Wyoming Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

You can invest hours online searching for the legal document template that satisfies the state and federal standards you require. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Wyoming Foundation Contractor Agreement - Self-Employed from my service. If you already have a US Legal Forms account, you can Log In and then click the Acquire button. Following that, you can complete, modify, print, or sign the Wyoming Foundation Contractor Agreement - Self-Employed.

Every legal document template you receive is yours permanently. To obtain another copy of the purchased form, visit the My documents tab and click the relevant button. If you're using the US Legal Forms website for the first time, follow the simple instructions below.

Acquire and print a vast number of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- First, ensure you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have chosen the right form.

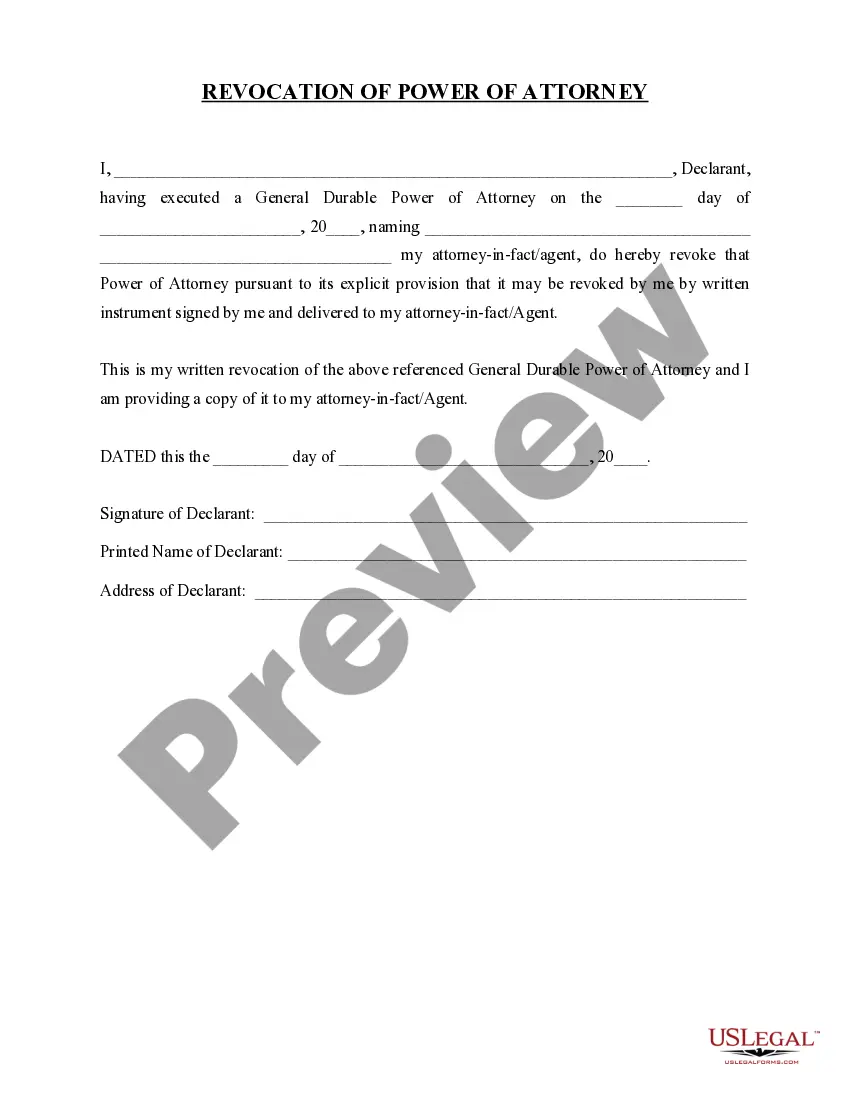

- If available, utilize the Preview button to look through the document template as well.

- To find another version of your form, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Get now to proceed.

- Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal account to pay for the legal form.

- Choose the format of your document and download it to your device.

- Make edits to your document if applicable. You can complete, modify, sign, and print the Wyoming Foundation Contractor Agreement - Self-Employed.

Form popularity

FAQ

To create a Wyoming Foundation Contractor Agreement - Self-Employed, start by defining the scope of work you expect from the contractor. Clearly outline the payment terms, deadlines, and specific responsibilities in the agreement. It's essential to include provisions for confidentiality and termination to protect both parties. Using a platform like US Legal Forms can simplify this process, providing templates and guidance tailored for your needs.

Yes, an independent contractor is considered self-employed because they operate their business, providing services to clients without being on their payroll. This distinction allows for various tax benefits and greater flexibility in managing how and when work is completed. Understanding this relationship is crucial when drafting a Wyoming Foundation Contractor Agreement - Self-Employed to ensure compliance and clarity.

Filling out an independent contractor agreement involves detailing the work scope, payment arrangements, and any additional terms specific to the project. Each section should be clear and precise for both parties to understand their rights and responsibilities. If you focus on a Wyoming Foundation Contractor Agreement - Self-Employed, ensure that you incorporate local laws and best practices in your document.

When writing an independent contractor agreement, start with a clear title and the effective date of the contract. Include sections that detail the work being performed, payment structures, and responsibilities of both parties. Addressing state-specific requirements in your Wyoming Foundation Contractor Agreement - Self-Employed will help avoid any legal pitfalls.

To write a self-employed contract, begin by defining the parties involved and their roles. Next, outline the services to be provided, payment details, and timelines for completion. It is crucial to incorporate terms related to confidentiality and termination, which will ensure clarity in your Wyoming Foundation Contractor Agreement - Self-Employed.

Filling out an independent contractor form typically involves entering your personal details, business name, and contact information. Additionally, you should specify the scope of work, payment terms, and any deadlines or obligations related to the project. For a specific focus on the Wyoming Foundation Contractor Agreement - Self-Employed, ensure that you include clauses tailored to comply with Wyoming's regulations.

While an operating agreement is not mandated for LLCs in Wyoming, creating one is highly recommended. An operating agreement helps define your business structure, roles, and responsibilities. For those entering into a Wyoming Foundation Contractor Agreement - Self-Employed, having a clear operating agreement can prevent misunderstandings and provide a solid foundation for your business. It enhances protection of your business interests and offers clear guidelines for operation.

Yes, construction firms in Wyoming must be registered with the State Contractors Association and the Secretary of State. This registration is crucial for ensuring compliance with state regulations. It also aids in putting clients at ease, knowing that the contractor has met the required standards. If you are self-employed and working under a Wyoming Foundation Contractor Agreement - Self-Employed, this step is vital for your business's legitimacy and operational success.

Yes, Wyoming allows single-member LLCs, making it a popular choice for self-employed individuals. This structure provides you with limited liability protection, separating your personal assets from business debts. For those involved in construction, like those using the Wyoming Foundation Contractor Agreement - Self-Employed, this structure can enhance credibility and simplify tax filing. You can enjoy the benefits of an LLC while maintaining full control over your business.

In Wyoming, you do not need to register a sole proprietorship if you operate under your legal name. However, if you choose a different business name, you must file a trade name with the state. This is essential when you want to work under the Wyoming Foundation Contractor Agreement - Self-Employed. Registering helps establish credibility and protects your chosen business name from use by others.