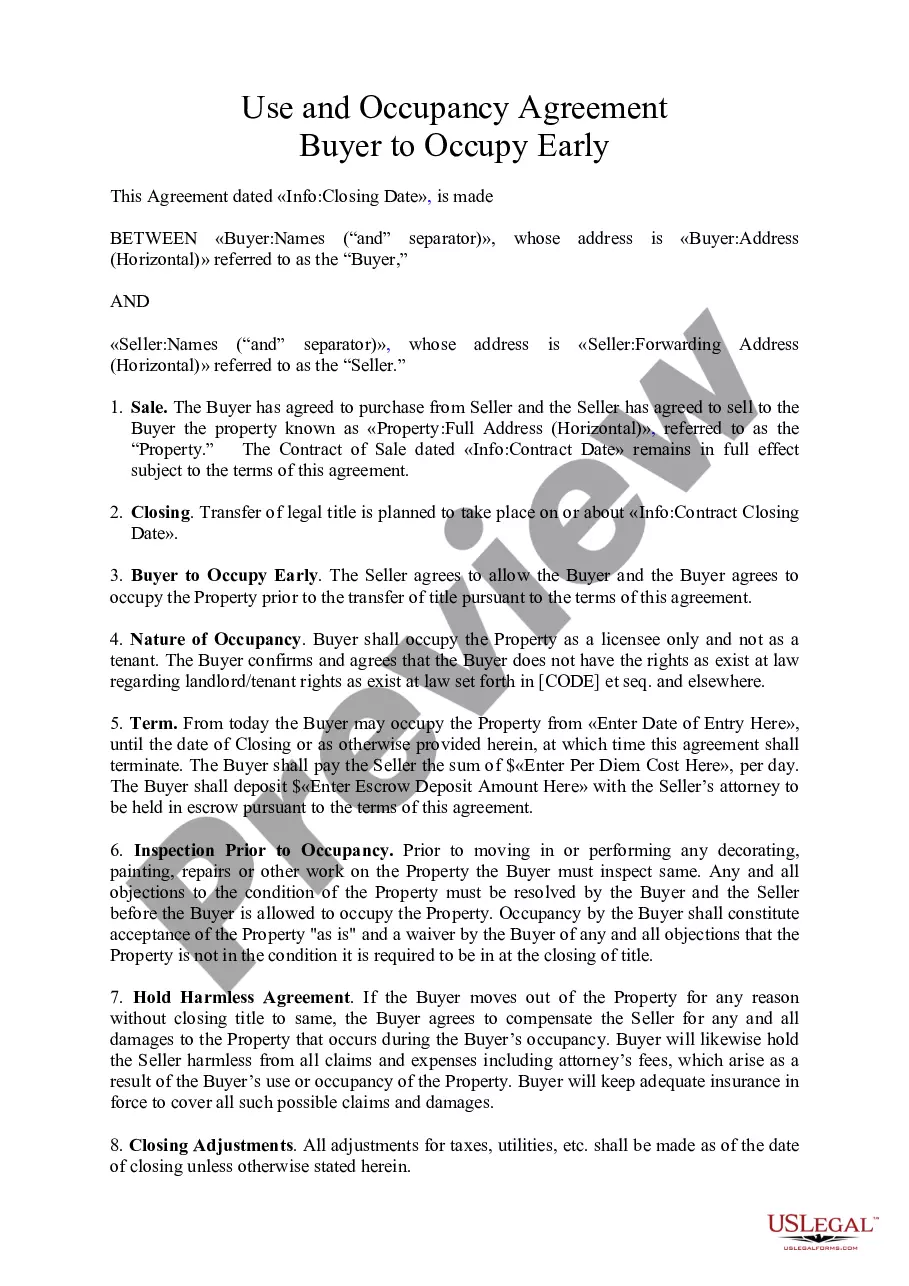

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

If you wish to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the largest array of legal forms available online.

Take advantage of the site’s simple and efficient search to obtain the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Wyoming Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- Use US Legal Forms to acquire the Wyoming Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and hit the Download button to obtain the Wyoming Assignment by Beneficiary of an Interest in the Trust Established for the Benefit of Beneficiary.

- You can also access forms you have previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

