West Virginia Amended and Restated Employee Stock Purchase Plan

Description

How to fill out Amended And Restated Employee Stock Purchase Plan?

Are you inside a place the place you need to have documents for sometimes enterprise or personal reasons nearly every day time? There are tons of authorized file layouts available online, but finding kinds you can depend on is not straightforward. US Legal Forms offers thousands of form layouts, much like the West Virginia Amended and Restated Employee Stock Purchase Plan, which can be created to meet federal and state requirements.

If you are currently acquainted with US Legal Forms internet site and have your account, merely log in. Afterward, you are able to obtain the West Virginia Amended and Restated Employee Stock Purchase Plan web template.

Unless you come with an bank account and want to start using US Legal Forms, follow these steps:

- Obtain the form you want and make sure it is to the proper city/county.

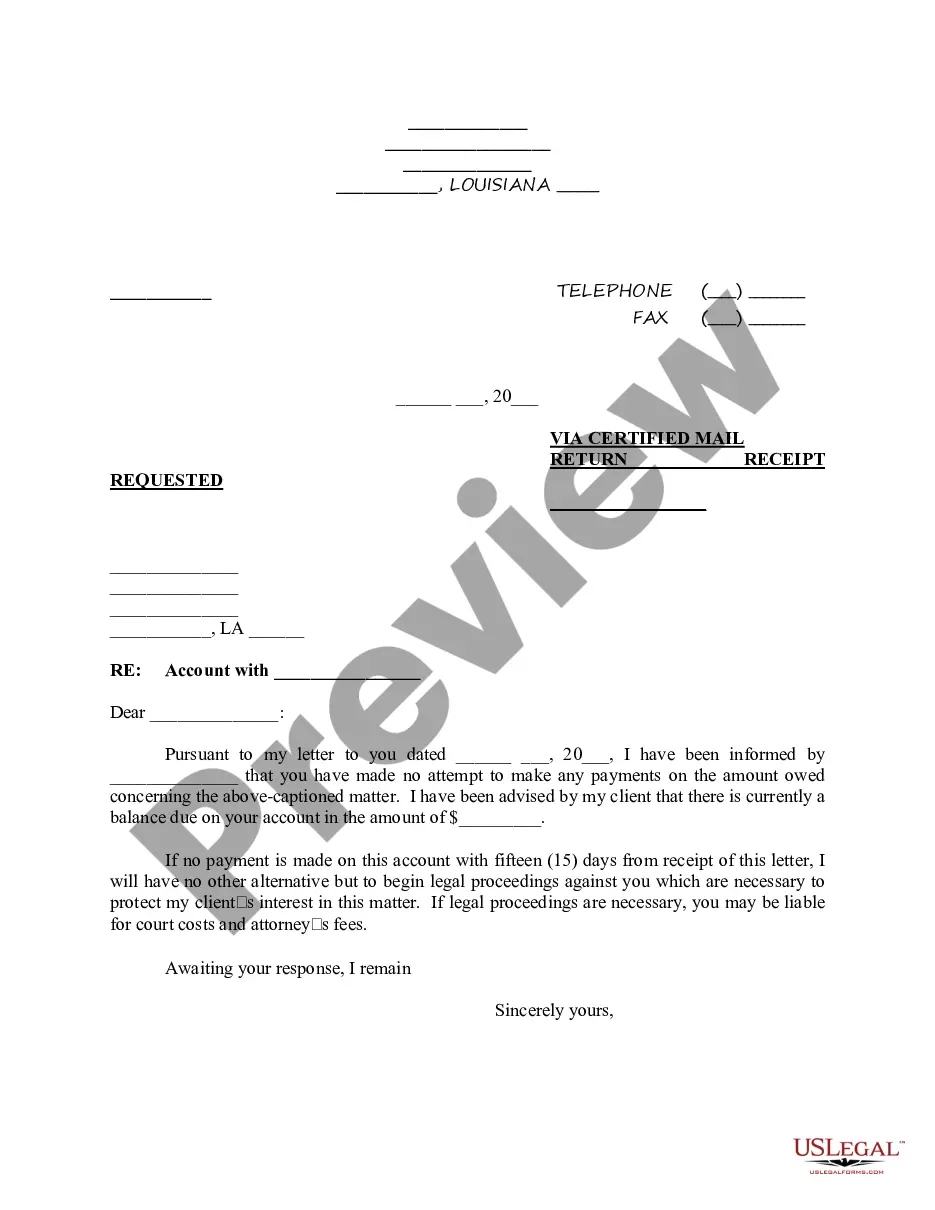

- Make use of the Review switch to examine the shape.

- See the information to actually have selected the appropriate form.

- If the form is not what you are looking for, make use of the Lookup discipline to obtain the form that meets your needs and requirements.

- Whenever you get the proper form, click Buy now.

- Opt for the prices strategy you desire, fill out the desired details to generate your bank account, and buy an order utilizing your PayPal or credit card.

- Select a practical data file formatting and obtain your duplicate.

Locate all the file layouts you may have bought in the My Forms food list. You may get a more duplicate of West Virginia Amended and Restated Employee Stock Purchase Plan any time, if necessary. Just click the required form to obtain or produce the file web template.

Use US Legal Forms, the most considerable collection of authorized types, to save time as well as prevent blunders. The services offers professionally made authorized file layouts that you can use for an array of reasons. Produce your account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

The lock-up period is usually 90?180 days, depending on the company. Although lockups used to be fairly simple ? typically lasting 180 days ? they are gradually becoming more complex. Investors and employees usually want lockups that are shorter so that they can cash out earlier.

Quite commonly, companies offer a ''lookback'' feature in addition to the discount offered to make the plan more attractive. The lookback feature allows you to purchase the share price of EITHER the initial date of the offering period OR the purchase date, whichever is lower, to further increase the return.

In trading, a lookback period is the number of periods of historical data used for observation and calculation. It is how far into the past a system looks when trying to calculate the variable under review.

An offering period is the six months period of time you are contributing for a stock purchase. The first payroll deduction (at the beginning of the first offering period) will be included in the first paycheck of July each year.

5 Ways To Use Your ESPP Contribute To Long Term Wealth. Contributing to an ESPP can boost your efforts towards building wealth through long-term investing. ... Reinvest Into A Roth IRA. An ESPP can be an avenue to fund a Roth IRA. ... Supplement Cash Flow. ... Short Term Savings Goals. ... Pay down debt.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

Using the wrong price when there is no lookback. Even with an ESPP that has no lookback, the purchase price discount for calculating the ordinary income for the taxes is still computed from the price on the first day of the offering period and not on the purchase date.

If you leave or terminate from the company, you will cease to participate in the ESPP and your contributions will be refunded as soon as administratively possible.