Georgia Revocable Living Trust for Minors

Description

How to fill out Revocable Living Trust For Minors?

If you need to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Georgia Revocable Living Trust for Minors in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to retrieve the Georgia Revocable Living Trust for Minors.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for your correct city/state.

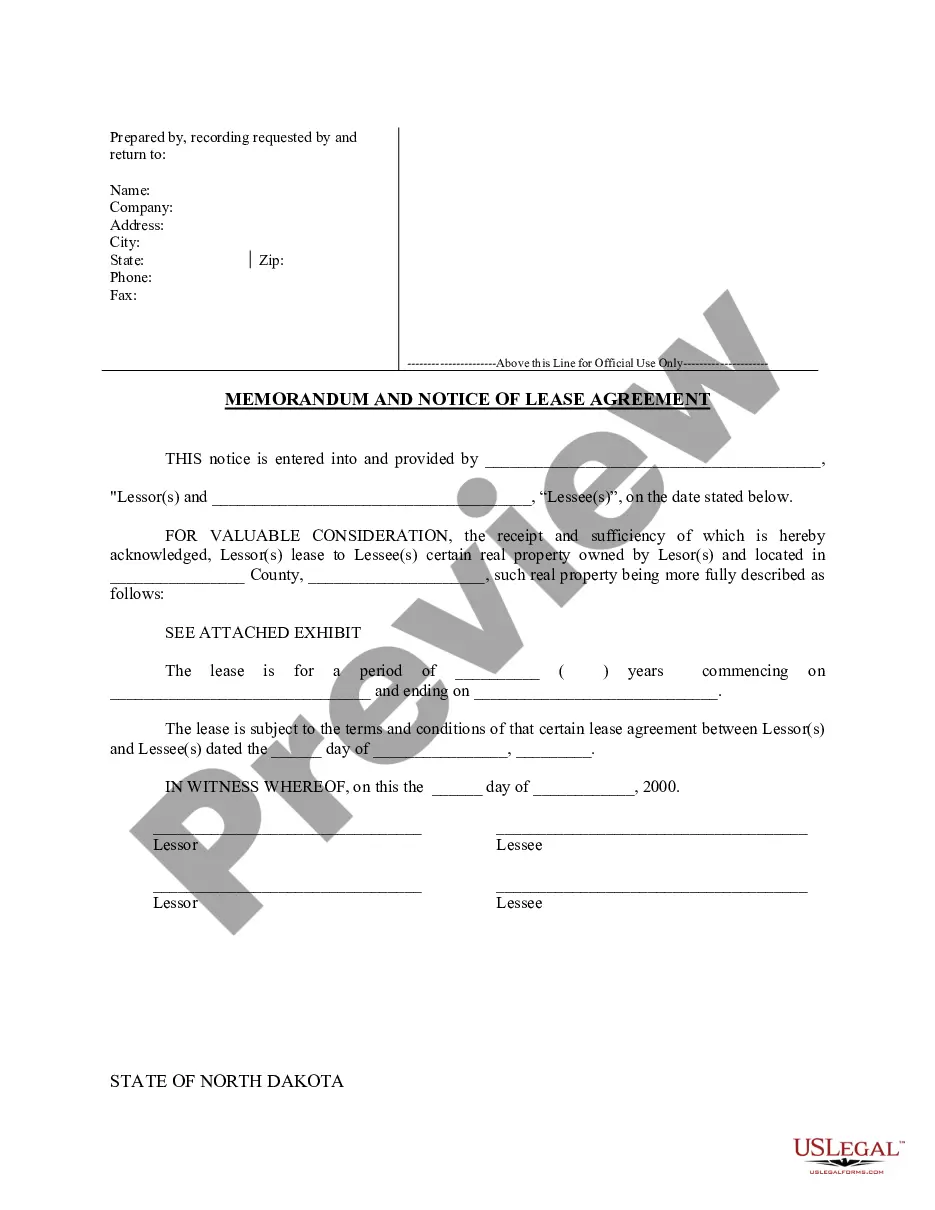

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

One downside of a revocable trust is that it cannot protect assets from creditors after your passing. While a Georgia Revocable Living Trust for Minors provides flexibility and control during your lifetime, it does not offer the same asset protection as an irrevocable trust. Additionally, you may incur some administrative costs while setting up and maintaining the trust. It’s important to weigh these factors against the potential benefits.

A trust works for minors by holding assets until they reach a predetermined age or milestone. With a Georgia Revocable Living Trust for Minors, you can designate a trustee to manage these assets according to your guidelines. This ensures that your child benefits from the resources without direct control until they are ready. You simplify financial management and provide security for their future.

Deciding between a revocable and an irrevocable trust for your child is crucial. A Georgia Revocable Living Trust for Minors offers flexibility, allowing you to adjust terms as necessary. In contrast, an irrevocable trust locks in your decisions and may limit your control over assets. It’s important to evaluate your family's needs and goals before making a choice.

Yes, a minor can benefit from a Georgia Revocable Living Trust for Minors. While minors cannot directly own property, a trust allows you to manage their assets until they reach adulthood. This arrangement ensures that the funds are used wisely and according to your wishes. Setting up such a trust can safeguard your child's financial future.

In Georgia, minors cannot directly own property. However, a Georgia Revocable Living Trust for Minors allows you to hold assets for their benefit until they reach adulthood. By setting up such a trust, you ensure that minors can benefit from the property without holding legal title. This arrangement provides protection and oversight until your children are old enough to manage their inheritance responsibly.

While a Georgia Revocable Living Trust for Minors offers numerous benefits, there are some downsides to consider. For instance, it does not provide tax benefits like irrevocable trusts, and the assets within it remain part of your estate for tax purposes. Additionally, setting up a trust requires time and effort, which might not be appealing for everyone. It's essential to weigh these factors against the advantages when considering your estate planning options.

To set up a Georgia Revocable Living Trust for Minors, start by identifying the assets you want to include. Next, you will draft the trust document, specifying the terms of management and distribution for your minor children. You may choose to work with a legal professional to ensure compliance with state laws, making the process easier and more efficient. Once established, transfer your assets into the trust to secure them for your children.

A Georgia Revocable Living Trust for Minors is often the best option for safeguarding a minor's assets. This type of trust allows you to retain control while providing for your children’s needs over time. Furthermore, it can be tailored to meet specific requirements and circumstances, ensuring that the assets are well-managed until the minors reach adulthood. This flexibility makes it a popular choice among parents.