Wyoming Demand for Payment of an Open Account by Creditor

Description

How to fill out Demand For Payment Of An Open Account By Creditor?

Are you currently inside a place where you require documents for sometimes company or person reasons virtually every time? There are a variety of legal papers themes available on the net, but locating kinds you can rely is not effortless. US Legal Forms offers 1000s of kind themes, just like the Wyoming Demand for Payment of an Open Account by Creditor, that are created in order to meet state and federal needs.

When you are already informed about US Legal Forms website and get your account, simply log in. Afterward, you can acquire the Wyoming Demand for Payment of an Open Account by Creditor format.

If you do not have an account and need to start using US Legal Forms, abide by these steps:

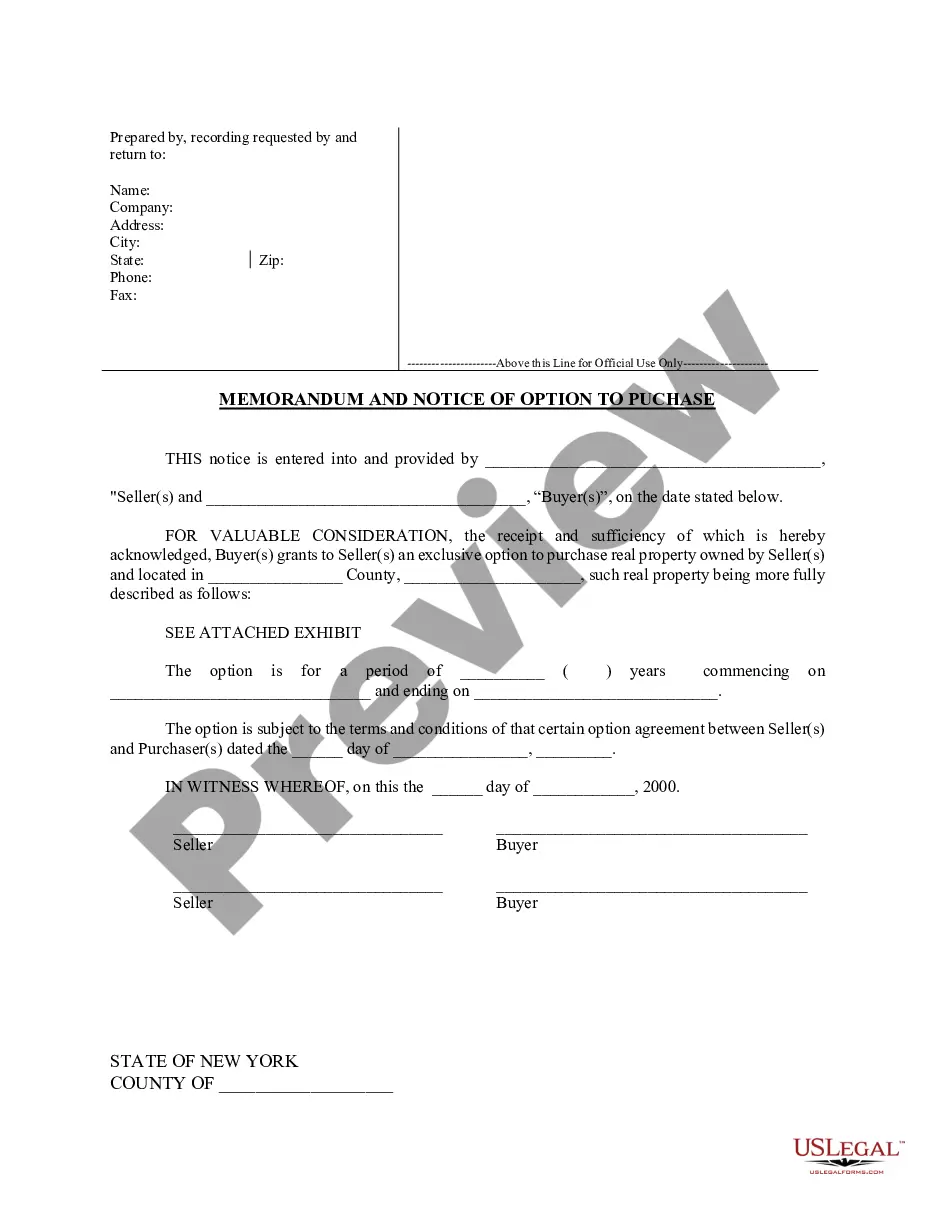

- Get the kind you require and ensure it is for the appropriate metropolis/county.

- Use the Review button to check the form.

- See the explanation to actually have selected the right kind.

- In case the kind is not what you`re seeking, make use of the Lookup industry to find the kind that meets your requirements and needs.

- When you obtain the appropriate kind, click Get now.

- Pick the costs plan you want, fill out the desired information and facts to make your account, and buy your order using your PayPal or charge card.

- Select a hassle-free data file structure and acquire your copy.

Locate all the papers themes you might have purchased in the My Forms menus. You can obtain a additional copy of Wyoming Demand for Payment of an Open Account by Creditor whenever, if required. Just go through the necessary kind to acquire or print out the papers format.

Use US Legal Forms, the most substantial variety of legal forms, to save time as well as prevent blunders. The services offers skillfully produced legal papers themes which can be used for a range of reasons. Produce your account on US Legal Forms and commence making your life a little easier.

Form popularity

FAQ

Wyoming Statute of Limitations on Debt Collection In Wyoming, the statute of limitations on debt collection varies ing to the type of debt involved. For written contracts and agreements, the statute of limitations is ten years. Oral contracts have a statute of limitations of eight years.

Minor Breach. ... Material Breach. ... Anticipatory Breach. ... Fundamental Breach. ... Actual Breach.

Elements Needed to Prove Breaches Proof you performed your obligations under the terms of the contract or, alternatively, proof you were justified in not doing so. Proof the defendant failed to perform their obligations under the terms of the contract. Proof you suffered damages due to the defendant's breach.

Satisfaction of Judgment: The document stating the Judgment Debtor has satisfied the judgment. Wyoming Statute requires this to be filed by the Judgment Creditor with the Circuit Court Clerk in order to remove the judgment from credit reports as being unpaid by the Judgment Debtor.

Wyoming's legal interest rate is 7% per year. This rate can be changed in a contract or agreement or otherwise set by law, however. A separate state law sets the rate of interest on court judgments at 10% per year unless otherwise stated by in a contract that is the subject of the court's decision.

A breach of contract is when one party to the contract doesn't do what they agreed. Breach of contract happens when one party to a valid contract fails to fulfill their side of the agreement. If a party doesn't do what the contract says they must do, the other party can sue.

4 Elements of a Breach of Contract Claim (and more) The existence of a contract; Performance by the plaintiff or some justification for nonperformance; Failure to perform the contract by the defendant; and, Resulting damages to the plaintiff.

The primary solutions are damages, specific performance, or contract cancellation and restitution.