West Virginia Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment

Description

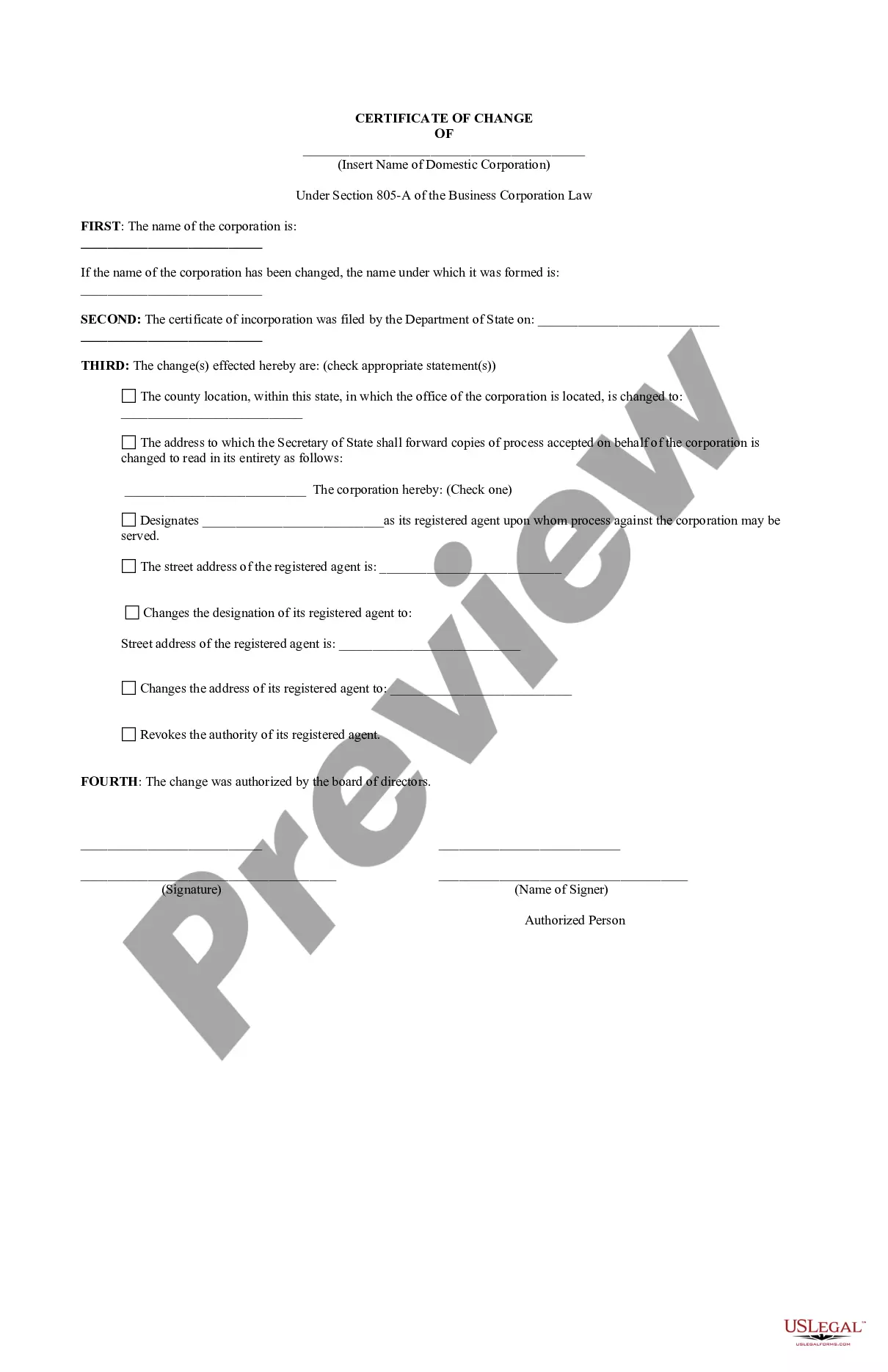

How to fill out Proposed Amendment To Article 4 Of Certificate Of Incorporation To Authorize Issuance Of Preferred Stock With Copy Of Amendment?

If you wish to comprehensive, download, or printing lawful file themes, use US Legal Forms, the most important collection of lawful types, that can be found on the Internet. Take advantage of the site`s basic and convenient research to obtain the paperwork you will need. Different themes for organization and individual reasons are sorted by types and claims, or search phrases. Use US Legal Forms to obtain the West Virginia Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment with a few clicks.

In case you are currently a US Legal Forms consumer, log in to the profile and click on the Acquire switch to find the West Virginia Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment. You may also accessibility types you formerly acquired within the My Forms tab of the profile.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the form for the correct city/land.

- Step 2. Use the Review solution to look through the form`s articles. Don`t forget to read through the information.

- Step 3. In case you are not satisfied using the kind, make use of the Lookup area near the top of the display to locate other types in the lawful kind web template.

- Step 4. Once you have identified the form you will need, select the Buy now switch. Select the costs program you favor and add your references to sign up to have an profile.

- Step 5. Approach the transaction. You should use your charge card or PayPal profile to complete the transaction.

- Step 6. Select the file format in the lawful kind and download it on your own gadget.

- Step 7. Complete, modify and printing or signal the West Virginia Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment.

Every single lawful file web template you buy is your own property eternally. You may have acces to every single kind you acquired in your acccount. Go through the My Forms segment and pick a kind to printing or download again.

Compete and download, and printing the West Virginia Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment with US Legal Forms. There are millions of professional and state-certain types you can utilize for your personal organization or individual requirements.

Form popularity

FAQ

If you prefer to file by mail (instead of online), you'll need to: Download and complete the West Virginia LLC Articles of Organization (Form LLD-1) Fill out the Articles of Organization and Customer Order Request form. ... Prepare a check or money order for $100 and make it payable to ?West Virginia Secretary of State?

West Virginia requires all business entities and individuals to obtain a business registration certificate from the State Tax Department before doing business in the state. This certificate (sometimes referred to as a ?business license?) is needed for each business location.

When you are ready to dissolve your West Virginia corporation, you file original Articles of Dissolution with the West Virginia Secretary of State, Business Division (SOS). West Virginia SOS does not require the use of their forms. They do not require original signatures.

You can change your West Virginia registered agent any time by filing an Application to Appoint or Change Process, Officers and/or Addresses with the West Virginia Secretary of State, Business Division (SOS). You can submit your documents by fax, mail, or in person.

File a dissolution, termination, withdrawal, or cancellation online quickly and conveniently through the One Stop Business Portal. The Secretary of State's Office also provides forms that meet minimum state law requirements available online through the Secretary of State Form Search.

How do I close my sales and use tax account? You can contact us through MyTaxes or by sending a letter with the closing date and the reason you are requesting the account be closed.

A business license is valid for one year starting on July 1 and ending on June 30. A business license renewal will be sent out around the first of June each year. All business licenses expire on June 30 of each year. Business license fees are not prorated.