Wyoming General Form of Receipt

Description

How to fill out General Form Of Receipt?

Are you currently in a situation where you require documents for either business or personal use virtually every day.

There are numerous authentic document templates accessible on the web, but finding ones you can rely on is not easy.

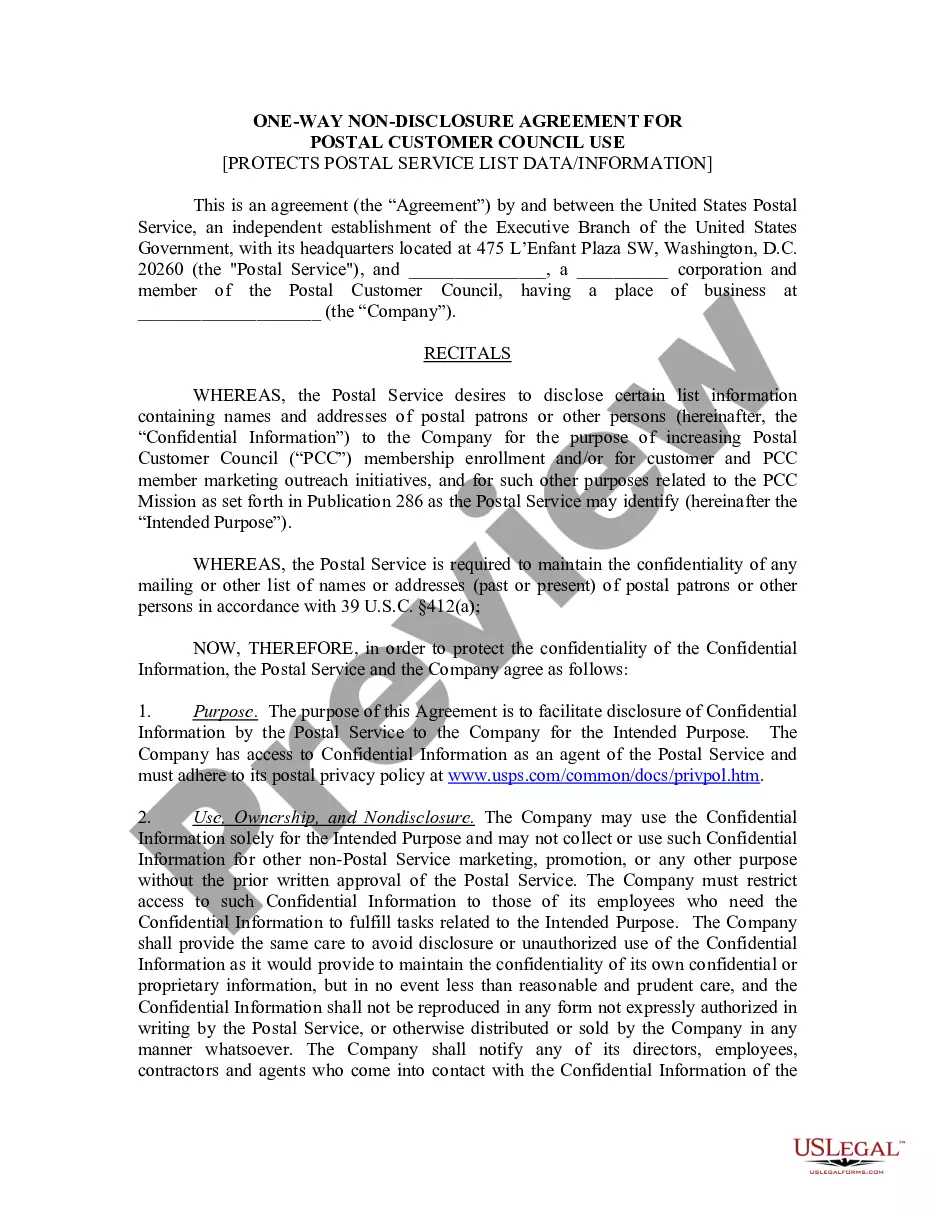

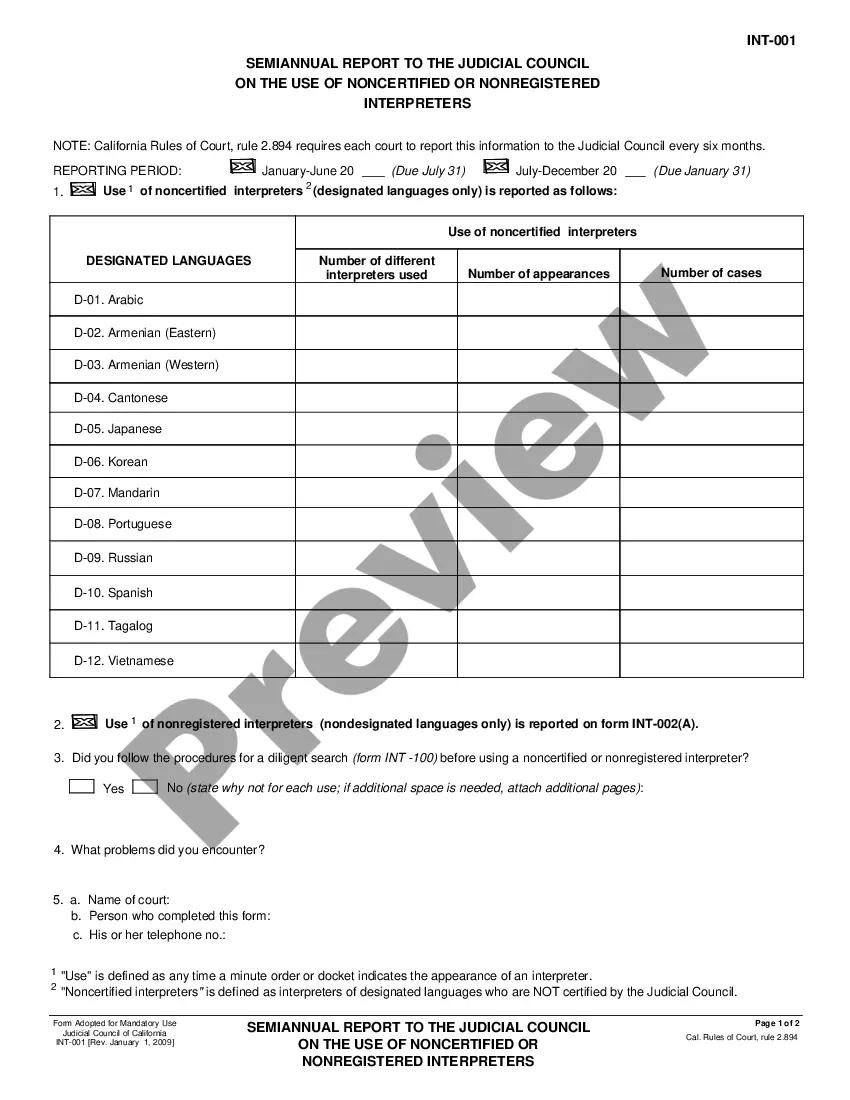

US Legal Forms provides thousands of form templates, like the Wyoming General Form of Receipt, which are designed to meet state and federal requirements.

Once you find the right form, click on Purchase now.

Choose the payment option you want, fill in the necessary information to create your account, and pay for the order using your PayPal or Credit Card. Select a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Wyoming General Form of Receipt template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

- Use the Review option to evaluate the form.

- Check the details to make sure you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

You can verify a business in Wyoming by searching the Secretary of State's business database online. This tool allows you to check if a business is registered and its current status. This verification process can be crucial for ensuring that you're dealing with legitimate entities. For easy tracking of transactions, always consider using the Wyoming General Form of Receipt for your records.

Generally, a Wyoming LLC does not need to file a tax return with the state itself due to the lack of a state income tax. This means that most business owners enjoy minimal tax burdens. However, you should still consult with a tax professional to understand any potential federal tax obligations. Ensuring detailed record-keeping with templates like the Wyoming General Form of Receipt can prove beneficial in this regard.

To acquire a certificate of good standing in Wyoming, you must request it through the Wyoming Secretary of State's office. The application process is straightforward, and you can often do it online. This certificate verifies that your business is compliant with Wyoming's laws, which can be crucial for securing loans or other business resources. Keep your receipts organized using the Wyoming General Form of Receipt to streamline this process.

