West Virginia Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

Selecting the correct lawful document template can be quite challenging. Clearly, there are numerous designs accessible on the web, but how will you locate the authentic type you require.

Use the US Legal Forms website. The service provides thousands of templates, including the West Virginia Auditor Agreement - Self-Employed Independent Contractor, that you can utilize for business and personal purposes. All of the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to download the West Virginia Auditor Agreement - Self-Employed Independent Contractor. Use your account to search through the legal forms you have previously purchased. Visit the My documents section of your account and get another copy of the document you need.

Complete, modify, and print the acquired West Virginia Auditor Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Use the service to obtain professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

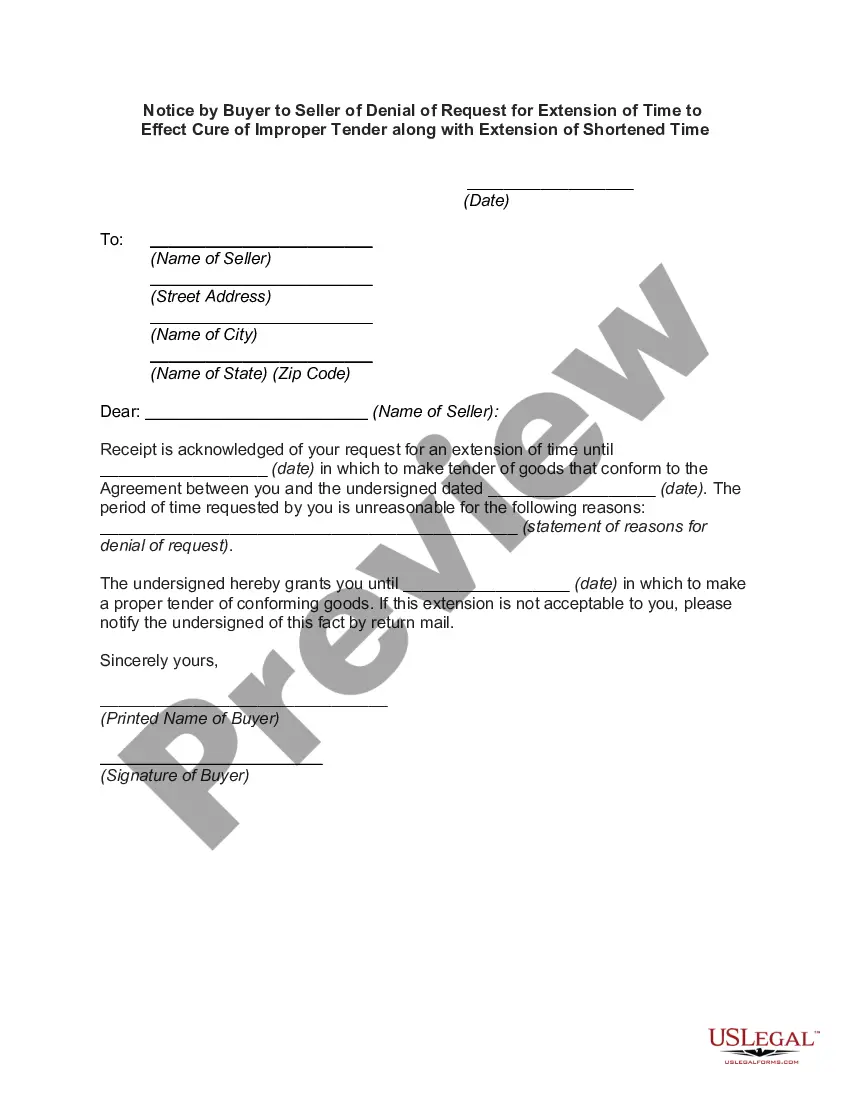

- First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and examine the form details to confirm it is the right one for you.

- If the form does not meet your needs, take advantage of the Search area to find the appropriate type.

- Once you are confident that the form is suitable, click the Purchase now button to obtain the document.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

