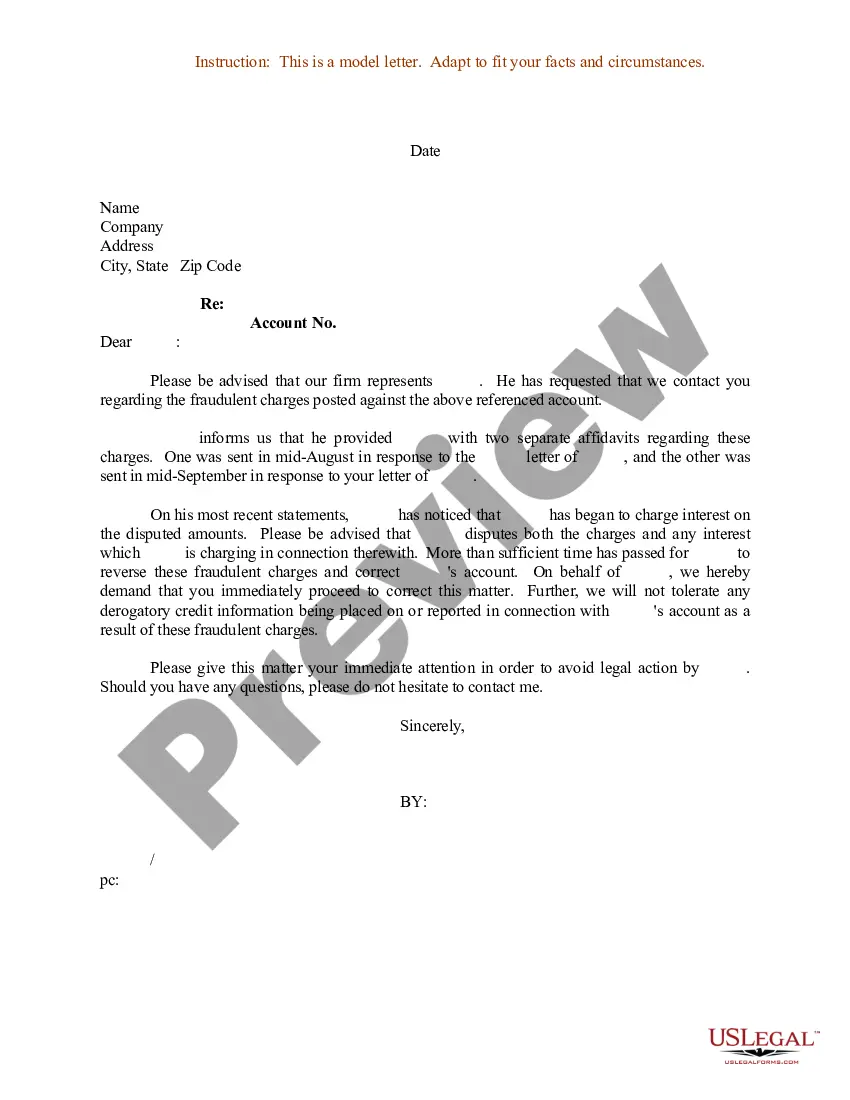

Kansas Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

You may commit hrs on the web looking for the lawful document format which fits the state and federal demands you need. US Legal Forms provides thousands of lawful types which can be reviewed by professionals. You can easily obtain or printing the Kansas Sample Letter for Fraudulent Charges against Client's Account from your support.

If you currently have a US Legal Forms account, you may log in and then click the Download button. Afterward, you may complete, modify, printing, or indicator the Kansas Sample Letter for Fraudulent Charges against Client's Account. Each and every lawful document format you buy is your own forever. To get yet another copy of the obtained kind, proceed to the My Forms tab and then click the related button.

Should you use the US Legal Forms website for the first time, adhere to the straightforward guidelines listed below:

- Initial, ensure that you have chosen the best document format for the area/city of your choosing. Read the kind outline to ensure you have picked the correct kind. If accessible, utilize the Preview button to appear with the document format too.

- If you wish to get yet another model of your kind, utilize the Search area to get the format that fits your needs and demands.

- Once you have discovered the format you need, click on Buy now to proceed.

- Select the rates prepare you need, type in your references, and register for your account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal account to fund the lawful kind.

- Select the structure of your document and obtain it in your gadget.

- Make changes in your document if needed. You may complete, modify and indicator and printing Kansas Sample Letter for Fraudulent Charges against Client's Account.

Download and printing thousands of document web templates using the US Legal Forms website, that offers the biggest collection of lawful types. Use expert and condition-distinct web templates to tackle your company or personal demands.

Form popularity

FAQ

This is known as fraud and is illegal. When you contact your bank, they'll take action straight away to protect your account so no more money can be taken. For example, they might cancel your cards or cheque book and send you a replacement. You should also report the crime to the police through Action Fraud.

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item?especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

If you report a fraudulent charge within two days, you can't be held responsible for more than $50 in charges. Keep in mind that you have 60 days to dispute the transaction or else you could be stuck paying for it.

A: Contact your bank immediately if you suspect unauthorized transactions on your debit card.

The sooner you contact your bank, the more likely you are to get your money back ? and if the transaction is unauthorised, the sooner the bank can stop any further transactions. When you report a mistaken or unauthorised transaction, make sure the bank gives you a reference number.

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.