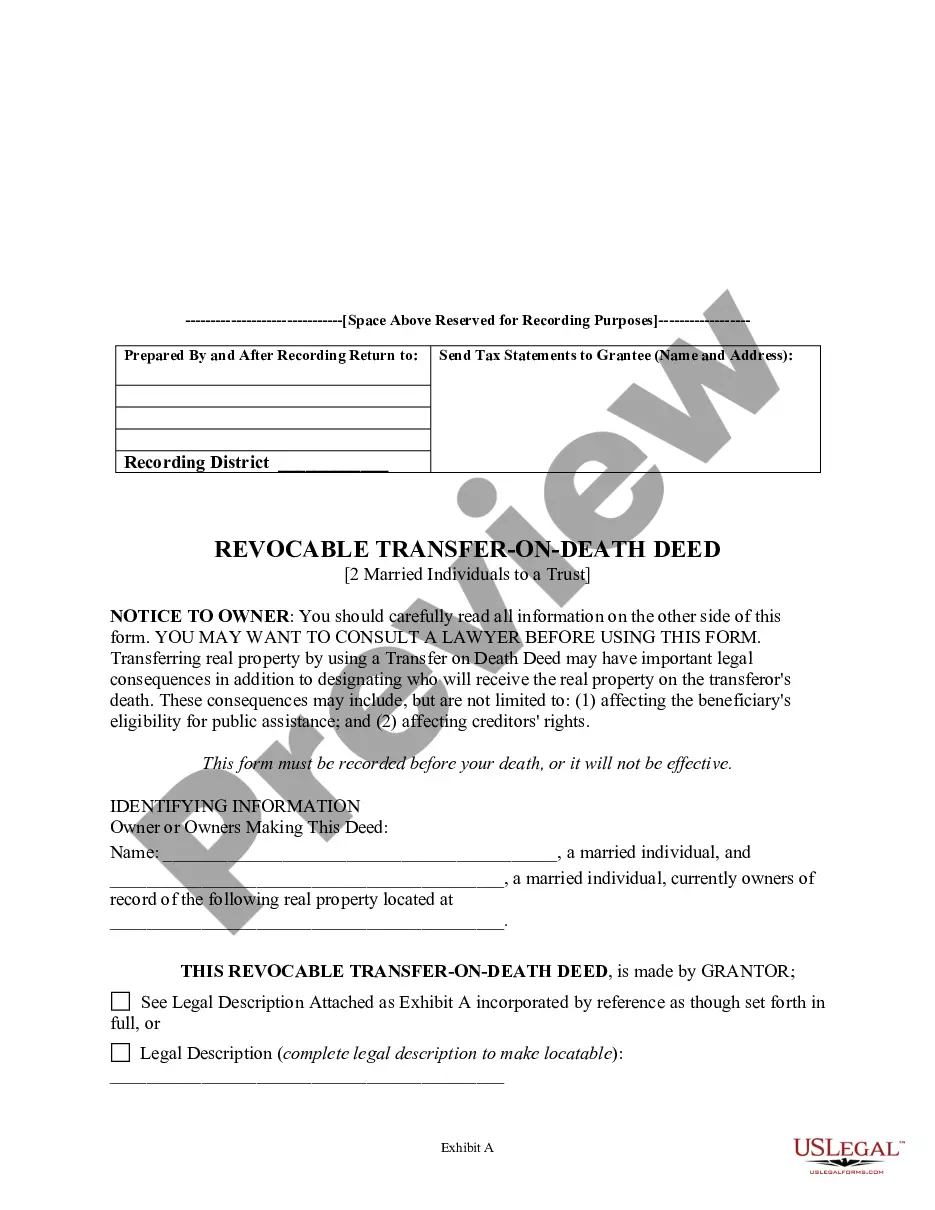

Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust

Description

How to fill out Alaska Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To A Trust?

Regardless of social or professional position, filling out legal forms is a regrettable requirement in the modern world.

It is frequently nearly impossible for an individual lacking legal education to create such documents from scratch, primarily due to the complex language and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Verify that the template you have selected is appropriate for your region, as regulations from one state or area do not apply to another.

Examine the document and review a brief overview (if available) of the scenarios the document can apply to.

- Our platform features a vast array of over 85,000 ready-to-use state-specific forms suitable for nearly any legal matter.

- US Legal Forms also serves as a valuable resource for associates or legal advisors seeking to enhance their time efficiency using our DIY documents.

- Whether you need the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust or any other valid document for your region, US Legal Forms has you covered.

- Here's how to obtain the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust within minutes utilizing our reliable platform.

- If you are already a subscriber, simply Log In to your account to download the required form.

- However, if you are new to our platform, please follow these steps before acquiring the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust.

Form popularity

FAQ

Generally, transferring property via an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust does not automatically exempt your beneficiaries from capital gains tax. However, the basis of the property may be stepped up to its current market value at the time of death, potentially reducing capital gains tax liability for the heirs. For personalized tax advice related to property transfer, it's wise to consult with tax professionals or legal experts.

While the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust offers many benefits, there are some potential downsides to consider. For instance, if the property owner incurs substantial debts, creditors may still have claims against the property, even after death. Additionally, if the owner becomes incapacitated, the TOD may complicate matters, as it cannot be used for asset management during their lifetime. Therefore, weigh these factors carefully.

Choosing between a Transfer on Death Deed and a beneficiary deed requires careful consideration of your individual situation. A Transfer on Death Deed can allow for more direct control over asset transfer without probate, while a beneficiary deed might provide more flexible options for managing assets during your lifetime. Assess your financial and familial needs carefully, as both options have distinct advantages. Consulting with an expert can help clarify which choice suits your circumstances best.

Many states in the U.S. recognize Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust, including Alaska, Arizona, California, and Florida, among others. Each state has its own rules and requirements for executing these deeds. It's crucial to consult with a legal expert familiar with your state’s regulations. This ensures proper compliance and effective transfer of ownership.

The disadvantages of an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust include the lack of immediate asset protection and possible complications in case of family disputes. Moreover, if not properly established, a TOD may create unintended tax implications for survivors. Consulting a real estate attorney or utilizing resources such as USLegalForms can provide clarity on these issues.

Yes, you can have two beneficiaries on an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust. By naming multiple beneficiaries, you can ensure that your property is distributed according to your wishes after your death. It’s important to consider how the property will be handled if one beneficiary predeceases you, so be sure to detail your wishes in the deed.

To transfer an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust to two beneficiaries, you must explicitly name both individuals in the deed. It is essential to ensure that the deed clearly states their equal rights to the property after your passing. Proper execution and recording of the deed with the appropriate county office are also crucial for it to be legally binding.

One potential disadvantage of an Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust is that it does not provide protections against creditors. This means that if one spouse has outstanding debts, creditors may claim the property upon death. Additionally, it does not address complexities that can arise from family dynamics, such as changes in marital status or disputes between beneficiaries.

Despite the benefits, there are some disadvantages to consider with a transfer on death deed, such as the potential for disputes among heirs. Additionally, this deed does not shield assets from creditors, which may pose risks later on. Importantly, it does not provide benefits like living trusts do for asset management. Evaluating your situation with a knowledgeable service like US Legal Forms can help you make an informed decision about the best approach for your specific needs.

While it is not legally required to have a lawyer assist you with a transfer on a death deed, particularly for the Anchorage Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust, having legal guidance can be very helpful. A lawyer can ensure the deed is properly drafted and executed, which minimizes potential issues later. If you prefer a more affordable option, platforms like US Legal Forms offer resources and templates to help you through the process confidently.