West Virginia Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

US Legal Forms - one of the most prominent collections of legal documents in the U.S. - offers an extensive selection of legal templates that you can either download or print.

By utilizing the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the West Virginia Executive Employee Stock Incentive Plan in just a few minutes.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your credentials to sign up for an account.

- If you already possess a subscription, sign in and download the West Virginia Executive Employee Stock Incentive Plan from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms from the My documents tab in your account.

- If you wish to use US Legal Forms for the first time, here are some basic instructions to help you get started.

- Make sure you have selected the correct form for your city/state.

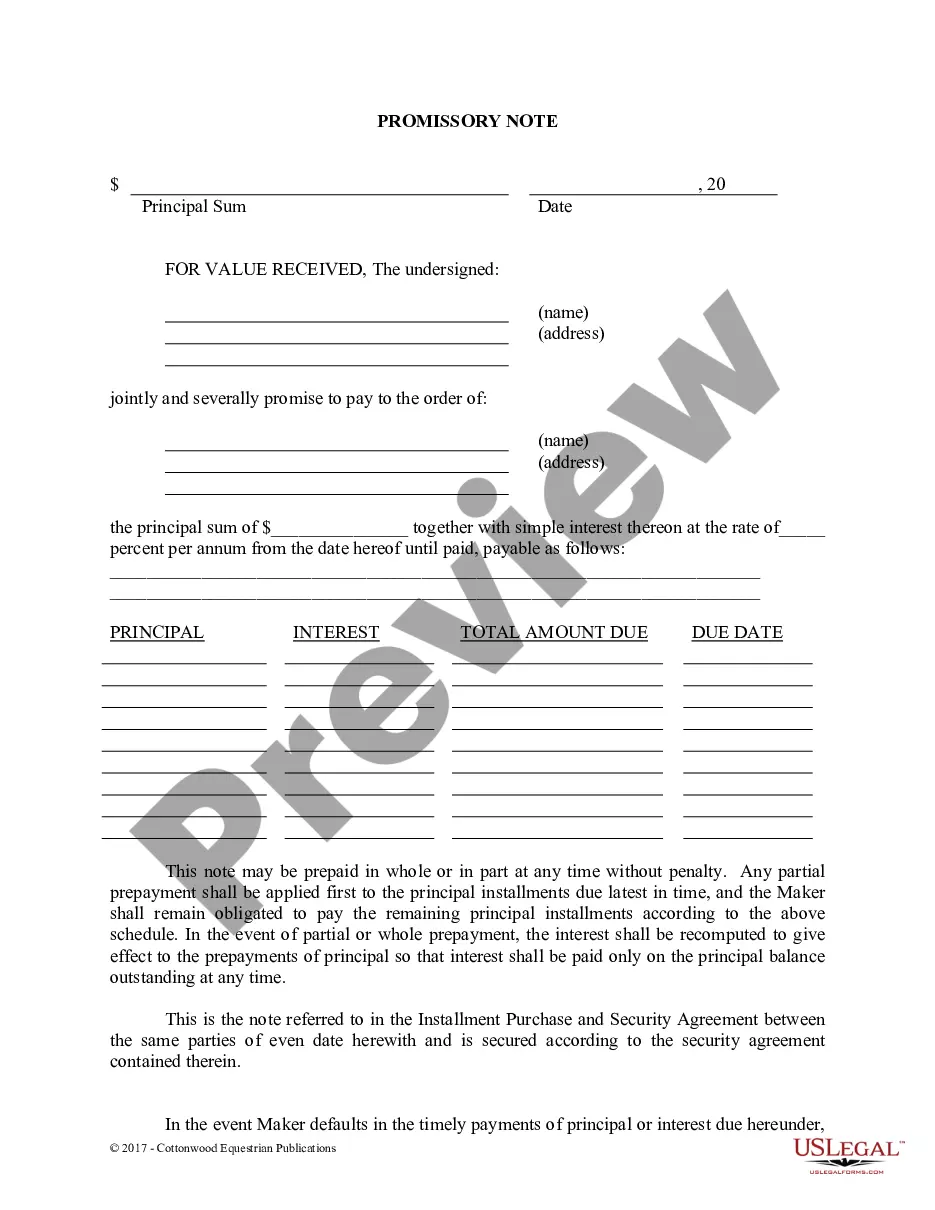

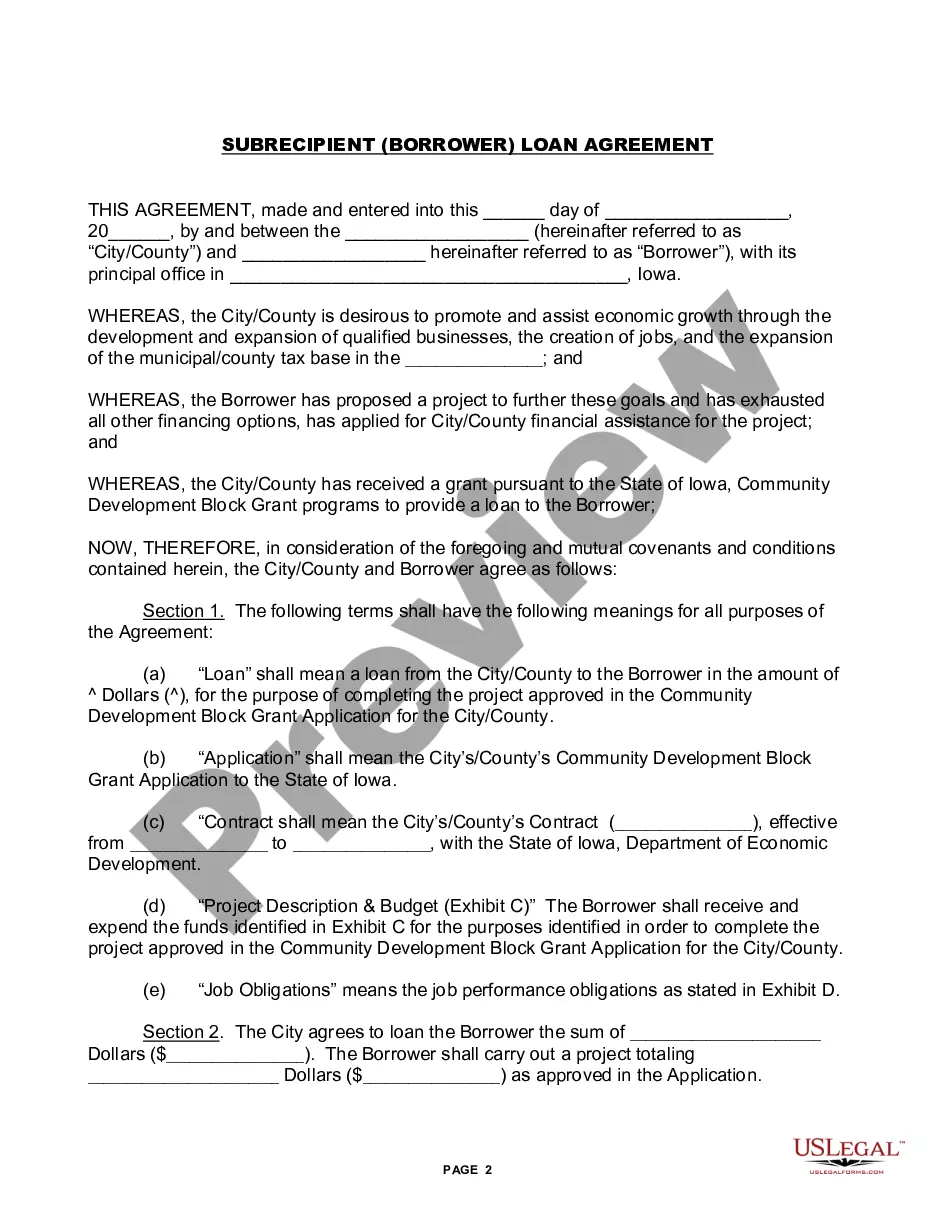

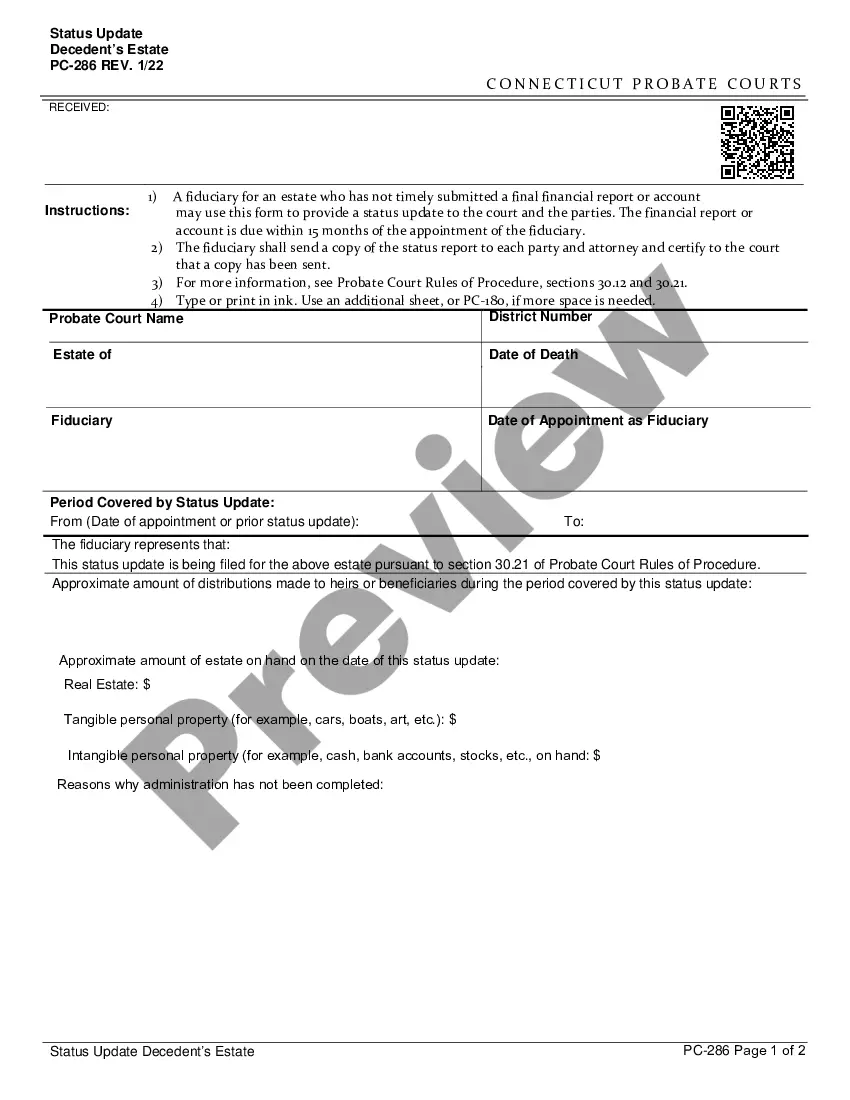

- Click the Review button to examine the form's content.

Form popularity

FAQ

An Employee Stock Ownership Incentive Plan is a program designed to provide employees with an ownership stake in the company through stock options or stock grants. Specifically, the West Virginia Executive Employee Stock Incentive Plan aims to encourage a stronger connection between employees and the overall business objectives. By aligning employee interests with company performance, this plan can improve motivation and productivity. It serves as both a performance incentive and a mechanism for employee retention, making it beneficial for both parties.

