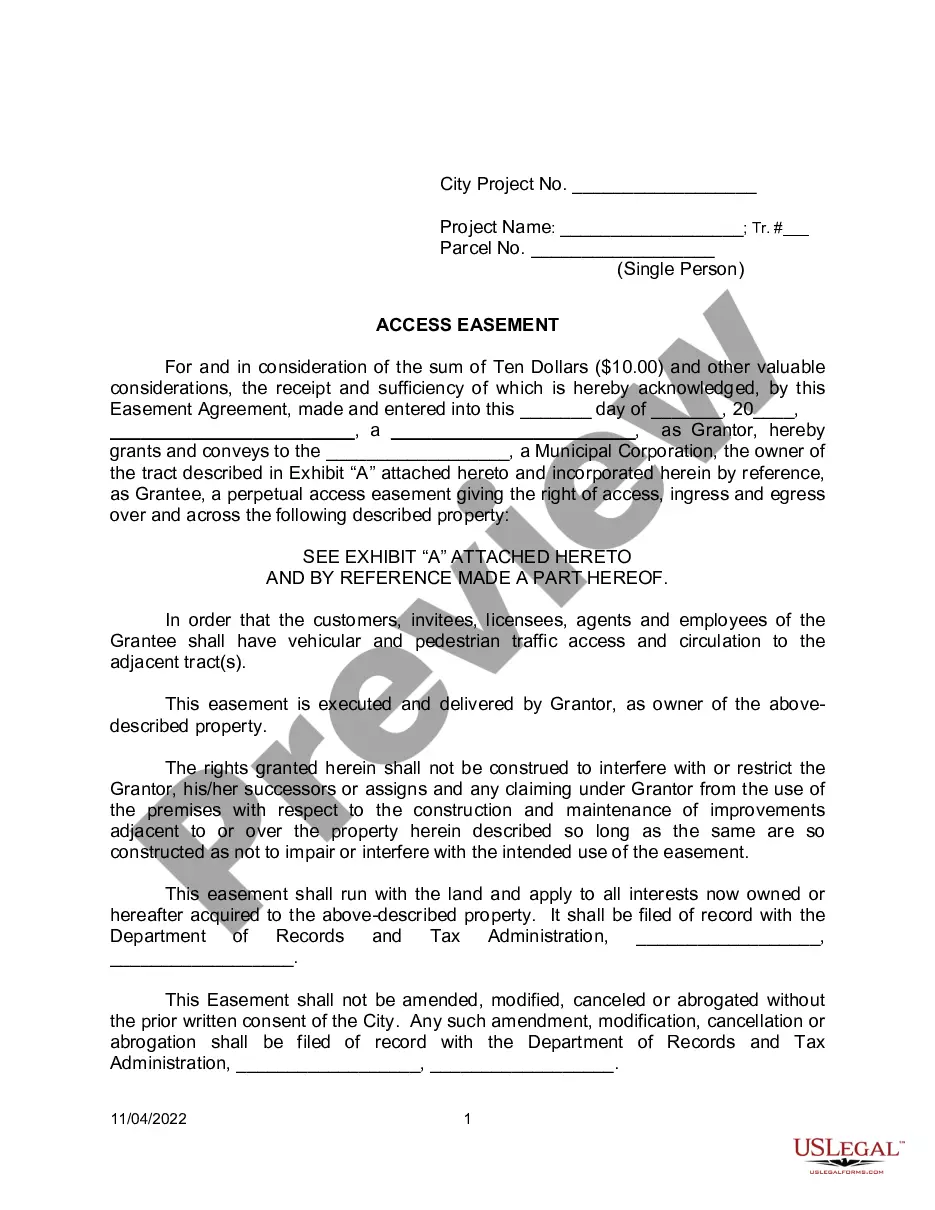

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a broad selection of legal paperwork templates you can either download or print.

By utilizing the website, you can discover countless forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust in moments.

Review the form summary to confirm you have selected the appropriate form.

If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In to download the Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously obtained forms from the My documents section of your account.

- If you are planning to use US Legal Forms for the first time, here are simple steps to help you start.

- Ensure you have selected the correct form for your location/state.

- Click the Review button to check the form's details.

Form popularity

FAQ

Beneficiary income generally includes any distributions or payments made to you from the trust's earnings. This can cover interest, dividends, and other revenue generated by trust assets. Understanding what qualifies as beneficiary income under a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust can help ensure you report everything correctly and maximize your benefits.

To report beneficiary income, you should include it on your tax return as it may impact your overall tax liability. Make sure you receive a Schedule K-1 if the trust is a complex trust, which outlines your share of the income. Using a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust can make this process clearer, helping you accurately document your earnings.

Beneficiary income refers to the portion of trust earnings that an individual receives. When utilizing a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust, this income can include distributions made from the trust's profits. It is essential to understand this income to manage your tax obligations and personal finances effectively.

Wyoming has no state income tax primarily due to its diverse and robust economy, which includes significant revenue from natural resources and tourism. This tax structure attracts individuals and businesses, especially those considering trusts, like the Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust. This favorable environment supports growth and wealth accumulation for residents and beneficiaries.

Several states, including Wyoming, do not tax trust income, making them attractive for establishing trusts. Beneficiaries can retain more of their income, which encourages long-term financial planning. Utilizing a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust can take full advantage of these tax benefits, boosting overall returns.

Trust income is generally reported on Form 1041, which the trust itself files. If you receive distributions as a beneficiary, you will report the income on your individual tax return, typically through Form 1040. Particularly, if you benefit from a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust, it's essential to track all income received for proper reporting.

Yes, beneficiaries usually receive a Form 1099 for trust income if the trust makes distributions. This form provides important information that individuals need for their tax filings. Specifically, if you participate in a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust, be sure to report the income accurately as designated on the 1099.

Distributing trust income requires the trustee to follow the trust's stipulations diligently. Each beneficiary receives income based on their designated share, which could include aspects like a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust. Clear communication and documentation of these distributions help ensure a smooth process and limit potential disputes.

Distributing trust income to beneficiaries involves following the terms outlined in the trust document. Typically, the trustee manages these distributions fairly and in accordance with the trust's provisions. If the trust includes a Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust, the income can be allocated based on the specified percentage, ensuring compliance and clarity.

No, Wyoming does not impose a state income tax on trusts, which can significantly benefit individuals looking to establish a trust. This policy encourages the establishment of trusts such as the Wyoming Assignment by Beneficiary of a Percentage of the Income of a Trust, making it an attractive option for asset protection and wealth management. Thus, maintaining more wealth for beneficiaries is easier.