West Virginia Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

If you wish to complete, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal applications are categorized by types and states, or by keywords.

Step 4. After locating the form you need, click the Get now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to retrieve the West Virginia Storage Services Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to access the West Virginia Storage Services Agreement - Self-Employed.

- You can also find forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

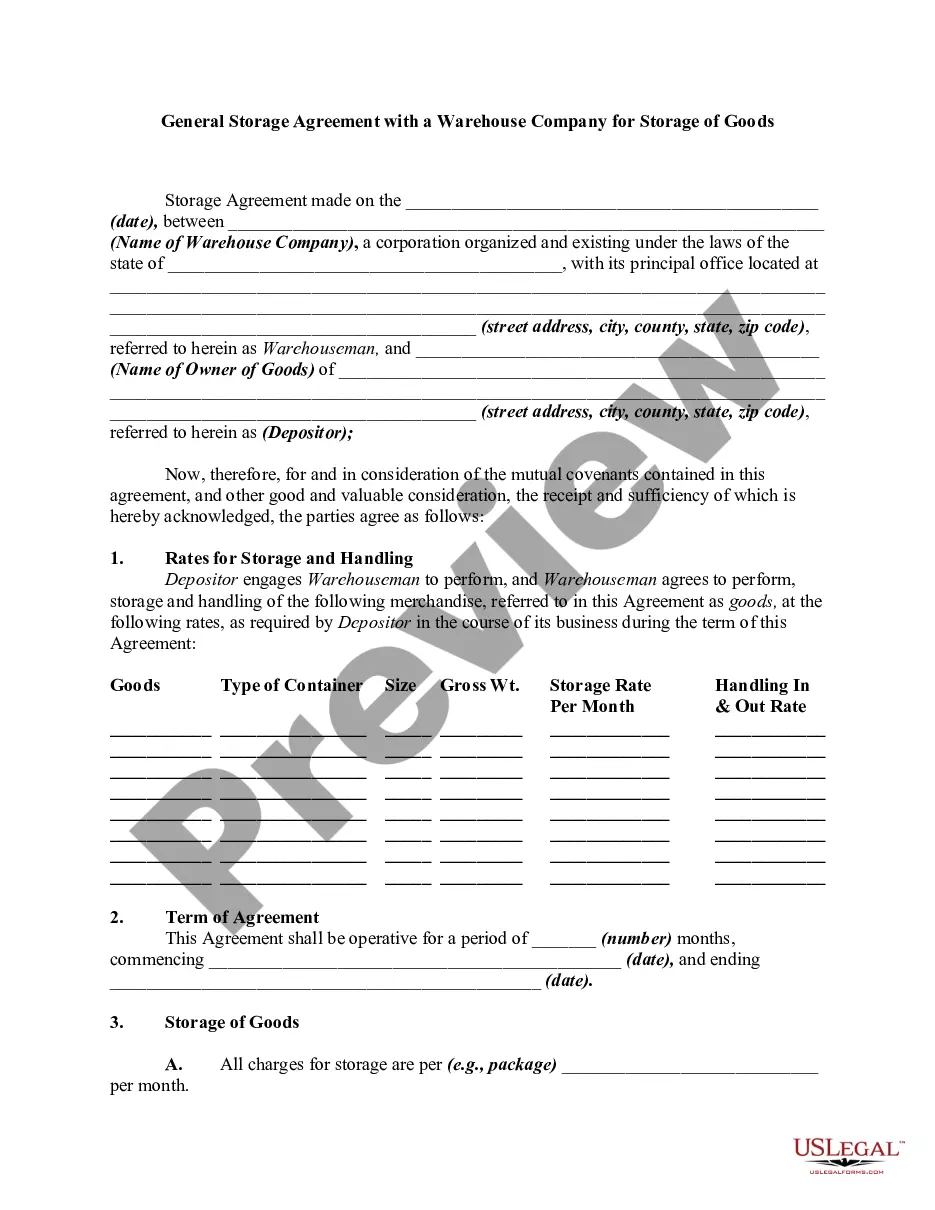

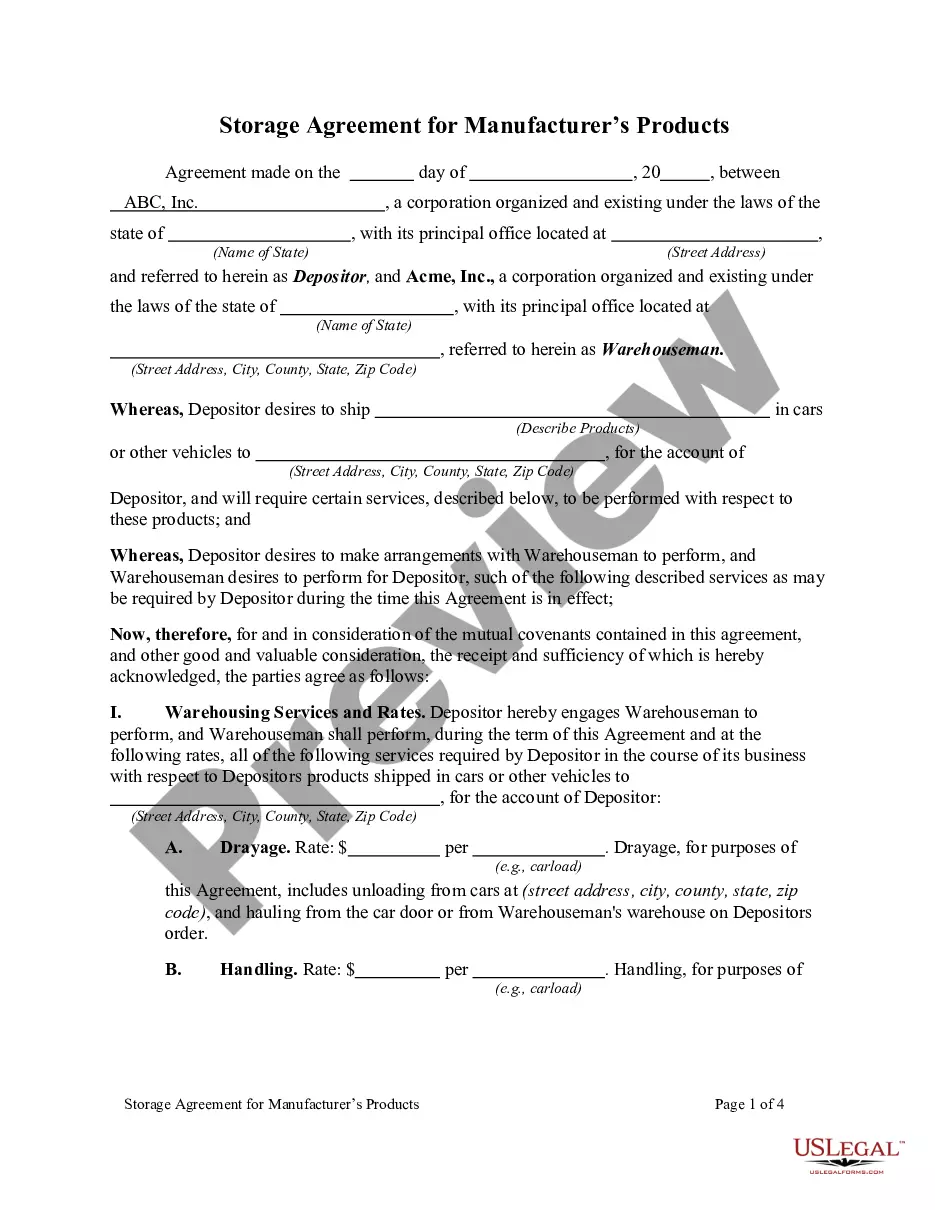

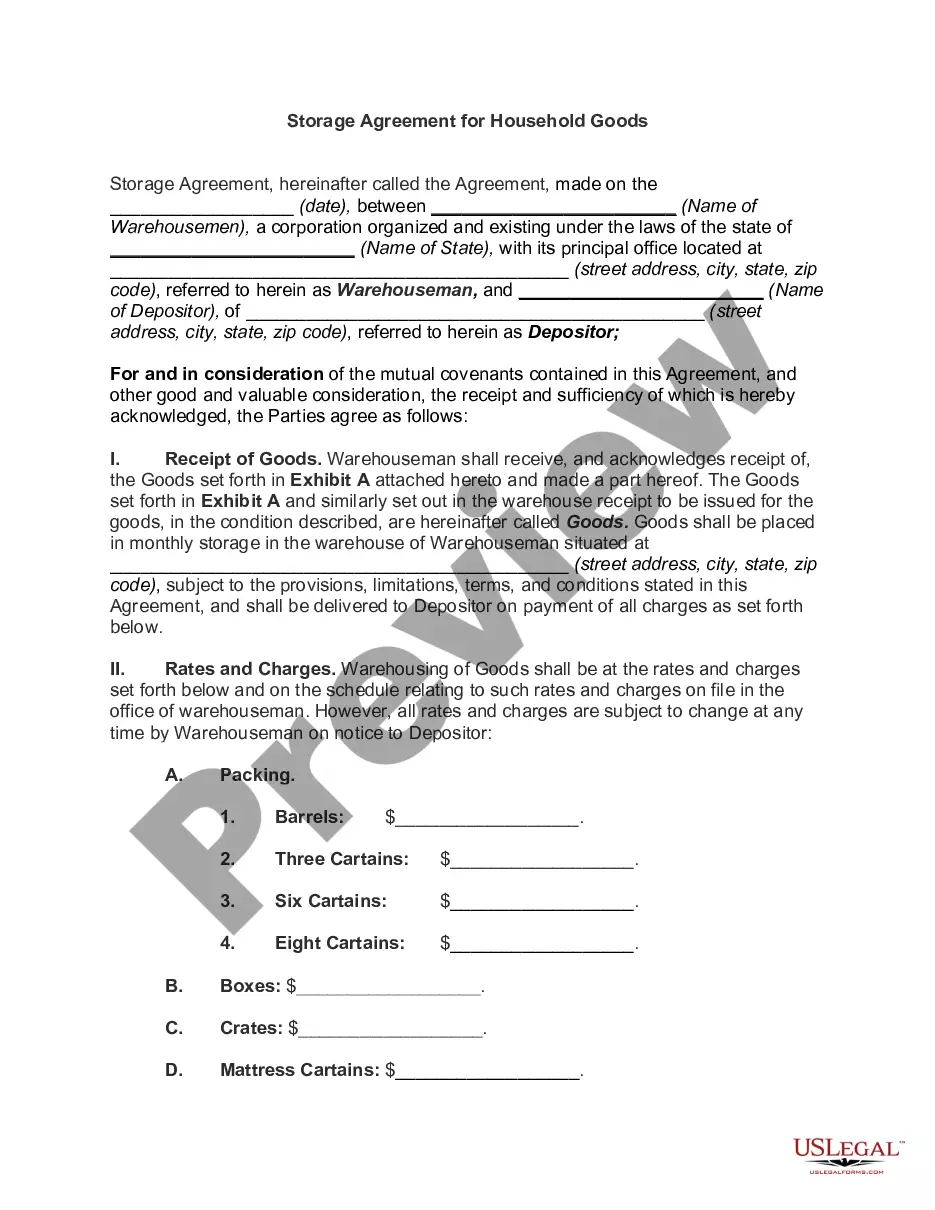

When writing a storage contract, focus on clarity and detail. Include sections on payment, duration of service, and access to the storage unit. A well-structured contract promotes transparency and trust, which are crucial in West Virginia Storage Services Contracts - Self-Employed.

To write a storage contract, start by detailing the parties involved and specify the rental terms, including the size of the storage unit and monthly fees. Be sure to include clauses on security deposits, insurance options, and the process for terminating the contract. For convenience, you might explore Uslegalforms for templates tailored to West Virginia Storage Services Contracts - Self-Employed.

