Wyoming Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

Are you currently in a location where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, including the Wyoming Drafting Agreement - Self-Employed Independent Contractor, designed to meet state and federal requirements.

If you find the correct form, simply click Buy now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and proceed to purchase the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have acquired in the My documents section. You can retrieve an additional copy of the Wyoming Drafting Agreement - Self-Employed Independent Contractor at any time, if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Wyoming Drafting Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

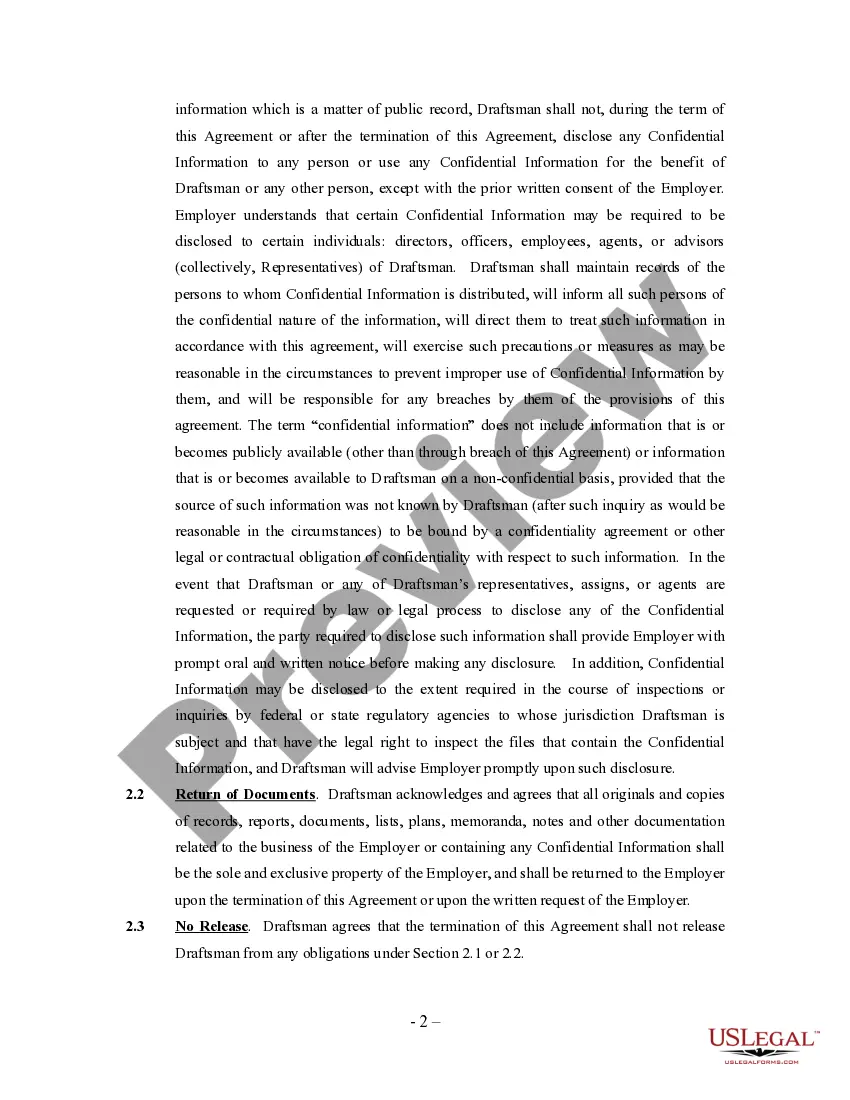

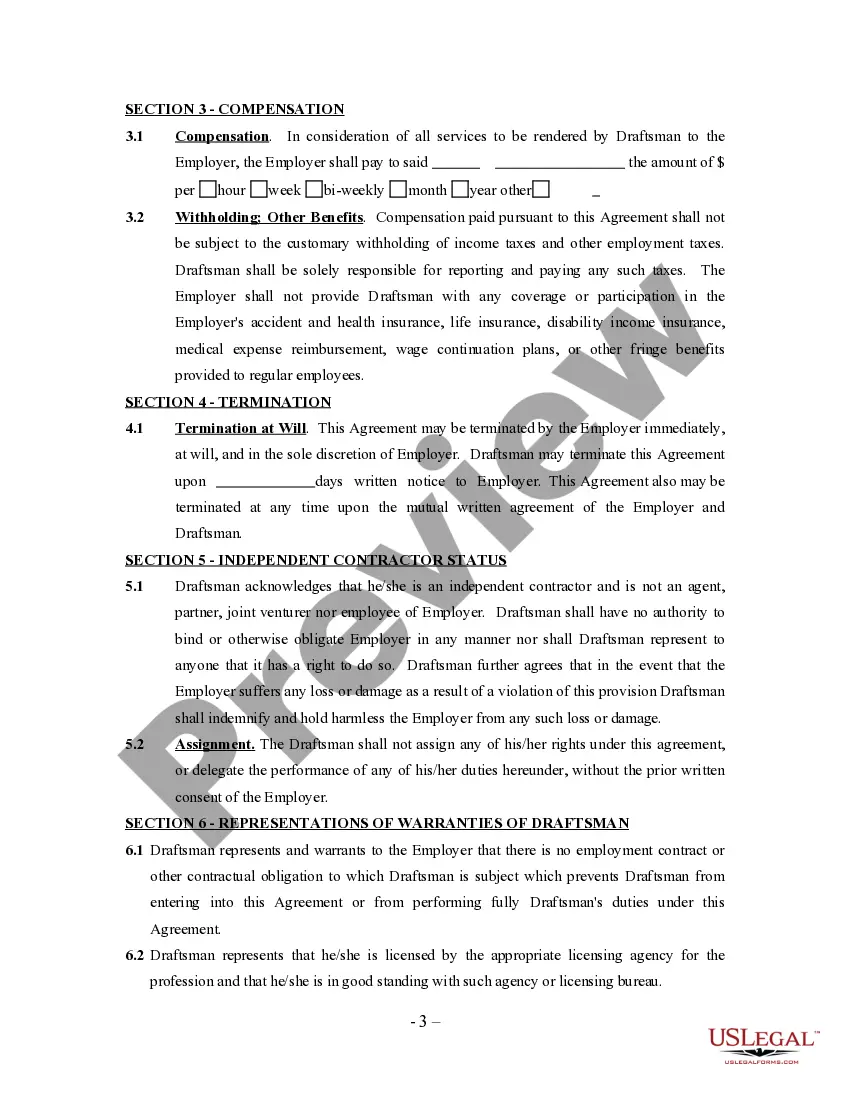

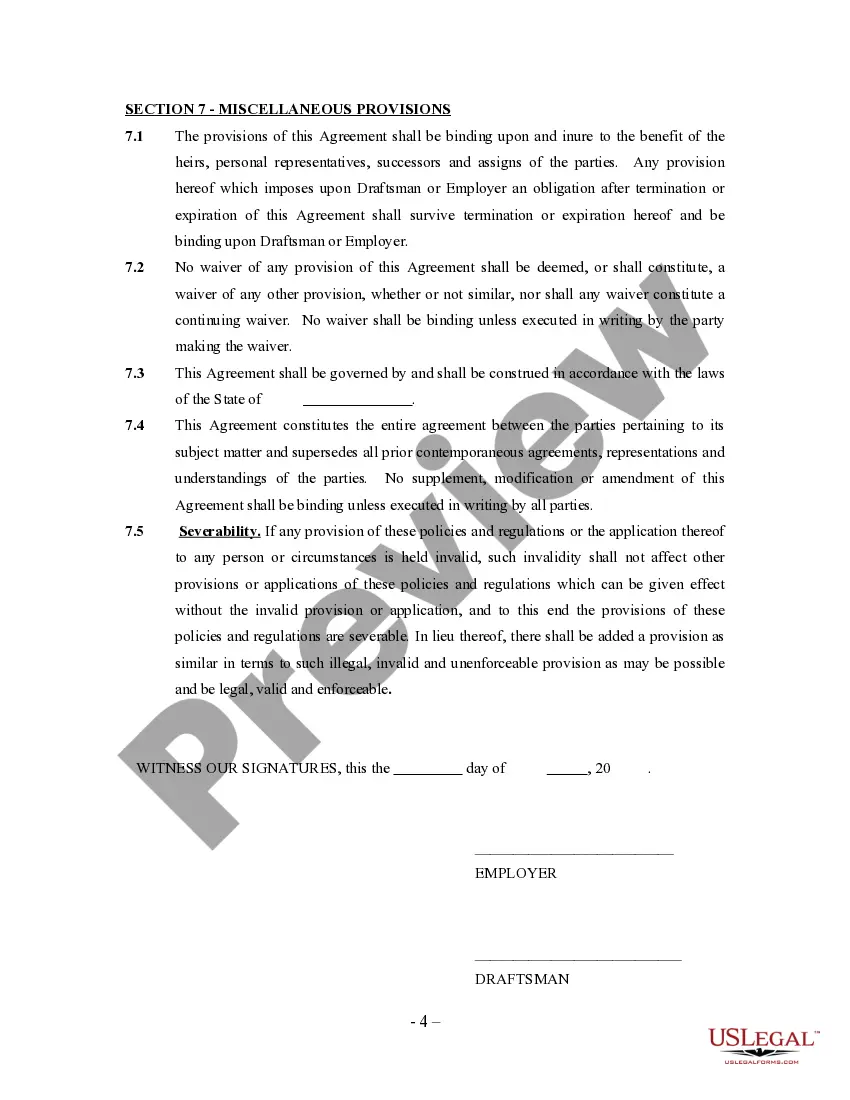

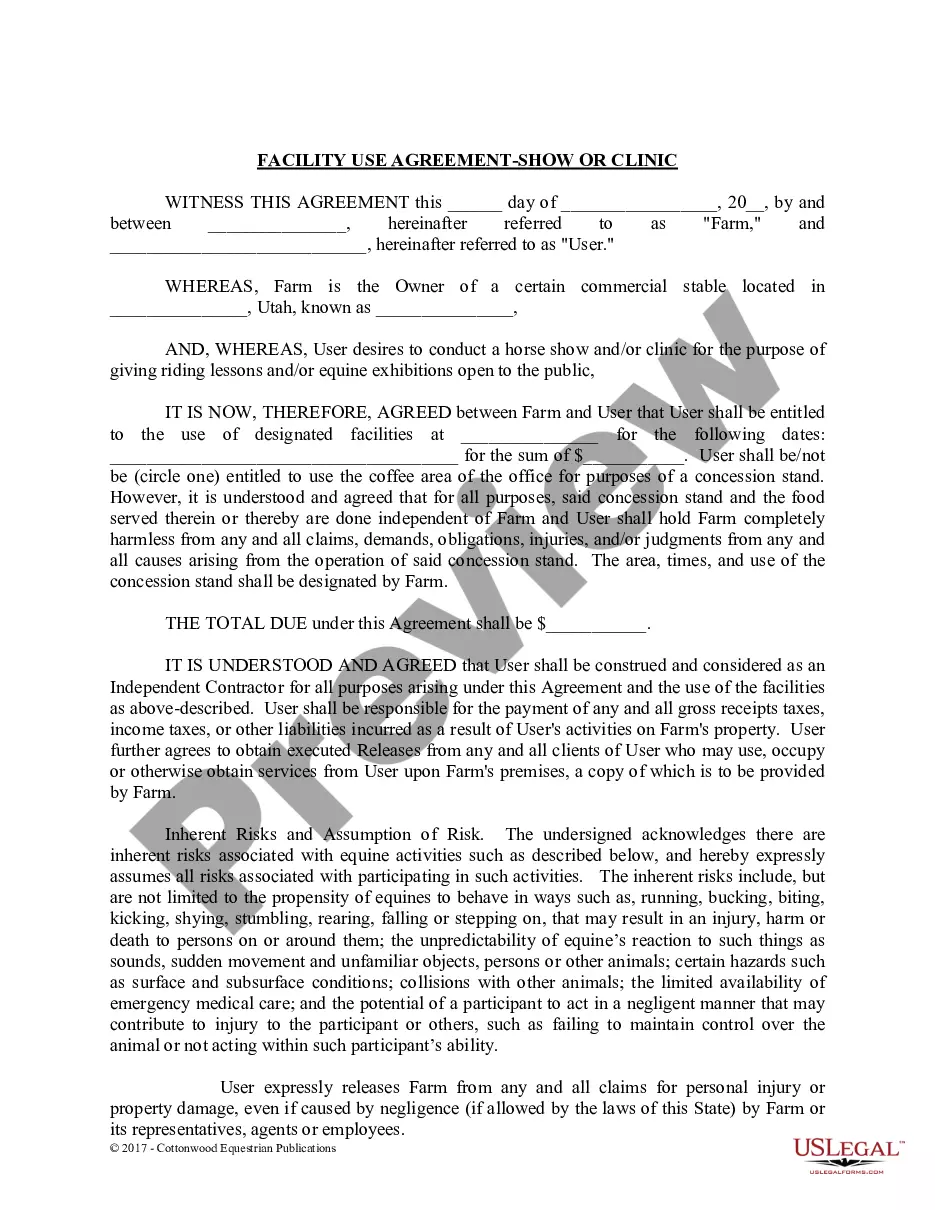

A basic independent contractor agreement defines the working relationship between a contractor and a client. It typically includes essential clauses such as payment, duration of work, and confidentiality terms. This agreement establishes clear expectations, which can help prevent disputes. For those needing guidance, a Wyoming Drafting Agreement - Self-Employed Independent Contractor from uslegalforms provides a solid foundation to create a compliant and comprehensive contract.

To write a contract as an independent contractor, start by outlining the scope of work clearly. Include essential details such as payment terms, deadlines, and the responsibilities of both parties. A well-structured contract protects you and your client, reducing misunderstandings. Utilizing a Wyoming Drafting Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process and ensure necessary legal elements are included.

Yes, you can write your own legally binding contract, provided you include essential elements such as clear terms, obligations, and compensation. Make sure the contract is signed by all involved parties, which reinforces its legality. If you need assistance, consider using USLegalForms for a comprehensive framework tailored to a Wyoming Drafting Agreement - Self-Employed Independent Contractor, ensuring all bases are covered.