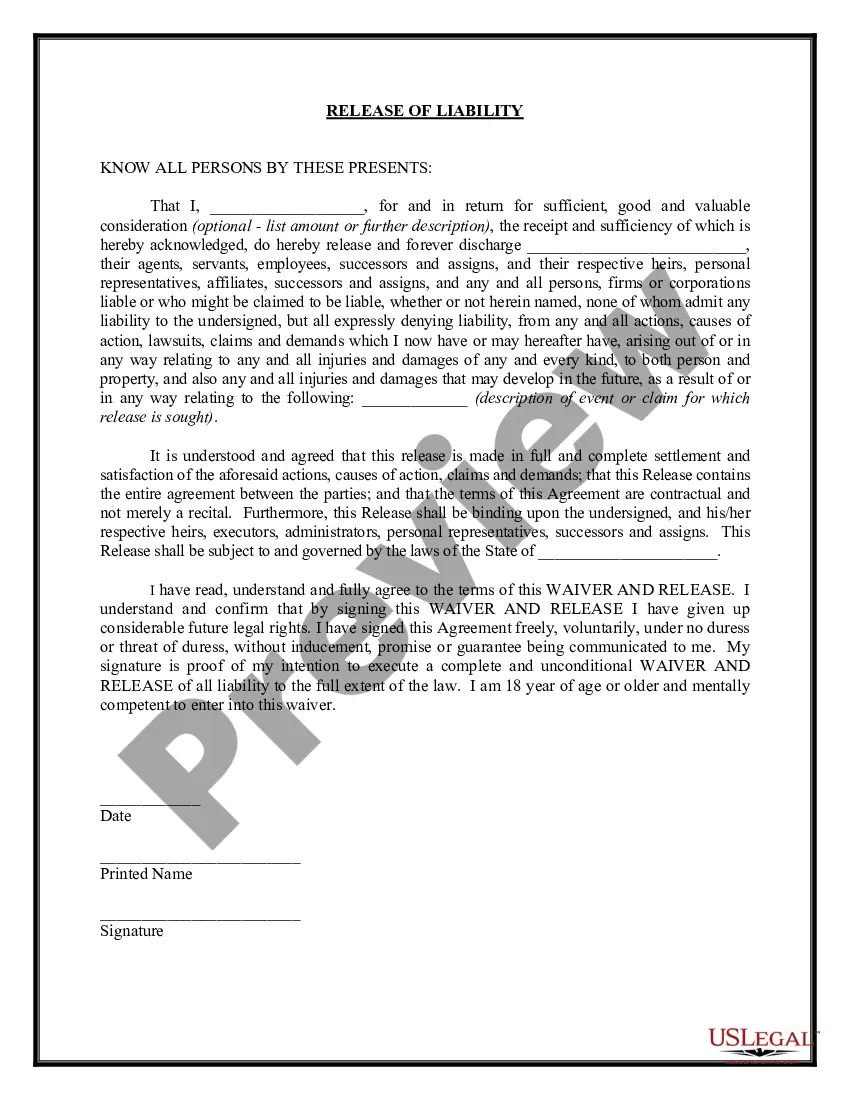

Yes, having a contract is essential for independent contractors. A contract, like the West Virginia Auditor Agreement - Self-Employed Independent Contractor, protects your interests and clarifies expectations. It provides a legal framework that defines the terms of your engagement, including payment and deliverables. By using a proper contract, you minimize risks and enhance professional credibility.

The basic independent contractor agreement outlines the terms and conditions between a company and an independent contractor. This document includes details about the scope of work, payment, deadlines, and the duration of the project. A clearly defined West Virginia Auditor Agreement - Self-Employed Independent Contractor helps both parties understand their responsibilities and rights. By using this agreement, you can avoid misunderstandings and ensure a smooth working relationship.

Creating an independent contractor agreement starts with outlining the scope of work, payment terms, and deadlines. You should also include confidentiality clauses and terms for termination to avoid future disputes. Using a platform like U.S. Legal Forms can help you generate a comprehensive West Virginia Auditor Agreement - Self-Employed Independent Contractor with ease, ensuring all necessary elements are included. This approach minimizes risks and lays a solid foundation for your working relationship.

Typically, the hiring party drafts the independent contractor agreement. However, both the contractor and the hiring entity should review and agree on the terms to ensure clarity. Depending on the complexity, it might be beneficial to consult with a legal professional to tailor the West Virginia Auditor Agreement - Self-Employed Independent Contractor to specific needs. This cooperation helps protect both parties and establishes mutual understanding.

West Virginia tax form 140 is the individual income tax return form used by residents of the state. It is essential for reporting your income and determining your tax liability. This form is particularly important for self-employed individuals, as it outlines the necessary information regarding income earned and deductions. Filing correctly using the West Virginia Auditor Agreement - Self-Employed Independent Contractor ensures that you meet state tax obligations and avoid penalties.

Yes, West Virginia does allow independent contractors to operate legally within the state. This flexibility enables individuals to work in various fields while maintaining their independence. However, it's important for contractors to understand the tax obligations and regulatory requirements that come with this status. The West Virginia Auditor Agreement - Self-Employed Independent Contractor can guide you through the necessary compliance steps.

The West Virginia state auditor plays a crucial role in overseeing the financial operations of the state. This includes managing public funds and ensuring that they are used efficiently and effectively. The auditor also provides transparency by auditing various state agencies and reporting on their financial practices. Overall, the West Virginia Auditor Agreement - Self-Employed Independent Contractor emphasizes the importance of financial accountability in the state.