Yes, Wyoming mandates that businesses, including LLCs, submit an annual report. This report provides updates on the business's status and verifies that the company continues to meet state requirements. By actively filing your annual report, you maintain your business's good standing in Wyoming. You can find the necessary forms, including the Wyoming General Form of Receipt, through platforms that simplify compliance.

Wyoming does not require most LLCs to file a state tax return because there is no state income tax. This law makes Wyoming an attractive destination for business owners. Nevertheless, you should remain aware of other potential taxes and associated filing requirements. Utilizing tools like the Wyoming General Form of Receipt helps track expenses efficiently.

A Wyoming LLC does not have to file a state tax return, as the state does not impose an income tax on LLCs. However, if your LLC has employees or is structured as a corporation, you must fulfill specific filing requirements. It’s essential to keep good financial records, including receipts, which the Wyoming General Form of Receipt can assist with. Thus, your tax obligations remain minimal and manageable.

Forming an LLC in Wyoming offers several advantages, such as no state income tax and strong privacy laws. The state supports business growth by providing flexible management options and minimal fees. Using resources such as the Wyoming General Form of Receipt can guide you through the formation process, making it easier and more effective.

Forming a Wyoming LLC involves several steps. First, choose a unique name for your LLC and appoint a registered agent. Then, file the Articles of Organization with the Wyoming Secretary of State. Utilizing the Wyoming General Form of Receipt can help you manage these steps efficiently, ensuring that you meet all requirements without hassle.

While Wyoming LLCs have many advantages, there are a few disadvantages to consider. Non-resident members may face additional tax regulations in their home states. Additionally, you need to maintain a registered agent in Wyoming, which can add to your ongoing costs. It's always wise to review your specific situation and weigh the benefits against potential drawbacks.

Absolutely, forming an LLC in Wyoming while residing elsewhere is straightforward. Many non-residents take advantage of Wyoming's business-friendly laws and tax benefits. You will need to complete the necessary forms, and using the Wyoming General Form of Receipt can simplify your application process significantly.