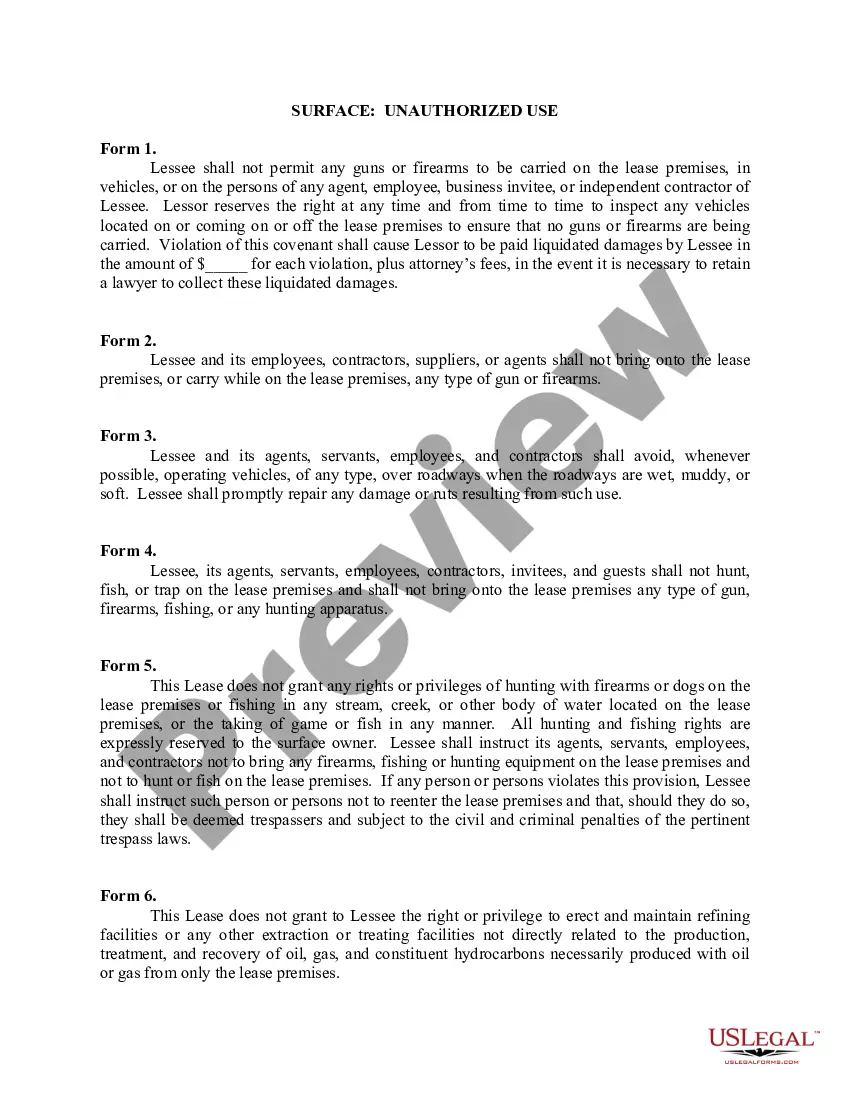

In West Virginia, individuals can perform some small projects without a contractor license, but the specifics can vary. Typically, tasks like minor repairs or maintenance may not require a license, but larger projects do. It’s essential to view the regulations closely to ensure compliance when managing your West Virginia Storage Services Contracts - Self-Employed.

To write a simple contract agreement, start with the names of the parties involved, followed by a clear description of the services provided. Include payment terms, any deadlines, and conditions for termination. By keeping it straightforward, you increase the clarity for both parties when engaging in West Virginia Storage Services Contracts - Self-Employed.

Storage contracts outline the terms between the storage provider and the customer for services rendered. Typically, these contracts specify fees, duration of service, and the rights and responsibilities of both parties. Understanding how these contracts work is essential for anyone using West Virginia Storage Services Contracts - Self-Employed.

Yes, you can write your own lease agreement template for West Virginia Storage Services Contracts - Self-Employed. However, it is vital to ensure that it complies with local laws and regulations. Uslegalforms provides templates that can guide you through creating a legally sound lease agreement tailored to your needs.

A contractor contract for West Virginia Storage Services Contracts - Self-Employed should outline the project scope, payment terms, timelines, and responsibilities. It should also include specific details such as the location of the storage unit, the duration of the service, and any applicable fees. Clearly defining these elements helps prevent misunderstandings and ensures both parties are on the same page.

When considering a West Virginia Storage Services Contract - Self-Employed, you may encounter several disadvantages of a land contract. First, these contracts often lack the protections found in traditional real estate transactions, placing you at risk of losing your investment if default occurs. Additionally, the seller retains title until the full payment is made, which can complicate your ownership rights. Lastly, the terms may not be as flexible as you would like, making it essential to review your options carefully.

A land contract in West Virginia allows the buyer to make monthly payments directly to the seller while living on the property. Legal documents outline the payment schedule, the responsibilities of both parties, and any terms related to property maintenance. These contracts can provide unique opportunities, particularly when combined with a West Virginia Storage Services Contract - Self-Employed, catering to various business needs.

Typically, a down payment is required for a land contract, although the amount can vary based on the agreement between the parties. This upfront payment helps secure the deal and shows the seller that the buyer is committed. If you are entering a West Virginia Storage Services Contract - Self-Employed, understanding what your down payment entails can lead to a smoother transaction.