While an Employee Stock Ownership Plan offers numerous benefits, such as increased employee engagement, it does have potential downsides. The West Virginia Executive Employee Stock Incentive Plan can lead to employee financial exposure if the company's stock value declines. Additionally, setting up and maintaining an ESOP can be complex and may involve significant legal costs. It is essential for companies to weigh these factors carefully before implementing such a plan.

An Employee Stock Ownership Plan, such as the West Virginia Executive Employee Stock Incentive Plan, allows employees to acquire ownership in the company through stock. This plan enables companies to grant shares to employees, promoting a culture of ownership and investment in the company’s success. Employees receive these stocks as part of their compensation, which can enhance loyalty and motivation. In essence, it aligns employees' interests with the company's future.

The difference between Long-Term Incentive Plans (LTIPs) and ESOPs, such as the West Virginia Executive Employee Stock Incentive Plan, centers on their structure and goal. LTIPs often provide performance-based compensation linked to long-term company objectives, while ESOPs provide direct ownership in the company through stock. This means that employees under an ESOP have a more immediate stake in the company’s performance.

The ESOP incentive plan is an employee benefit plan that provides workers with an ownership interest in the company through stock ownership. Specifically, the West Virginia Executive Employee Stock Incentive Plan allows employees to acquire shares over time, enhancing their investment in the company's future. This can lead to increased satisfaction and a sense of belonging within the organization.

The primary difference between an ESOP and an equity incentive plan lies in their structure and purpose. An ESOP, as featured in the West Virginia Executive Employee Stock Incentive Plan, is generally designed to create employee ownership, while an equity incentive plan focuses on rewarding employees with stock options or grants based on performance. This distinction affects the way employees engage with the company's success.

An employee stock incentive program is a strategy that companies use to encourage employees to work towards the company's success by providing them with stock options. The West Virginia Executive Employee Stock Incentive Plan is a prime example of this, enabling employees to possess a stake in the business. This approach not only boosts employee morale but also promotes company loyalty as employees directly benefit from their efforts.

While the West Virginia Executive Employee Stock Incentive Plan offers numerous benefits, it does have potential downsides. One concern is the financial risk associated with having a large portion of retirement savings tied to the company’s stock performance. Moreover, the complexity of setting up an ESOP can create challenges for management and may require ongoing administrative costs.

The ESOP compensation plan refers to a method where companies provide employees with ownership interest in the business through stock. Specifically, the West Virginia Executive Employee Stock Incentive Plan allows employees to benefit directly from the company's growth and success. This plan not only enhances employee motivation but also aligns their interests with the company's objectives, fostering a sense of ownership.

The $100,000 rule, applicable to incentive stock options, states that an employee can only exercise ISOs worth up to $100,000 per calendar year. This limit ensures that employees face favorable tax treatment while still offering a significant incentive. For participants in the West Virginia Executive Employee Stock Incentive Plan, understanding this rule is crucial for effective financial planning and maximizing the benefits of their stock options.