Sample Letter regarding Cancellation of Deed of Trust

Description

How to fill out Sample Letter Regarding Cancellation Of Deed Of Trust?

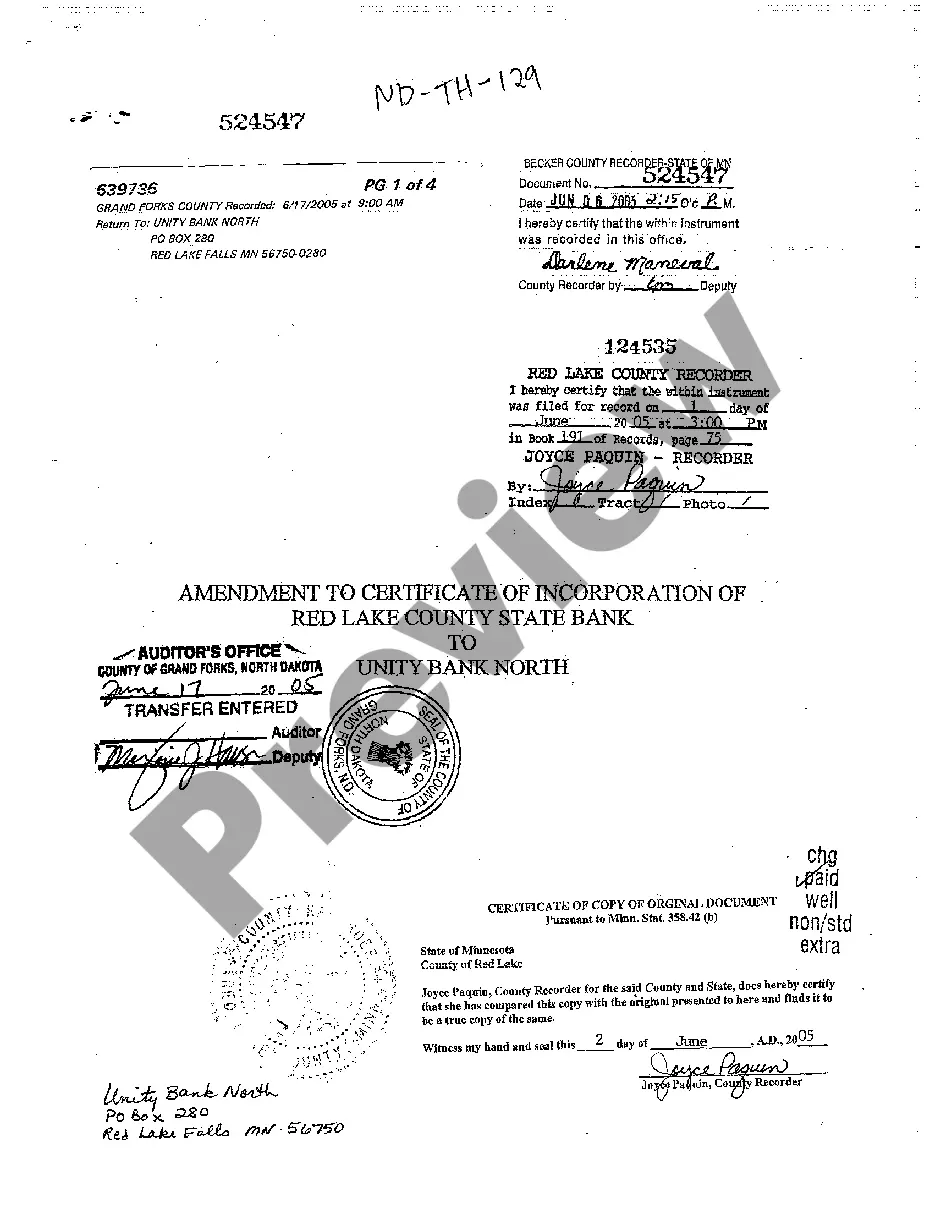

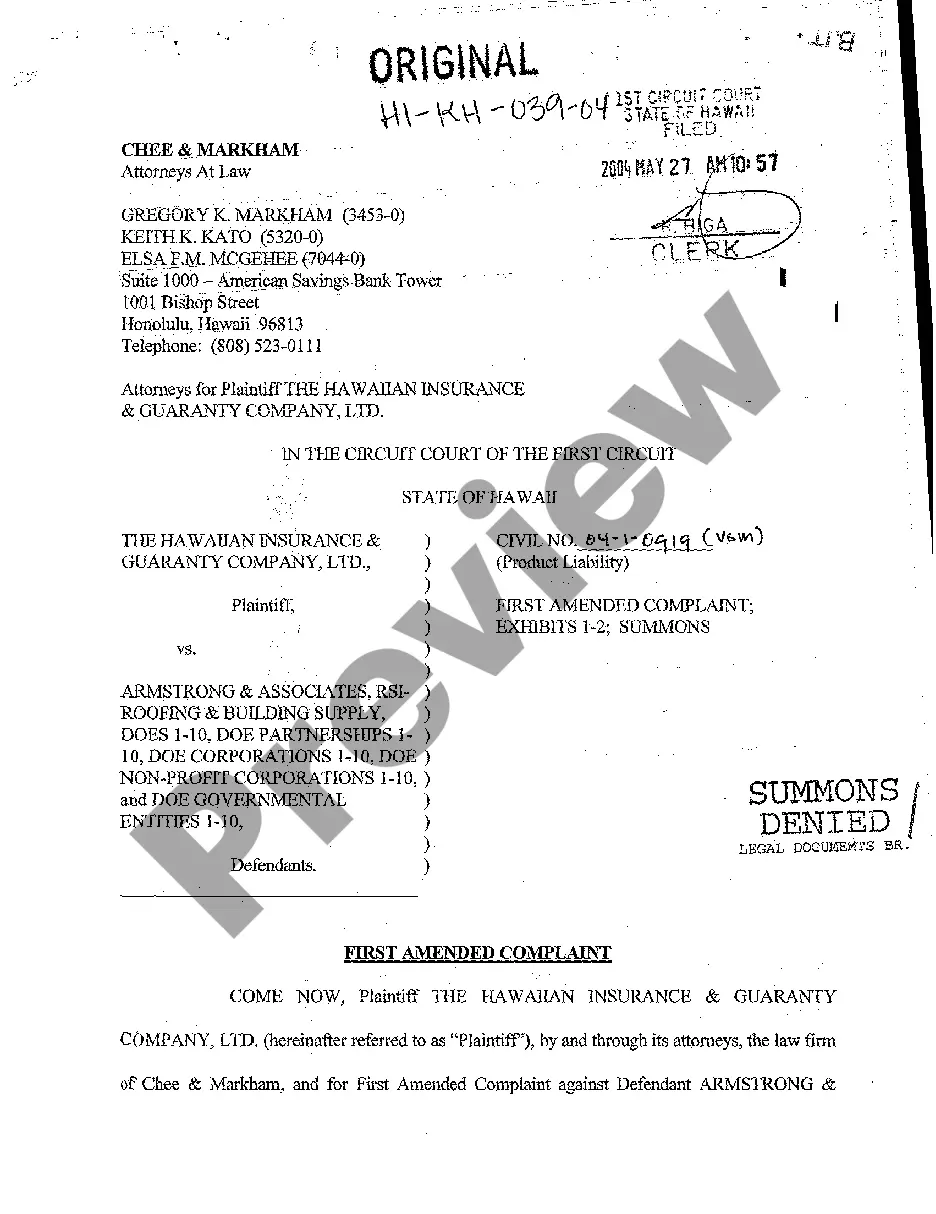

Use US Legal Forms to get a printable Sample Letter regarding Cancellation of Deed of Trust. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and provides reasonably priced and accurate templates for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to quickly find and download Sample Letter regarding Cancellation of Deed of Trust:

- Check to make sure you get the right template with regards to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter regarding Cancellation of Deed of Trust. Over three million users have used our service successfully. Select your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.