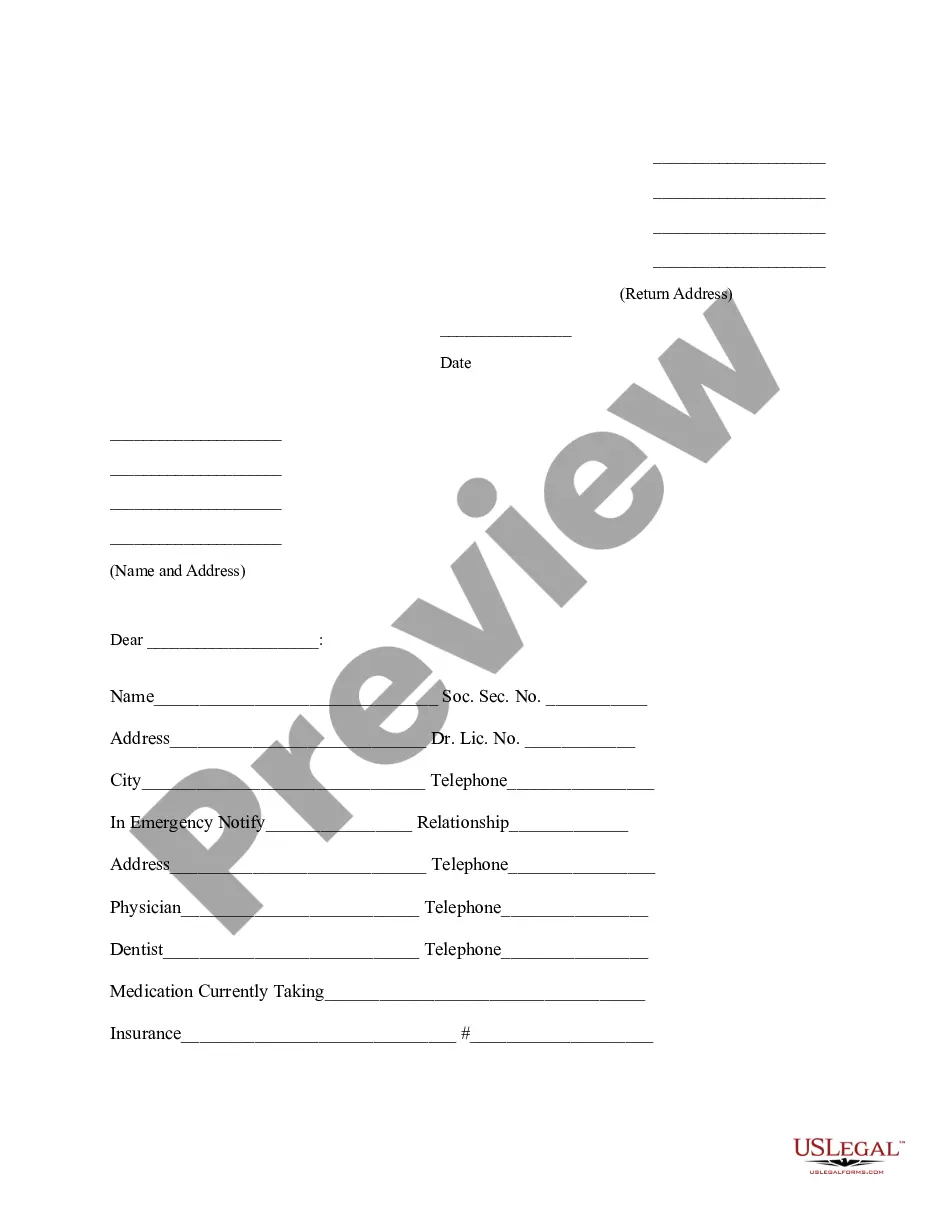

To fill out a declaration of independent contractor status form, you must provide your personal information and details about the nature of your work. Make sure to clarify your business operations and confirm you meet the independent contractor criteria. This declaration is important for establishing your Wyoming Drafting Agreement - Self-Employed Independent Contractor and protecting your status legally.

Filling out an independent contractor form is straightforward. Start with your personal details, such as name, address, and contact information. Next, describe the services you offer and include any relevant payment details. Ensure you double-check for accuracy, as this will establish your Wyoming Drafting Agreement - Self-Employed Independent Contractor.

