Wyoming Clauses Relating to Accounting Matters

Description

How to fill out Clauses Relating To Accounting Matters?

Have you been in the situation where you need to have paperwork for either business or personal functions almost every day? There are a lot of authorized file themes accessible on the Internet, but locating types you can depend on is not straightforward. US Legal Forms delivers a huge number of type themes, such as the Wyoming Clauses Relating to Accounting Matters, which are composed to meet state and federal demands.

If you are previously informed about US Legal Forms site and have your account, simply log in. Afterward, you can down load the Wyoming Clauses Relating to Accounting Matters template.

If you do not come with an account and need to begin using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is to the appropriate city/county.

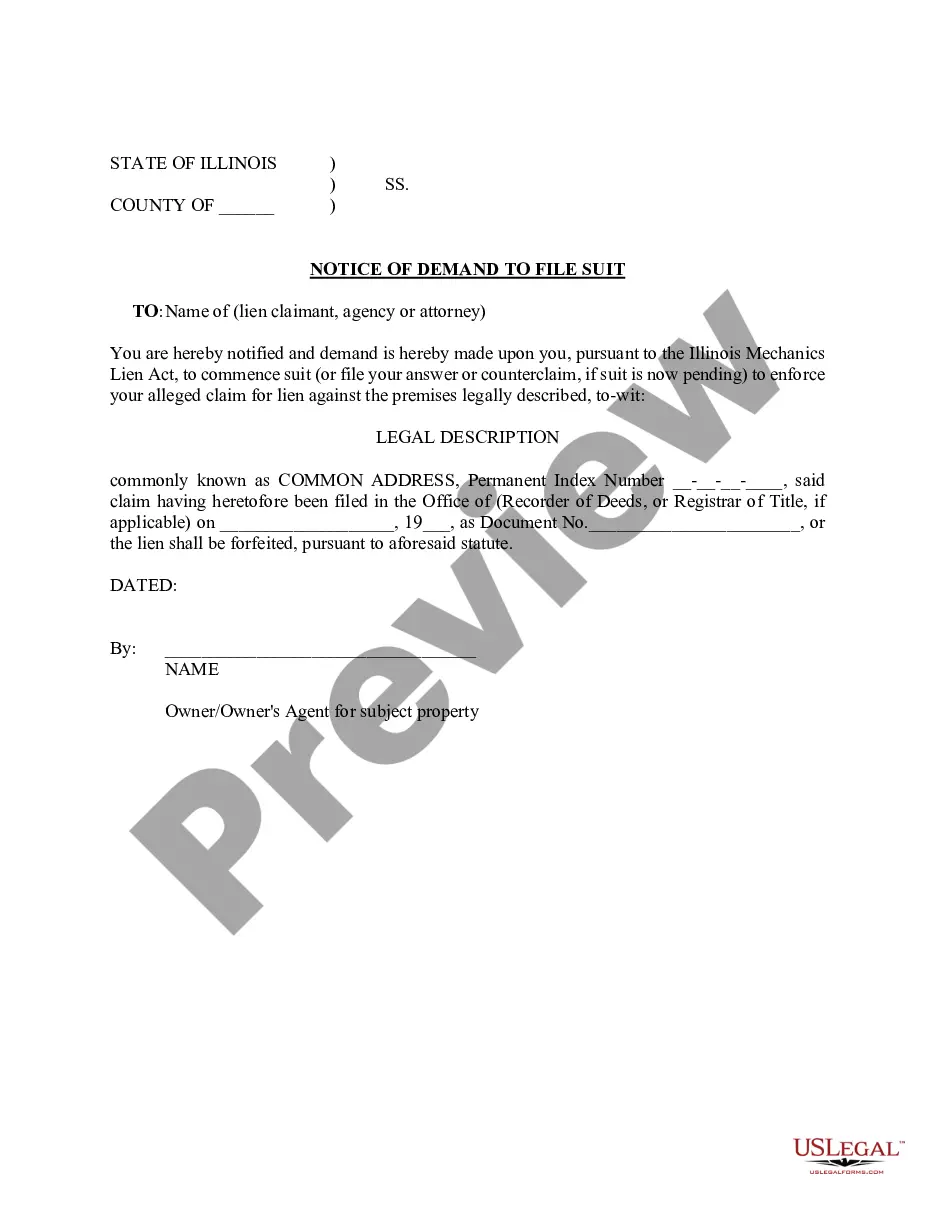

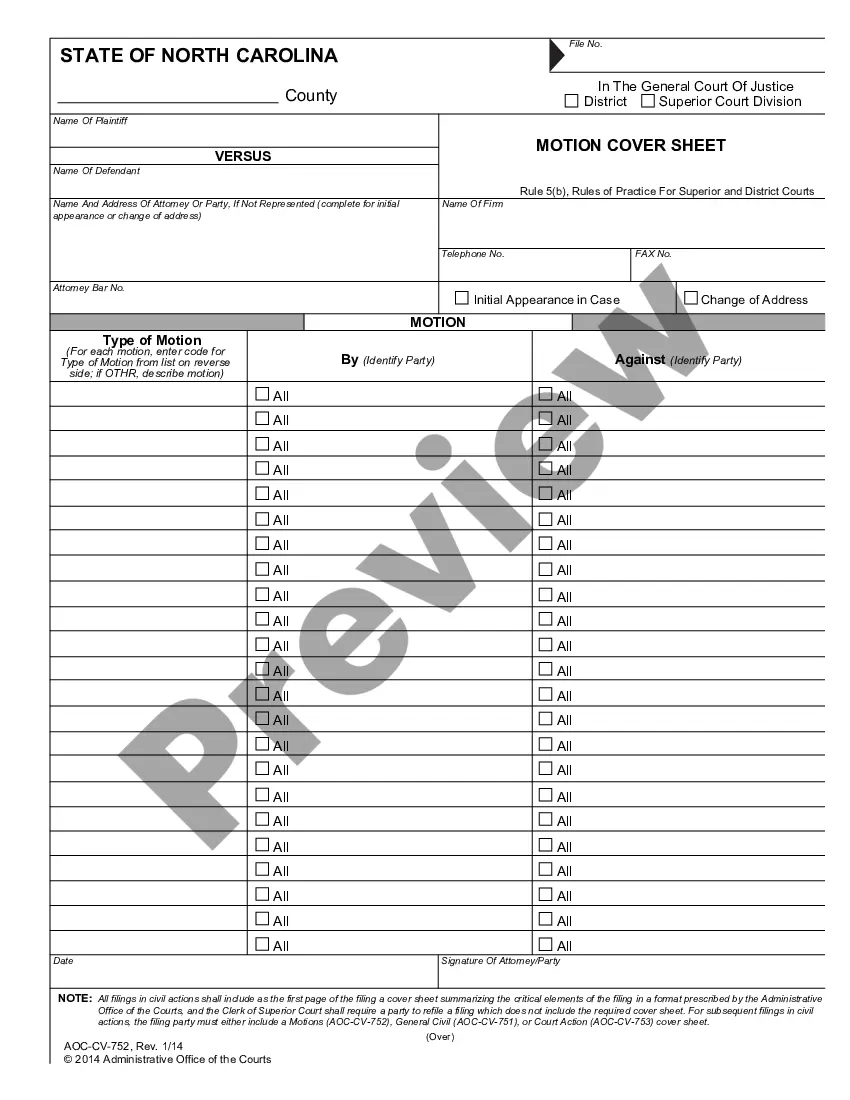

- Make use of the Review key to check the shape.

- Look at the explanation to ensure that you have selected the appropriate type.

- In the event the type is not what you are seeking, use the Look for discipline to obtain the type that fits your needs and demands.

- When you find the appropriate type, just click Acquire now.

- Select the costs strategy you need, submit the necessary info to make your money, and buy an order with your PayPal or bank card.

- Choose a hassle-free file formatting and down load your duplicate.

Discover each of the file themes you have purchased in the My Forms menus. You can get a further duplicate of Wyoming Clauses Relating to Accounting Matters anytime, if necessary. Just click on the required type to down load or produce the file template.

