Iowa Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Are you presently inside a place in which you need paperwork for either business or specific purposes virtually every working day? There are tons of lawful document templates available online, but discovering versions you can rely on isn`t straightforward. US Legal Forms offers 1000s of develop templates, such as the Iowa Sample Letter for Fraudulent Charges against Client's Account, which are composed to meet federal and state requirements.

In case you are currently informed about US Legal Forms site and possess a merchant account, merely log in. Afterward, you may acquire the Iowa Sample Letter for Fraudulent Charges against Client's Account web template.

Unless you have an accounts and wish to begin to use US Legal Forms, follow these steps:

- Obtain the develop you will need and ensure it is for the proper area/area.

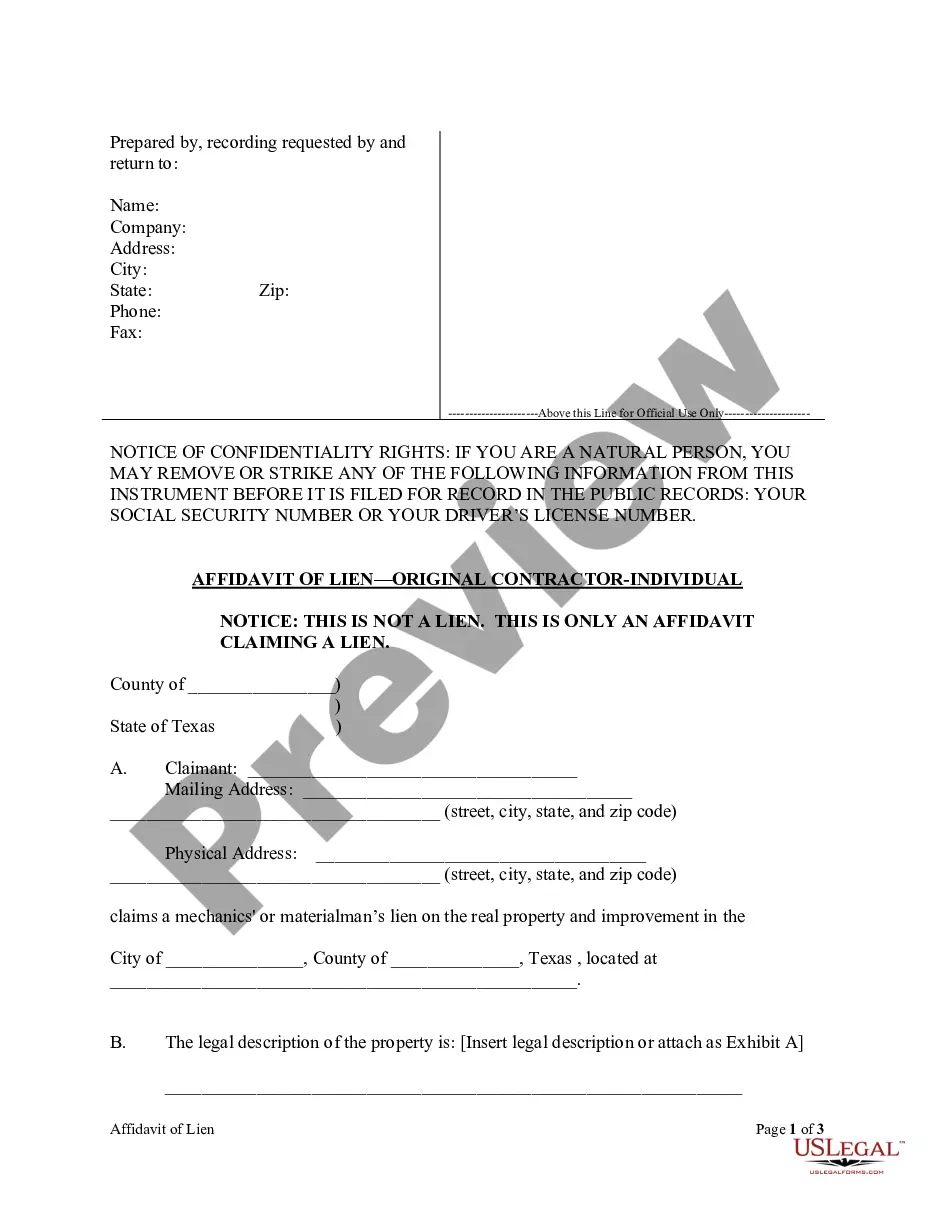

- Utilize the Preview option to review the form.

- Look at the explanation to actually have chosen the correct develop.

- In case the develop isn`t what you`re looking for, use the Research field to discover the develop that suits you and requirements.

- When you get the proper develop, just click Buy now.

- Choose the pricing program you would like, submit the necessary information and facts to generate your bank account, and pay money for an order with your PayPal or credit card.

- Select a handy data file formatting and acquire your backup.

Locate every one of the document templates you possess purchased in the My Forms menu. You can aquire a more backup of Iowa Sample Letter for Fraudulent Charges against Client's Account anytime, if possible. Just select the essential develop to acquire or produce the document web template.

Use US Legal Forms, the most substantial assortment of lawful forms, to save lots of efforts and avoid faults. The assistance offers appropriately made lawful document templates which you can use for an array of purposes. Generate a merchant account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

A: Contact your bank immediately if you suspect unauthorized transactions on your debit card.

If you report a fraudulent charge within two days, you can't be held responsible for more than $50 in charges. Keep in mind that you have 60 days to dispute the transaction or else you could be stuck paying for it.

The sooner you contact your bank, the more likely you are to get your money back ? and if the transaction is unauthorised, the sooner the bank can stop any further transactions. When you report a mistaken or unauthorised transaction, make sure the bank gives you a reference number.

What should I do if there are unauthorized charges on my credit card account? Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

This is known as fraud and is illegal. When you contact your bank, they'll take action straight away to protect your account so no more money can be taken. For example, they might cancel your cards or cheque book and send you a replacement. You should also report the crime to the police through Action Fraud.

The details of the transaction are as follows: ? Date of transaction: [INSERT DATE OF TRANSACTION] ? Amount of transaction:[INSERT AMOUNT OF TRANSACTION] ? Name of merchant: [INSERT NAME OF SELLER] ? Reasons for the request for chargeback: [FOR EXAMPLE you did not receive the goods, they were faulty etc] Please let me ...

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.