Wyoming Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

If you need to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you require. A variety of templates for commercial and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Wyoming Design Agreement - Self-Employed Independent Contractor in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Wyoming Design Agreement - Self-Employed Independent Contractor. You can also access forms you previously downloaded in the My documents section of your account.

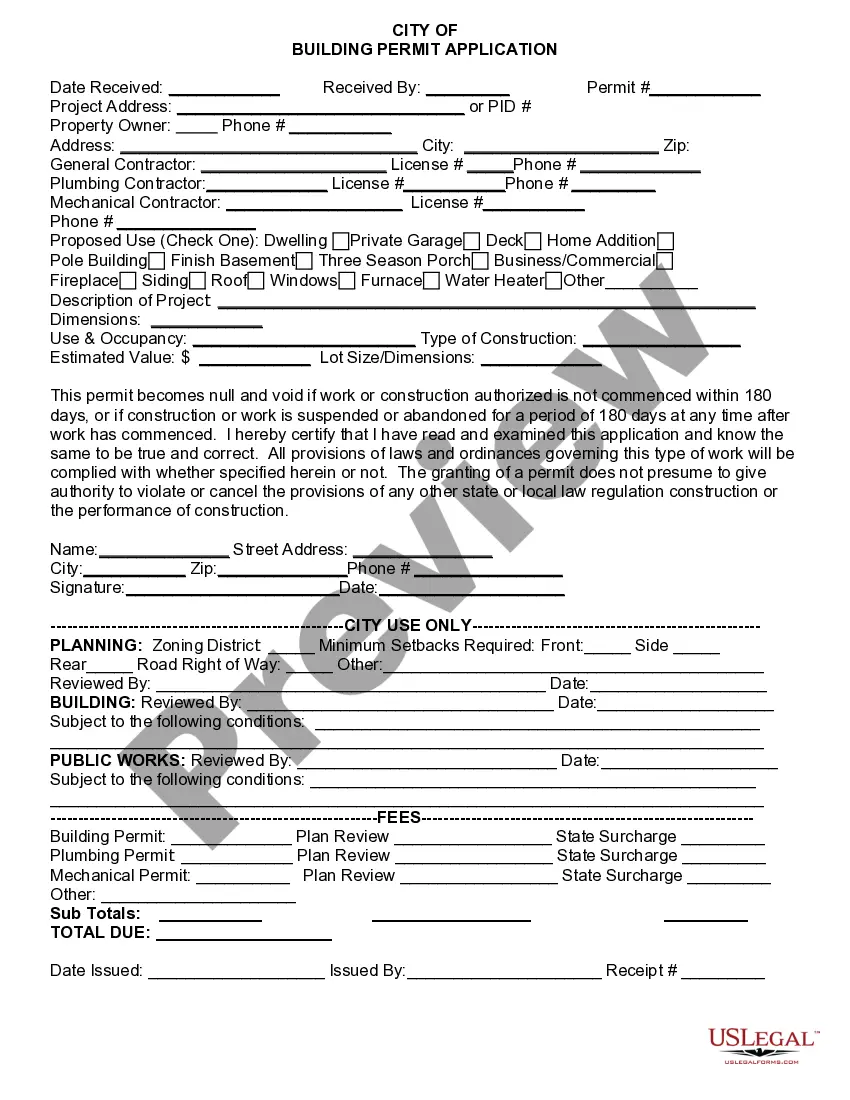

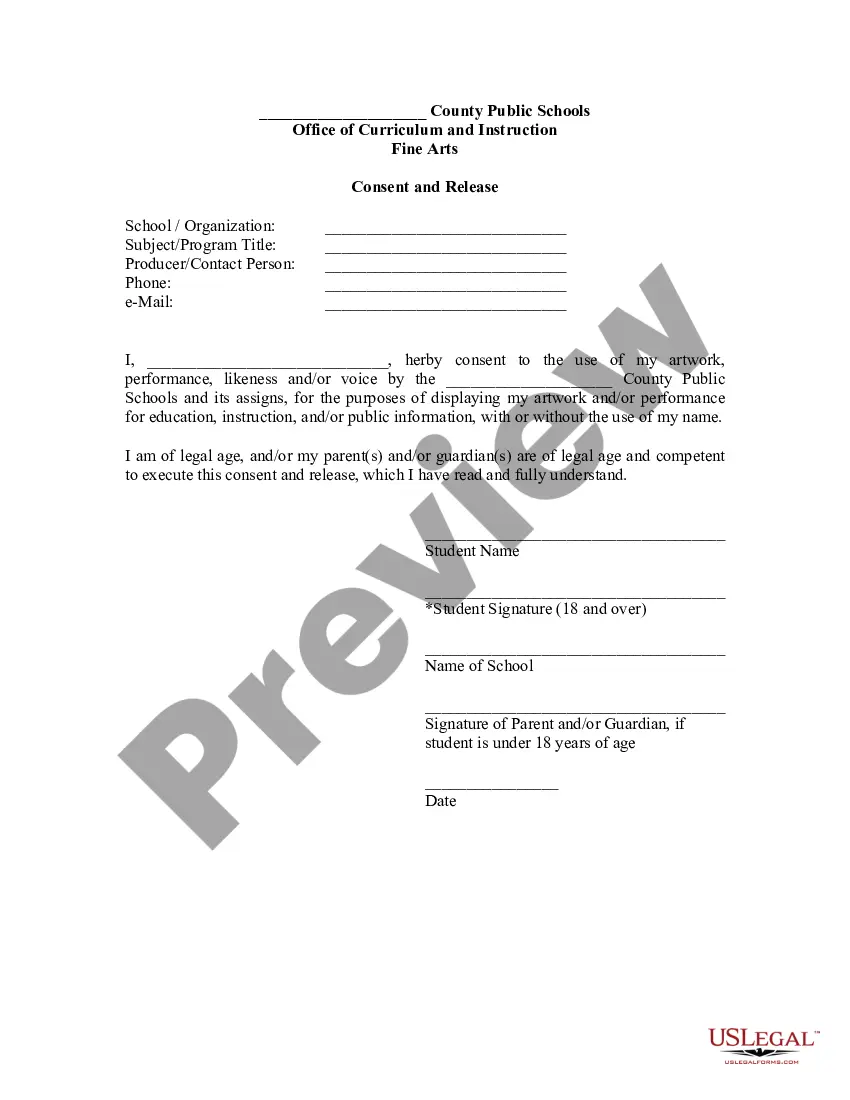

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s content. Be sure to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account. Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Wyoming Design Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- You have access to every form you downloaded within your account.

- Click on the My documents section and select a form to print or download again.

- Stay competitive and obtain, and print the Wyoming Design Agreement - Self-Employed Independent Contractor with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

Yes, an independent contractor is classified as self-employed. This status means that the individual operates their business independently, without an employer-employee relationship. Additionally, independent contractors enjoy the flexibility to set their schedules and work with multiple clients. If you are considering a Wyoming Design Agreement - Self-Employed Independent Contractor, you can formalize your work arrangement and clarify expectations with your clients.

An operating agreement is not legally required for LLCs in Wyoming; however, having one is highly recommended. A well-crafted operating agreement can outline the management structure and operational procedures of your business. It helps clarify member roles, profit distribution, and other important aspects. By using a Wyoming Design Agreement - Self-Employed Independent Contractor, you can create a structured environment that facilitates smooth business operations.

Independent contractors typically need to complete several key documents, including a contract, tax forms, and invoices. The Wyoming Design Agreement - Self-Employed Independent Contractor will outline terms of your engagement and payment structure. Additional paperwork may include obtaining necessary permits or licenses, depending on your field. Using platforms like uslegalforms can help streamline this process and ensure you meet all requirements.

