West Virginia Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

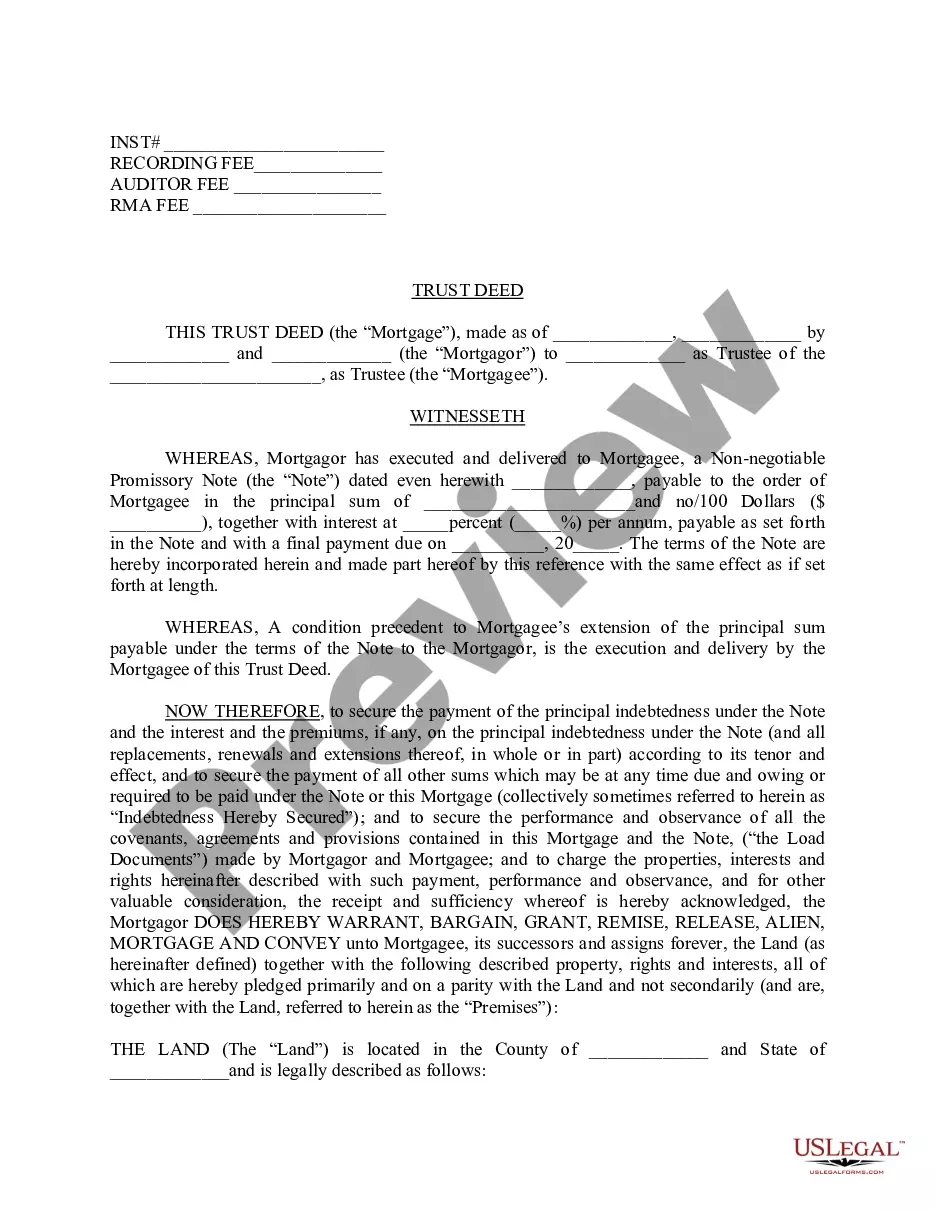

How to fill out Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

Discovering the right legitimate document format could be a struggle. Obviously, there are a lot of templates available online, but how can you get the legitimate form you want? Make use of the US Legal Forms web site. The service delivers a huge number of templates, such as the West Virginia Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment, which you can use for organization and private requires. Each of the kinds are checked by specialists and meet up with state and federal requirements.

In case you are presently signed up, log in in your profile and then click the Down load button to obtain the West Virginia Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment. Make use of your profile to look from the legitimate kinds you might have purchased previously. Go to the My Forms tab of your own profile and obtain one more backup from the document you want.

In case you are a fresh consumer of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

- First, ensure you have selected the proper form for your personal area/state. You are able to look over the form making use of the Review button and browse the form description to guarantee this is the best for you.

- When the form will not meet up with your expectations, utilize the Seach field to obtain the appropriate form.

- Once you are positive that the form is proper, click the Purchase now button to obtain the form.

- Opt for the rates plan you would like and enter the needed info. Create your profile and pay money for your order with your PayPal profile or Visa or Mastercard.

- Select the document structure and acquire the legitimate document format in your product.

- Complete, change and produce and indication the attained West Virginia Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

US Legal Forms may be the most significant catalogue of legitimate kinds in which you can see different document templates. Make use of the company to acquire skillfully-made papers that adhere to state requirements.

Form popularity

FAQ

Texas has one form for all domestic for-profit businesses. Fill out and file in duplicate Form 424, Certificate of Amendment. You can file it in person, by mail or online at Texas SOSDirect for $1 log in fee. You also can fax your amendment with form 807 with your credit card information.

Hence, limited period of existence and centralized management are not typical characteristics of a corporation.

(1) A corporation's board of directors may restate its articles of incorporation at any time with or without a vote of the members. (2) The restatement may include one or more amendments to the articles of incorporation.

NON-AMENDABLE ITEMS Names of incorporators; Names of original subscribers to the capital stock of the corporation and their subscribed and paid up capital; Names of the original directors; Treasurer elected by the original subscribers; Members who contributed to the initial capital of the non?stock corporation; or.

The Articles of Incorporation states the name, purpose, place of office, incorporators, capital stock, and term of the Company upon its establishment. The By-Laws outline the rules on annual and special meetings, voting, quorum, notice of meeting and auditors and inspectors of election.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

The Articles of Incorporation are like the constitution of the corporation that provides a broad framework for its establishment, whereas the bylaws can be likened to the individual laws that must be consistent with the Articles of Incorporation.

An amendment to your corporation's Articles of Incorporation is filed when you need to update, add to, or otherwise change the original content of your articles. Amendments are important corporate filings as they are required to modify essential corporate information, such as changes to stock information.