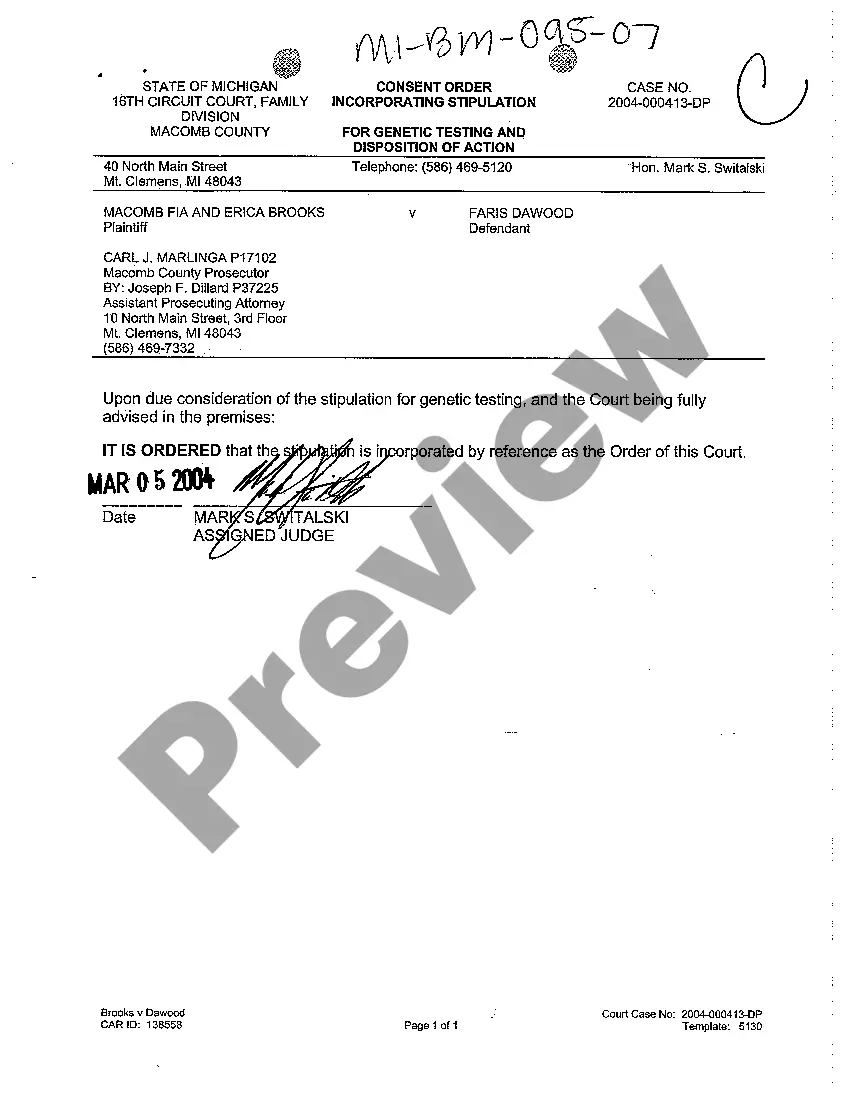

An independent contractor typically needs to complete an independent contractor agreement, a W-9 form for tax purposes, and any relevant state or local permits. Depending on the nature of the work, you may also require proof of insurance or licenses. Gathering these documents ensures you comply legally and fosters a professional relationship with clients while maintaining a robust Wyoming Drafting Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement involves several key steps. Begin with identifying the parties involved and their roles. Then, specify the services provided, payment structure, and duration of the agreement. Additionally, consider including terms for termination and confidentiality to protect both parties. This thorough approach strengthens your Wyoming Drafting Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, start by entering your name and the contractor's information at the top of the document. Next, clearly define the scope of work, including deliverables and deadlines. Ensure you outline payment terms, including rates and how often payments will be made. By following these steps, you create a solid Wyoming Drafting Agreement - Self-Employed Independent Contractor.

Typically, the business hiring the independent contractor drafts the agreement. This ensures the document reflects the company's requirements and expectations. However, the contractor may also request modifications to ensure clarity and fairness. For assistance, you can explore uslegalforms, where you can find resources for creating a Wyoming Drafting Agreement - Self-Employed Independent Contractor.

Wyoming does not require an operating agreement for independent contractors specifically. However, having one can clarify the terms of your business relationship, especially if multiple parties are involved. An operating agreement can serve as a valuable document to outline the rights and duties of each party. For a clear approach to drafting these agreements, consider tools offered by uslegalforms for crafting a Wyoming Drafting Agreement - Self-Employed Independent Contractor.