Wyoming Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

You can spend hours online searching for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

It is easy to obtain or print the Wyoming Demand for Collateral by Creditor from your service.

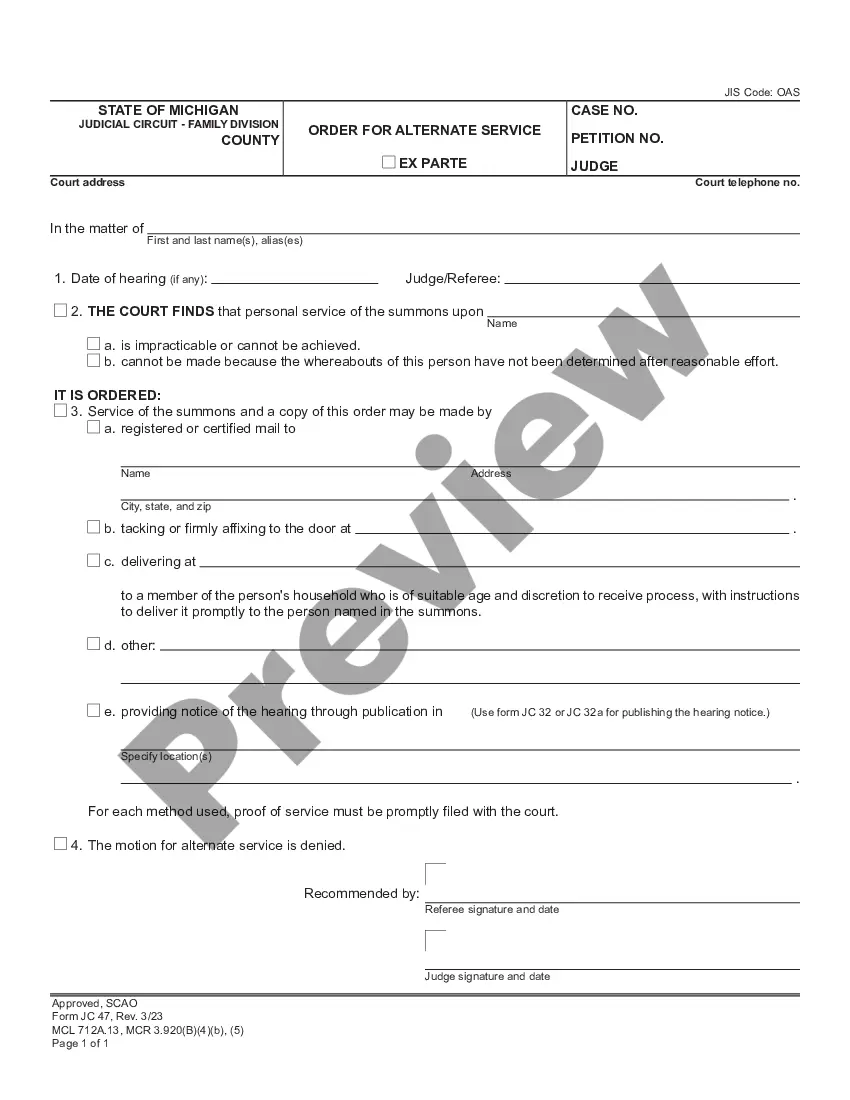

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Wyoming Demand for Collateral by Creditor.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/region of your preference.

- Check the form details to confirm you have selected the correct form.

Form popularity

FAQ

Abandoned property law in Wyoming governs the handling and reclamation of property that is left unattended. The law sets forth guidelines for identifying abandoned assets and facilitating their return to rightful owners. Those navigating the complexities of a Wyoming Demand for Collateral by Creditor should familiarize themselves with these laws for effective management.

Statute 34-1-142 in Wyoming addresses the procedures surrounding abandoned property and the responsibilities of holders. It outlines what constitutes abandoned property and how the owner can reclaim their rights. Understanding this statute can greatly benefit creditors making a Wyoming Demand for Collateral by Creditor.

Property in Wyoming is usually categorized as abandoned after five years of inactivity. However, certain conditions can apply depending on the type of asset in question. Creditors should keep this timeframe in mind when initiating a Wyoming Demand for Collateral by Creditor to reclaim collateral effectively.

In Wyoming, property is generally considered abandoned after a specific period of non-use, typically around five years. Various factors can influence this timeframe, including the type of property and its location. Being aware of these details is essential for a creditor pursuing a Wyoming Demand for Collateral by Creditor.

The race notice statute in Wyoming is a legal framework that provides protection for individuals who acquire property without notice of prior claims. This statute requires that any claims on a property must be publicly recorded to provide valid ownership rights. When dealing with secured transactions, grasping the race notice statute can be important for a Wyoming Demand for Collateral by Creditor.

In Wyoming, abandonment refers to the deliberate relinquishment of property with no intention to return. When someone leaves their belongings without care and fails to exercise control over them, those items may be deemed abandoned. Understanding these aspects can be crucial for creditors when filing a Wyoming Demand for Collateral by Creditor.

To perfect an interest in a deposit account, you must follow specific procedures outlined in Wyoming law. Typically, you should obtain control over the deposit account by entering into a control agreement with the bank that holds the account. Additionally, filing a UCC-1 Financing Statement is necessary to officially record your security interest. Ensuring perfection in this manner strengthens your position in any Wyoming Demand for Collateral by Creditor.

To perfect a security interest in accounts receivable, you must first create a security agreement with the debtor, specifying the accounts receivable as collateral. Then, you will need to file a UCC-1 Financing Statement to publicly declare your interest. This public notice protects your rights and gives you priority over other creditors. Properly perfecting your interest is vital in ensuring your claims are valid during a Wyoming Demand for Collateral by Creditor.

Perfecting interest in accounts receivable requires filing a UCC-1 Financing Statement with the appropriate state office, which in Wyoming is the Secretary of State. This statement needs to clearly identify the debtor and the collateral, which includes the right to collect accounts receivable. Once the UCC-1 is filed, your interest becomes legally enforceable against third parties. This step is crucial when pursuing a Wyoming Demand for Collateral by Creditor.

To conduct a UCC search in Wyoming, you can access the Wyoming Secretary of State’s website. You will find a dedicated section for UCC filings that allows you to search for secured transactions involving creditors and debtors. By entering relevant details, such as the debtor's name, you can uncover any filed UCC statements. This process is essential for understanding any existing interests in collateral when considering a Wyoming Demand for Collateral by Creditor.