To complete a declaration of independent contractor status form, first gather necessary information about your work and your business. Clearly state your role as a self-employed independent contractor and provide details about your services. Ensure that you review the Wyoming Design Agreement - Self-Employed Independent Contractor guidelines to ensure compliance. Finally, submit your form to the relevant authority to formalize your status.

Legal requirements for independent contractors typically include clear definitions of their services, proper tax treatment, and compliance with local laws. It’s essential to understand your obligations regarding taxes and insurance. By using platforms like USLegalForms, you can navigate the necessary regulations effectively, ensuring your Wyoming Design Agreement - Self-Employed Independent Contractor meets all legal standards.

Wyoming does not require an operating agreement for independent contractors, but having one is advisable. An operating agreement can clarify the roles, responsibilities, and procedures among parties, supporting a smoother working relationship. For those entering into a Wyoming Design Agreement - Self-Employed Independent Contractor, complementary agreements can enhance clarity and professionalism.

Typically, either the hiring party or the independent contractor can draft the agreement. However, it is often beneficial for the party providing the work to draft it, ensuring that their interests are clearly represented. Platforms like USLegalForms offer resources that make it easy to create a comprehensive Wyoming Design Agreement - Self-Employed Independent Contractor.

To create an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. Next, include essential clauses that protect both parties, like confidentiality and liability clauses. Using a platform like USLegalForms can simplify this process, providing templates designed specifically for a Wyoming Design Agreement - Self-Employed Independent Contractor.

Yes, independent contractors typically file as self-employed individuals when it comes to taxes. This means you will report your earnings on a Schedule C form along with your tax return. If you are utilizing the Wyoming Design Agreement - Self-Employed Independent Contractor, rest assured, it helps clarify your status, ensuring you meet both legal and tax obligations efficiently.

Filling out an independent contractor agreement involves carefully entering information about both parties involved. Write down the project description, payment details, and timeline in designated sections. Using a template like the Wyoming Design Agreement - Self-Employed Independent Contractor can guide you through this process, ensuring you do not miss any critical components.