Use US Legal Forms, the most substantial collection of authorized varieties, to save lots of time and steer clear of mistakes. The service delivers expertly manufactured authorized file themes which you can use for a variety of functions. Generate your account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Because the Rule Against Perpetuities is state law, states have the option of relaxing or eliminating its constraints. While Wyoming has not abolished the Rule Against Perpetuities, it does allow Trusts to last one thousand (1,000) years.

Section 6-4-302 - Promoting obscenity; penalties (a) A person commits the crime of promoting obscenity if he: (i) Produces or reproduces obscene material with the intent of disseminating it; (ii) Possesses obscene material with the intent of disseminating it; or (iii) Knowingly disseminates obscene material.

The governing body may exclude from any public or private hearing during the examination of a witness, any or all other witnesses in the matter being investigated.

Stat. 16-4-403 states as follows: ?All meetings of the governing body of an agency are public meetings, open to the public at all times, except as otherwise provided. No action of a governing body of an agency shall be taken except during a public meeting following notice of the meeting in ance with this act.

Section 6-2-202 - Felonious restraint; penalty (a) A person is guilty of felonious restraint if he knowingly: (i) Restrains another unlawfully in circumstances exposing him to risk of serious bodily injury; or (ii) Holds another in a condition of involuntary servitude.

(a) All public records shall be open for inspection by any person at reasonable times, during business hours of the governmental entity, except as provided in this act or as otherwise provided by law, but the governmental entity may make rules and regulations with reference to the inspection of the records as is ...

(a) The driver of any vehicle involved in an accident resulting in injury to or death of any person shall immediately stop the vehicle at the scene of the accident or as close thereto as possible but shall then forthwith return to and in every event shall remain at the scene of the accident until he has fulfilled the ...