West Virginia Alternative Method

Description

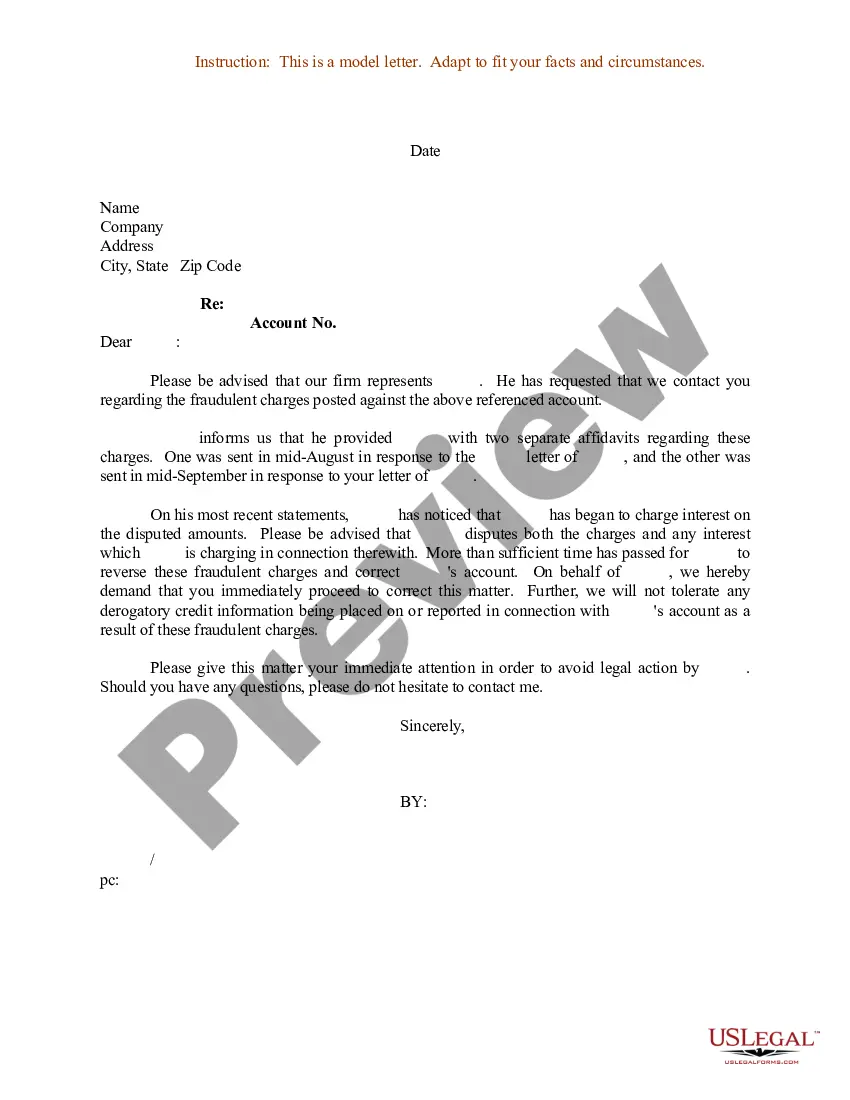

How to fill out Alternative Method?

Selecting the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the West Virginia Alternative Method, suitable for both business and personal needs.

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is appropriate, select the Purchase now button to acquire the form. Choose the pricing plan you desire and input the necessary information. Create your account and finalize your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired West Virginia Alternative Method. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain professionally-made documents that adhere to state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the West Virginia Alternative Method.

- Use your account to search for the legal forms you have previously ordered.

- Navigate to the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- Firstly, ensure you have selected the correct form for the city/state. You can view the form using the Review button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

WV/NRW-4. NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT.

How to get a sales tax permit in West Virginia. You can complete the form WV/BUS-APP found in this booklet or register online at Business for West Virginia. You need this information to register for a sales tax permit in West Virginia: Personal identification info (SSN, address, etc.)

The following sales and services are exempt per se from sales/use tax in West Virginia: 27a2 Advertising - Sales of radio or television broadcasting time, preprinted advertising circulars and outdoor advertising space, newspaper and magazine advertising space for the advertisement of goods or services.

You are considered a resident of West Virginia if you spend more than 30 days in West Virginia with the intent of West Virginia becoming your permanent residence, or if you are a domiciliary resident of Pennsylvania or Virginia and you maintain a physical presence in West Virginia for more than 183 days of the taxable

Eligibility RequirementsYou must have lived at your homestead for at least six (6) months. You must have been a resident of West Virginia for the 2 consecutive calendar years prior to your application. You must be 65 years of age on or before June 30th of the next year.

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

To apply for the sales tax exemption, organizations must submit a completed Certificate of Exemption to the West Virginia State Tax Department's Taxpayer Services Division.

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

Persons who are 65 years of age or older, or permanently and totally disabled, are entitled to an exemption from property taxes on the first $20,000 of assessed value on their owner- occupied residence.