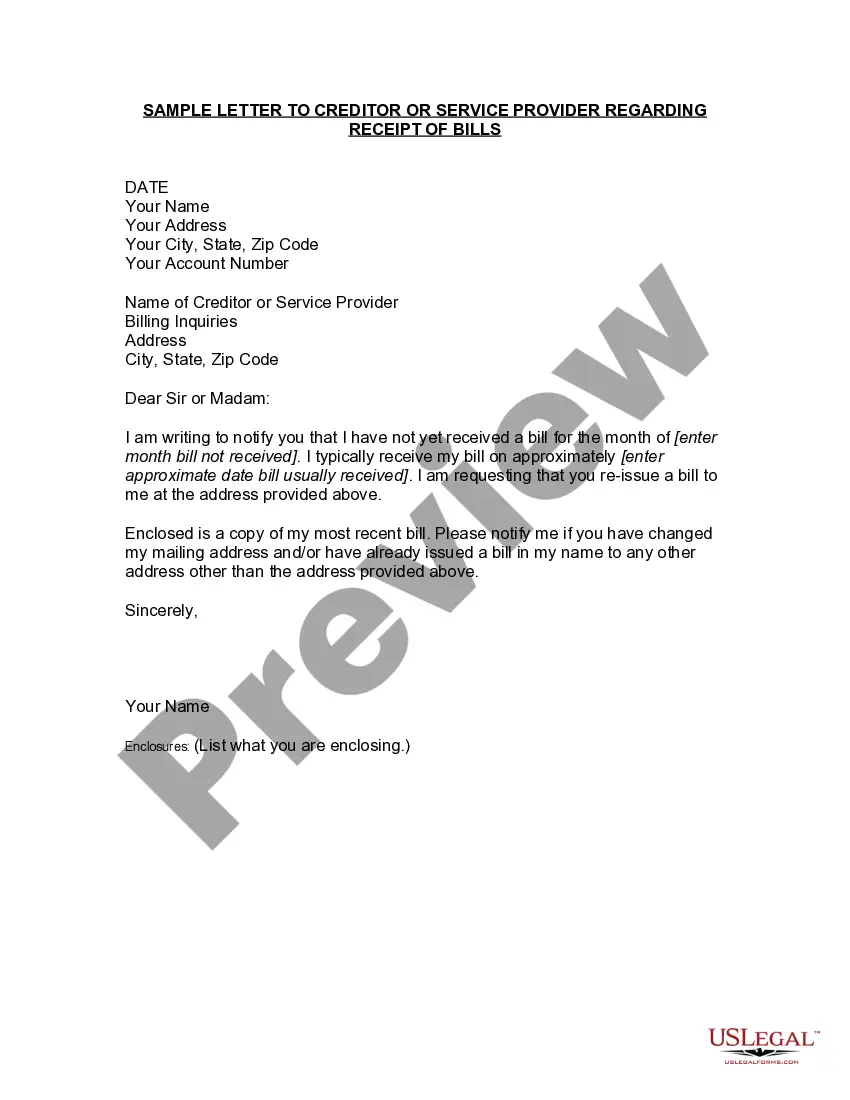

Iowa Sample Letter to Creditor or Service Provider Regarding Receipt of Bills

Description

How to fill out Sample Letter To Creditor Or Service Provider Regarding Receipt Of Bills?

You are able to commit several hours on the web looking for the authorized record format which fits the state and federal requirements you need. US Legal Forms gives thousands of authorized varieties that happen to be examined by specialists. It is possible to down load or printing the Iowa Sample Letter to Creditor or Service Provider Regarding Receipt of Bills from the service.

If you already possess a US Legal Forms account, you may log in and click the Download option. Next, you may comprehensive, modify, printing, or indicator the Iowa Sample Letter to Creditor or Service Provider Regarding Receipt of Bills. Each authorized record format you purchase is your own property for a long time. To have another version of the bought type, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms web site for the first time, follow the simple directions beneath:

- Very first, ensure that you have chosen the best record format to the state/area of your choice. Browse the type outline to make sure you have picked the proper type. If accessible, utilize the Review option to appear with the record format too.

- If you want to discover another variation of the type, utilize the Search field to obtain the format that meets your requirements and requirements.

- Once you have discovered the format you desire, click Purchase now to continue.

- Find the costs prepare you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal account to fund the authorized type.

- Find the structure of the record and down load it in your gadget.

- Make alterations in your record if needed. You are able to comprehensive, modify and indicator and printing Iowa Sample Letter to Creditor or Service Provider Regarding Receipt of Bills.

Download and printing thousands of record themes using the US Legal Forms web site, that provides the greatest collection of authorized varieties. Use skilled and status-particular themes to handle your small business or individual needs.

Form popularity

FAQ

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

The first step in collections is usually sending a letter demanding payment. If the debtor does not respond or pay, the creditor can hire a collection agency or take the debtor to court. In most cases, the creditor will win if the case goes to court and the debtor pays the debt plus interest and fees.

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and to who, as well as when you need to pay the debt. If you're still uncertain about the debt you're being asked to pay, you can request a debt verification letter to get more information.

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.