Rhode Island Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

Are you presently in a situation where you will require documents for either business or personal reasons almost all the time.

There are countless legal document templates accessible online, but finding reliable types can be challenging.

US Legal Forms offers thousands of document templates, including the Rhode Island Approval for Relocation Expenses and Allowances, which are designed to meet state and federal requirements.

Once you find the correct document, click Get now.

Choose a payment plan you prefer, fill out the necessary information to create your account, and pay for the transaction using PayPal or a credit card. Opt for a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Approval for Relocation Expenses and Allowances at any time if needed. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and prevent errors. The service provides properly crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Approval for Relocation Expenses and Allowances template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

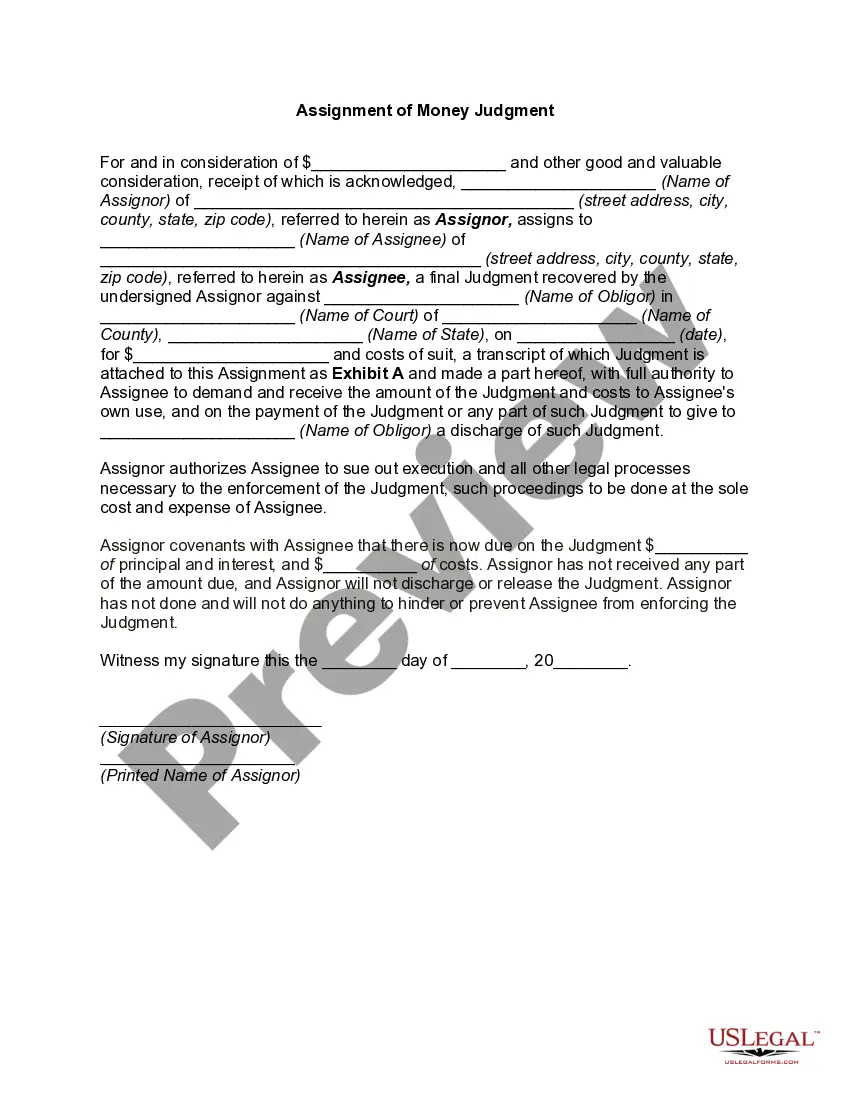

- Utilize the Preview button to examine the form.

- Read the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

When negotiating a relocation package, consider asking for expenses such as moving costs, temporary housing, and travel expenses. It's essential to research industry standards to ensure your requests align with common practices. Don't forget to mention Rhode Island Approval for Relocation Expenses and Allowances, as it provides a framework for what can be covered.

What is a relocation allowance? A relocation allowance is the payment made by an employer or the government agency; to cover transfer expenses and other costs incurred by an employee who is required to take up the employment elsewhere.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

Qualifying Relocation Expenses Payments and Beliefs CostsDisposal or intended disposal of old residence.Acquisition or intended acquisition of new residence.Transporting belongings.Travelling and subsistence.Domestic goods for the new residence.Bridging loans.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

Examples of non-qualifying expenses and benefits include: Mortgage or housing subsidies for an employee moving to a higher-cost area. Mortgage interest payments for the employee's existing home. Compensation for any financial loss to the employee on the sale of their home.

Relocation assistance may cover many areas , including packing and unpacking services, transportation and moving costs, temporary lodging, disposition of a residence, acquisition of a new residence, mortgage assistance, cultural training and language training.

The employer pays a lump sum directly to the employee to use in any way they need for their relocation. The employee is then required to file that amount as income.

Reimbursement. Reimbursement relocation packages allow transferees to pay for all moving expenses with the notion in mind that their employer will reimburse them with a specific amount of money after they have relocated. In doing this, a company covers most if not all moving expenses.