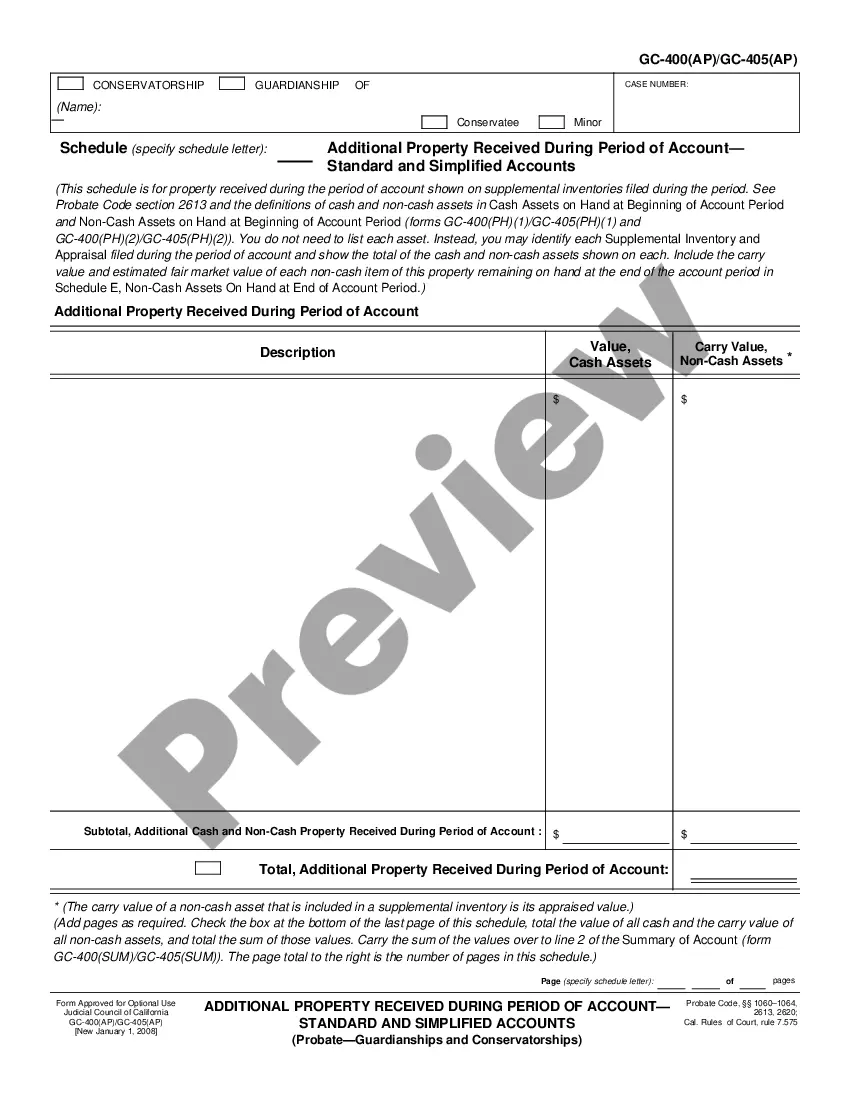

- Step 1. Make sure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

- Step 4. Once you have found the form you need, choose the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Certainly, a beneficiary can transfer their interest in a trust to another party. This process is formalized and hinges on proper documentation, ensuring legality and clarity in the transfer. Using the Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is the ideal solution for facilitating this transfer. This assignment form allows you to maintain control while enabling others to benefit from your interest.

No, Wyoming does not impose a state income tax on trusts. This aspect makes Wyoming an attractive destination for establishing trusts and reaping maximum benefits from your assets. The Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary allows you to navigate trust interests without the burden of state income tax complications. Thus, your wealth can be preserved and efficiently managed.

Assignment of beneficial interest refers to the transfer of a beneficiary's rights to receive benefits under a trust to another individual. This legal action is significant as it allows the designated party to receive income or distributions from the trust. To effectively complete this process, utilizing the Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is essential. This ensures your assignment is legally documented and acknowledged.

Beneficiaries hold specific powers that can significantly impact the management of a trust. They have the right to receive distributions and may also seek changes in the trust terms under certain conditions. Using the Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, they can assign their interests to others, thus expanding their options for asset management. This empowerment ensures that beneficiaries can make choices that are right for them.

Creating a trust in Wyoming offers several advantages. You benefit from strong privacy protections, reduced fees, and minimal regulations. Additionally, the Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary allows beneficiaries to easily manage and assign their interests, making this state a favorable choice for trust management. These features contribute to a secure and efficient environment for trust beneficiaries.

The right to assign interest allows a beneficiary to transfer their financial interest in the trust to another party. This can provide flexibility in managing assets and ensuring that the intended benefits reach the right individuals. The Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary facilitates this process smoothly. With the appropriate form, you can make informed decisions regarding your trust interests.

Yes, a beneficiary can assign their interest in a trust. It is important to understand that the process requires proper documentation to ensure legality. The Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a document that enables this assignment. By using this form, you maintain clarity and legal standing in your financial transactions.

Transferring stock from a trust to a beneficiary typically involves following the trust's established procedures. This can include filling out certain forms and providing any necessary documentation. Ensuring compliance with the trust's terms is crucial for a smooth transfer. If you require assistance with this process, consider the Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary as a practical solution.

Yes, Wyoming does not levy a state income tax, making it an attractive option for establishing trusts. This characteristic allows more of the trust's assets to grow, which can be beneficial for the beneficiaries. It also simplifies the distribution of assets when the time comes. To take advantage of this benefit, consider utilizing a Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

The best state to create a trust often depends on your specific financial goals and circumstances. Wyoming is frequently favored due to its flexible trust laws and favorable tax treatment. Additionally, it offers strong privacy protections and less bureaucracy. When considering a trust, explore the advantages offered by a Wyoming Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.