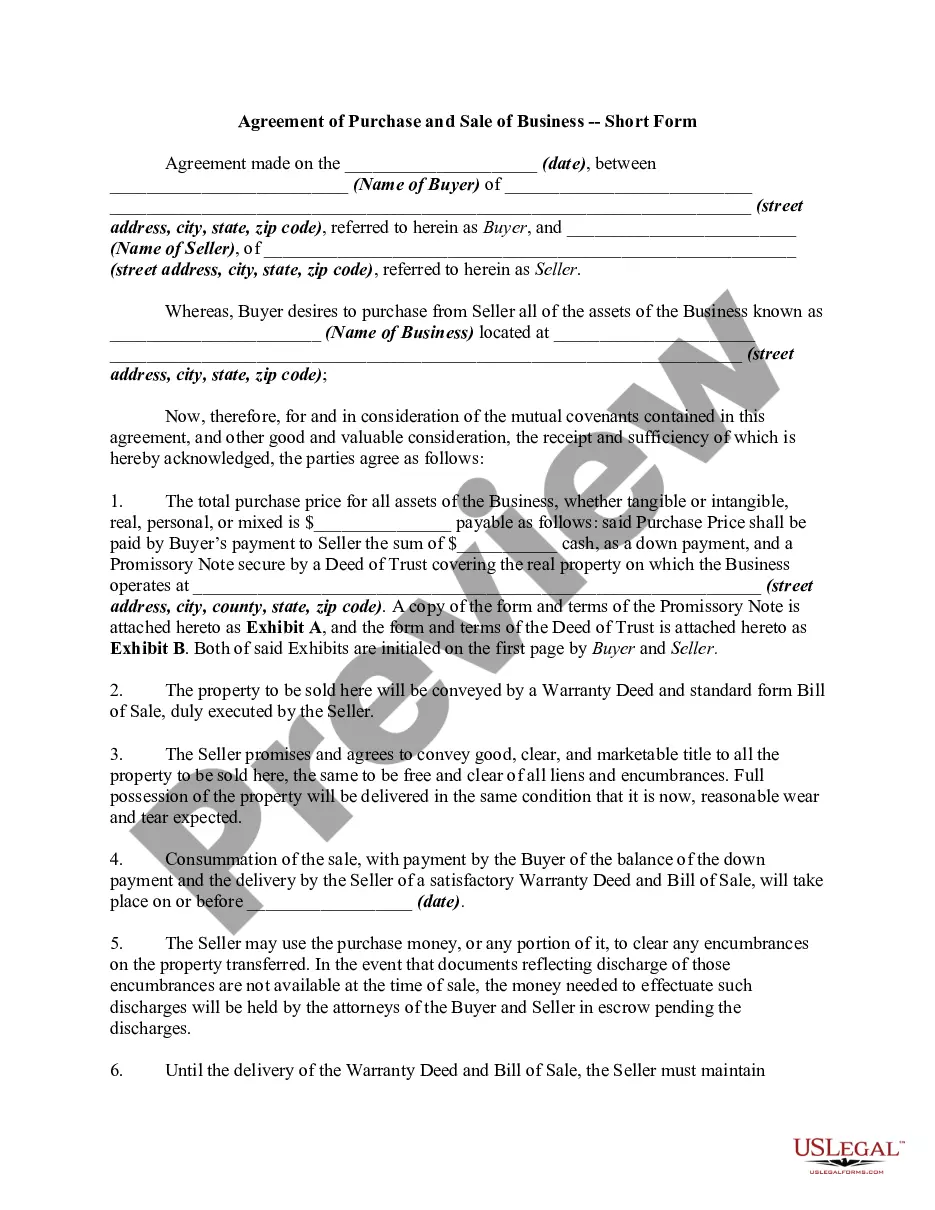

Wyoming Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

US Legal Forms - one of the largest collections of legal documents in the US - provides a selection of legal document templates that can be downloaded or printed.

By using the site, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords. You can obtain the latest iterations of forms like the Wyoming Agreement for Purchase of Business Assets from a Corporation in minutes.

If you already possess a membership, Log In to download the Wyoming Agreement for Purchase of Business Assets from a Corporation from the US Legal Forms library. The Download button will appear on each form you encounter. You can access all previously obtained forms in the My documents section of your account.

Make adjustments. Fill out, modify, print, and sign the downloaded Wyoming Agreement for Purchase of Business Assets from a Corporation.

Every template you save in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Wyoming Agreement for Purchase of Business Assets from a Corporation with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your locality/state. Click the Review button to check the contents of the form. Review the form details to ensure you've selected the right one.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire Now button. Then, choose your preferred pricing plan and enter your information to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Is an LLC Operating Agreement required in Wyoming? No. An Operating Agreement is not required in Wyoming. Although it is not required, the SBA recommends that all LLCs in every state have a clear and detailed Operating Agreement.

A business sale agreement is a legal document that describes and records the price and other details when a business owner sells the business. It is the final step to transfer ownership after negotiations for the transaction have been completed.

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

What should an LLC operating agreement include?The legal name of the company.Any fictitious business names or DBAs.The company address.Name and address of your registered agent (who accepts legal service of process on your behalf.) Every LLC must have a registered agent under state law.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.