West Virginia Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

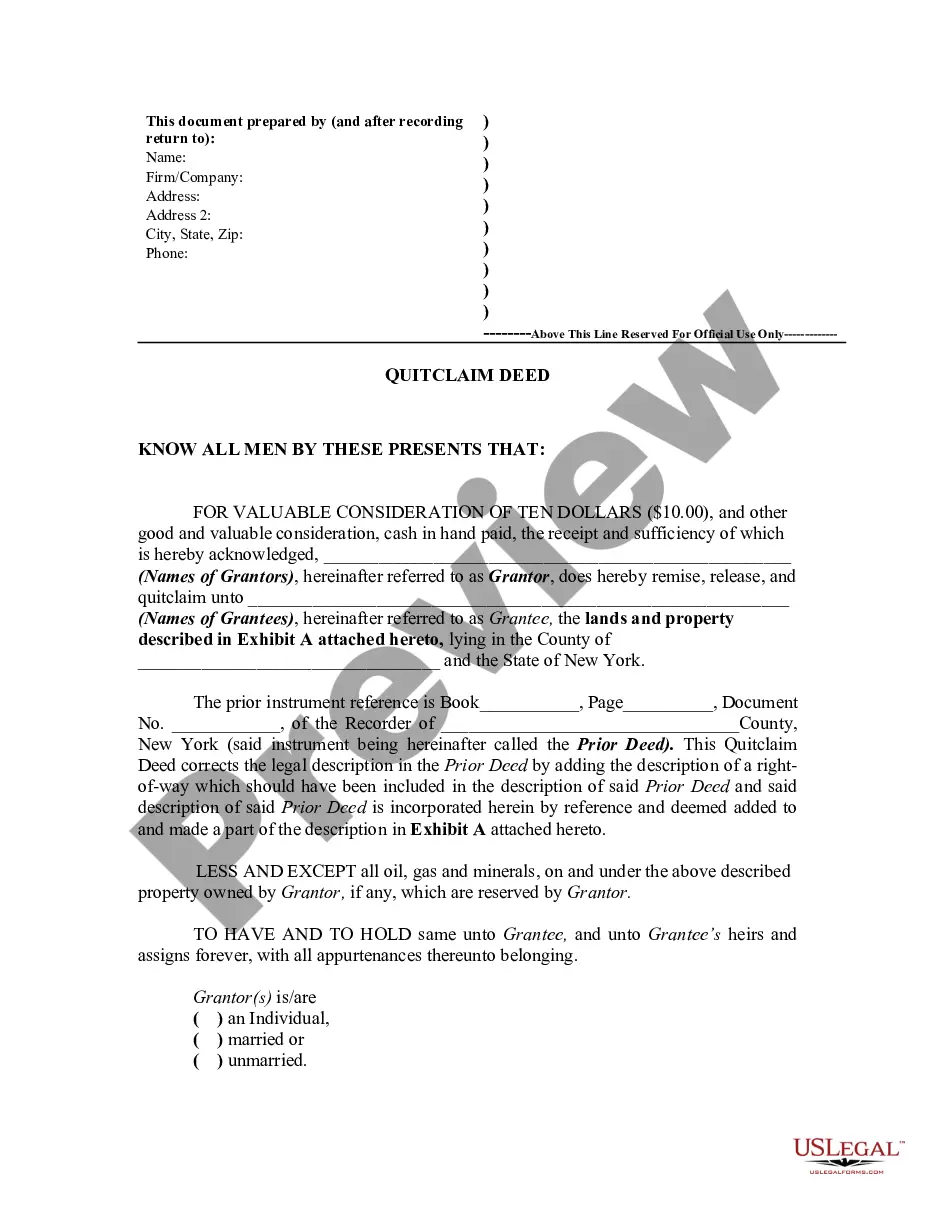

You are capable of dedicating several hours online searching for the legal document template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal forms that are assessed by experts. You can download or print the West Virginia Account Executive Agreement - Self-Employed Independent Contractor from the service.

If you have a US Legal Forms account, you can sign in and click on the Download button. After that, you can complete, modify, print, or sign the West Virginia Account Executive Agreement - Self-Employed Independent Contractor. Every legal document template you obtain is yours permanently. To get another copy of the acquired form, visit the My documents section and click on the corresponding button.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the area/city you choose. Review the form description to confirm you have chosen the right form. If available, utilize the Review button to look through the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you desire, click Get now to proceed.

- Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make modifications to the document if necessary. You can complete, edit, sign, and print the West Virginia Account Executive Agreement - Self-Employed Independent Contractor.

- Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms.

Form popularity

FAQ

To fill out an independent contractor form, begin by entering your personal information and the client's details. Clearly state the nature of the work, payment terms, and any other important clauses. Using our platform, you can access templates for a West Virginia Account Executive Agreement - Self-Employed Independent Contractor which simplifies this process and ensures you cover necessary components efficiently.

Yes, West Virginia allows independent contractors to operate under certain guidelines. As long as both parties agree on the terms laid out in the West Virginia Account Executive Agreement - Self-Employed Independent Contractor, the arrangement is legal and enforceable. It is advisable to familiarize yourself with both state and federal regulations to avoid any potential issues.

An independent contractor typically needs to fill out a W-9 form for tax purposes along with any specific forms required by your state. For a West Virginia Account Executive Agreement - Self-Employed Independent Contractor, additional documents might be necessary depending on the type and scope of work. Always check local regulations to ensure compliance.

Filling out an independent contractor agreement requires you to provide accurate details about both parties involved. Make sure to enter the contractor's name, address, and social security number. Additionally, outline the services provided and payment arrangements, making it a comprehensive West Virginia Account Executive Agreement - Self-Employed Independent Contractor.

To write an independent contractor agreement, start by clearly defining the scope of work. Include important details such as payment terms, the duration of the engagement, and any confidentiality obligations. It is crucial to specify that this is a West Virginia Account Executive Agreement - Self-Employed Independent Contractor to ensure compliance with state laws.

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Write-Off Personal ExpensesBy writing off partial personal expenses, you can deduct the amount that is used for business. For example, if you use your personal phone for your delivery job and show that 50% of the usage on the phone is for work, you can deduct 50% of the phone bill on your 1099.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.