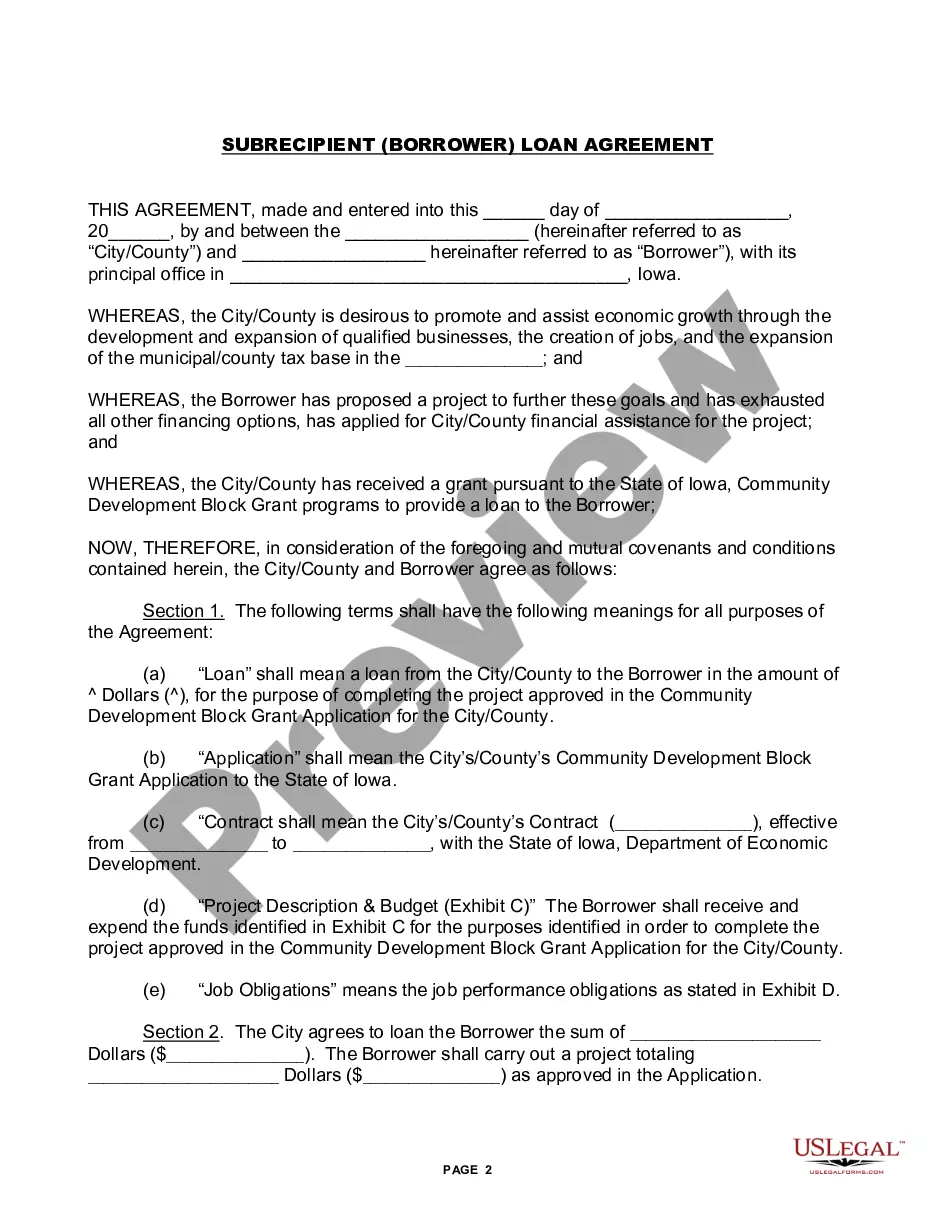

The Iowa Application for Geothermal Heating and Cooling System Property Tax Exemption is designed to provide financial assistance to Iowa homeowners who have installed a geothermal heating and cooling system in their residence. This tax exemption exempts the homeowner from paying the full amount of property taxes on the portion of the system installed on the property. There are two types of Iowa Application for Geothermal Heating and Cooling System Property Tax Exemption: the Residential Geothermal Heating and Cooling System Exemption, and the Commercial Geothermal Heating and Cooling System Exemption. The Residential Geothermal Heating and Cooling System Exemption is available to homeowners who have installed a geothermal system in their primary residence, while the Commercial Geothermal Heating and Cooling System Exemption is available to businesses who have installed a geothermal system in their commercial building. Both exemptions require that the geothermal system be installed in accordance with Iowa law and must be certified by an approved installer. In order to be eligible for the exemption, applicants must submit an application to their county assessor, along with proof of installation and certification of the geothermal system.

Iowa Application for Geothermal Heating and Cooling System Property Tax Exemption

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Application For Geothermal Heating And Cooling System Property Tax Exemption?

US Legal Forms is the simplest and most economical method to locate suitable official templates.

It boasts the largest online repository of business and personal legal documents created and validated by legal professionals.

Here, you can discover printable and fillable forms that adhere to national and local regulations - just like your Iowa Application for Geothermal Heating and Cooling System Property Tax Exemption.

Review the form description or preview the document to verify you’ve located the one that satisfies your criteria, or search for another one using the search tab above.

Select Buy now when you’re confident about its suitability with all the stipulations, and choose the subscription plan you prefer most.

- Acquiring your template entails only a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the form onto their device.

- Afterwards, they can locate it in their profile under the My documents section.

- And here’s how you can procure a properly drafted Iowa Application for Geothermal Heating and Cooling System Property Tax Exemption if you are using US Legal Forms for the first time.

Form popularity

FAQ

Under the Inflation Reduction Act (IRA) of 2022, the federal tax credit for residential geothermal system installations was increased from 26 to 30 percent, effective January 1, 2023. The 30 percent tax credit runs through 2032 and then gradually reduces until expiring in 2034.

Under the Inflation Reduction Act (IRA) of 2022, the federal tax credit for residential geothermal system installations was increased from 26 to 30 percent, effective January 1, 2023. The 30 percent tax credit runs through 2032 and then gradually reduces until expiring in 2034.

Geothermal heat pumps installed on residential property in Iowa are eligible for a tax credit equal to 20% of the Federal Tax Credit. Because the federal tax credit is set at 30%, the state tax credit is equal to 6% of the system cost.

What is the Tax Credit? The renewable energy tax credit covers 30% of the total system cost, including installation, of GeoThermal heat pumps meeting the requirements of the ENERGY STAR program. Under the Inflation Reduction Act in August 2022, the GeoThermal tax credits have been extended through December 31, 2034.

IDR Announces: Homestead Tax Exemption for Claimants 65 Years of Age or Older. Iowa Department Of Revenue.

Tax Credits & Incentives In August 2022, the tax credit for geothermal heat pump installations was extended through 2034. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax credit.

If you're installing geothermal, all you have to do is fill out a form (instructions here) stating the amount you spent when you file the year's income taxes. If the system installation is complete by the end of 2022, you can claim 26% of the installation cost on your taxes!

If you're installing geothermal, all you have to do is fill out a form (instructions here) stating the amount you spent when you file the year's income taxes. If the system installation is complete by the end of 2022, you can claim 26% of the installation cost on your taxes!