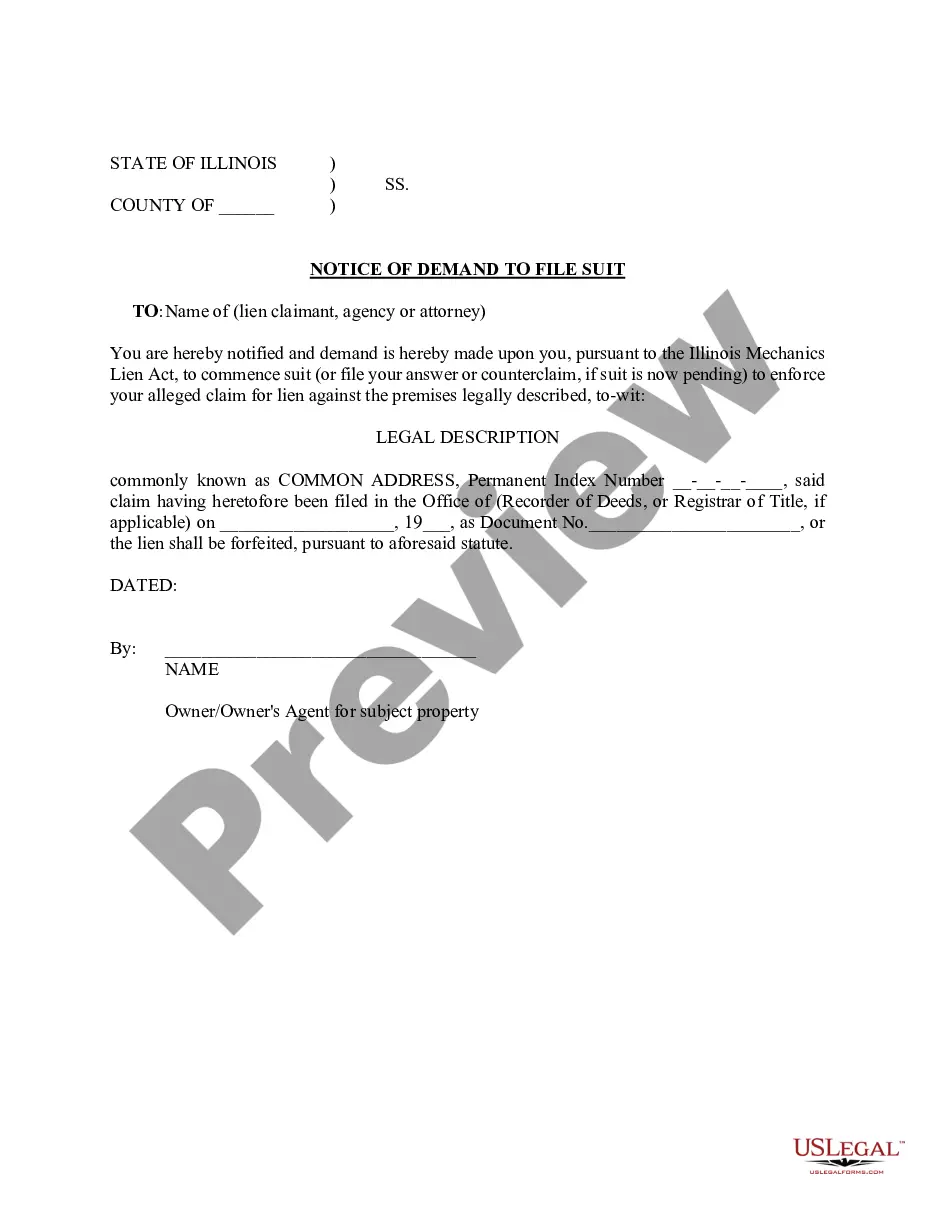

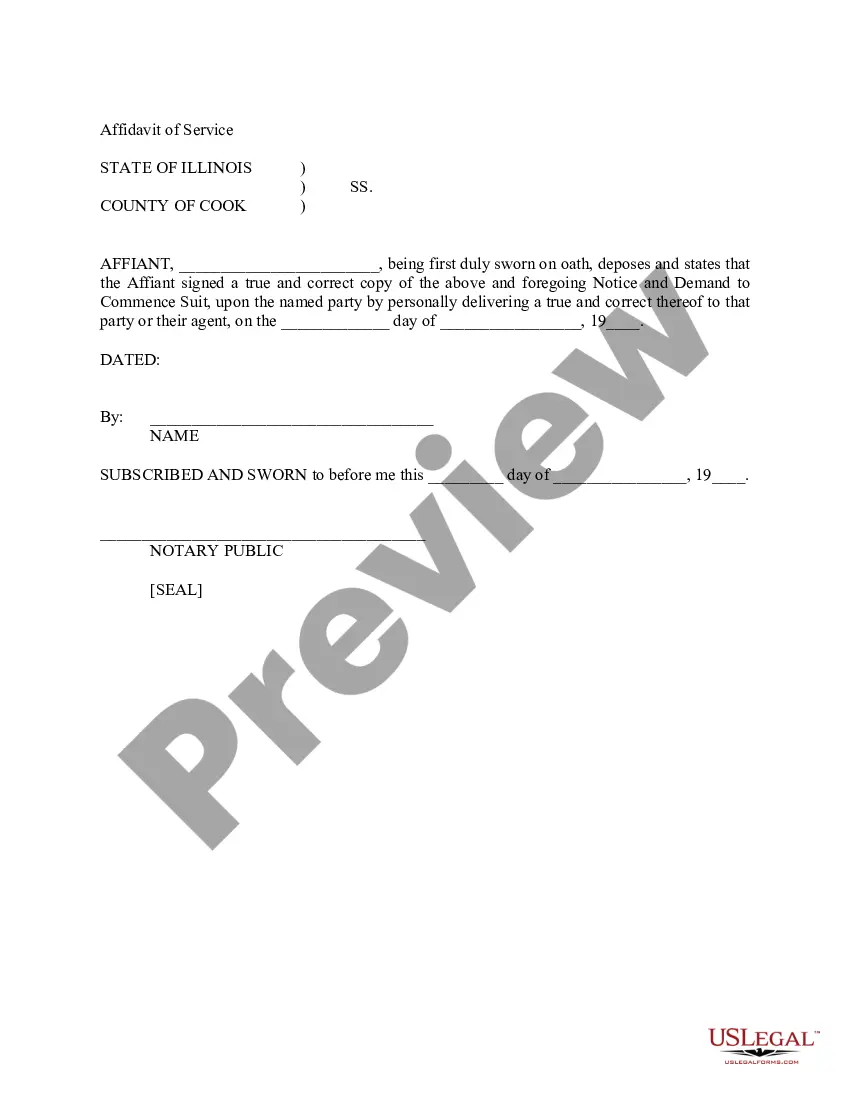

Illinois Notice of Demand to File Suit

Description

How to fill out Illinois Notice Of Demand To File Suit?

Searching for an Illinois Notice of Demand to File Suit example and completing them can be a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

Our attorneys prepare every document, so you simply need to complete them.

Choose your plan on the pricing page and set up your account. Decide whether you want to pay with a card or via PayPal. Download the form in your preferred file format. Now you can print the Illinois Notice of Demand to File Suit template or complete it using any online editor. Don’t worry about making errors because your form can be used, submitted, and printed as many times as needed. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the sample.

- Your saved samples are located in My documents and can be accessed anytime for future use.

- If you have not subscribed yet, it is advisable to register.

- Review our comprehensive instructions on how to obtain the Illinois Notice of Demand to File Suit template in a matter of minutes.

- To obtain a qualified example, verify its relevance for your state.

- Examine the example using the Preview option (if available).

- If a description is provided, read it to understand the details.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

In order to enforce a lien, the contractor, subcontractor or supplier must file a lawsuit. The deadline to file a lawsuit is two years from the last date work was performed or materials were supplied. A recorded lien is valid for these two years, but a failure to sue within that time frame voids the lien.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.

Judgment liens do not last for the full twenty years that the judgment is enforceable. The lien will expire seven years from the time it is recorded. 735 ILCS 5/12-101. However, real estate that has been levied upon within the seven-year period is allowed one additional year to be sold to enforce the judgment.

How long does a judgment lien last in Illinois? A judgment lien in Illinois will remain attached to the debtor's property (even if the property changes hands) for seven years.

In Illinois, a mechanics lien must be filed within 4 months after completion of work to be effective against subsequent property owners. If the lien is filed after 4 months but before 2 years after completion of work, it will still be effective against the original owner.

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.