West Virginia Material Return Record

Description

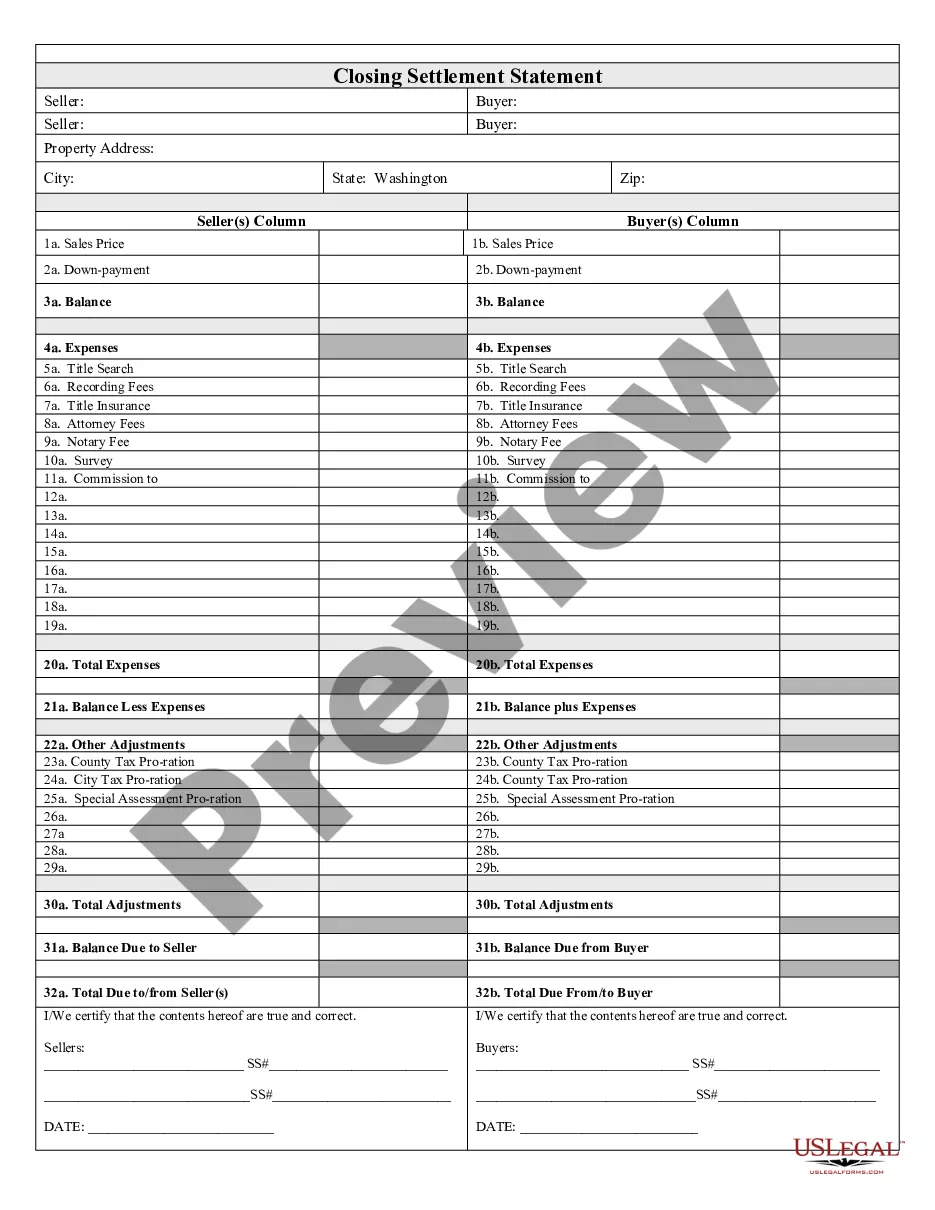

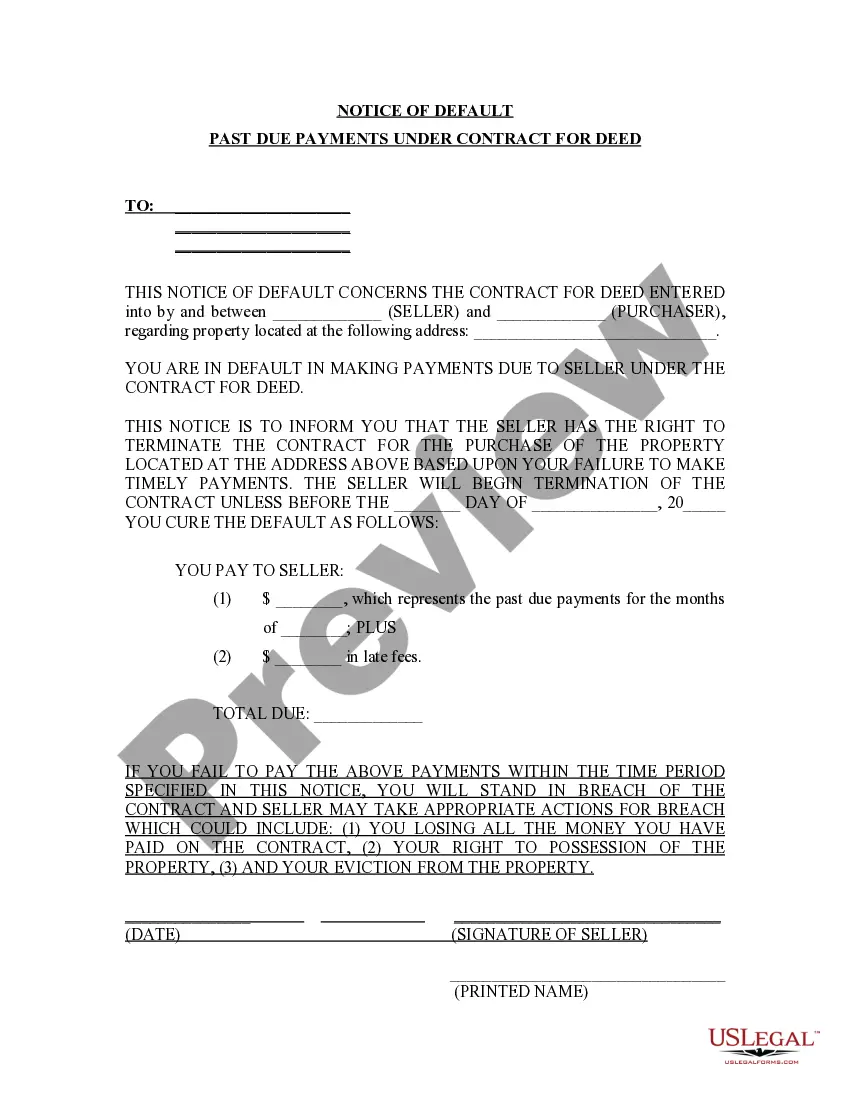

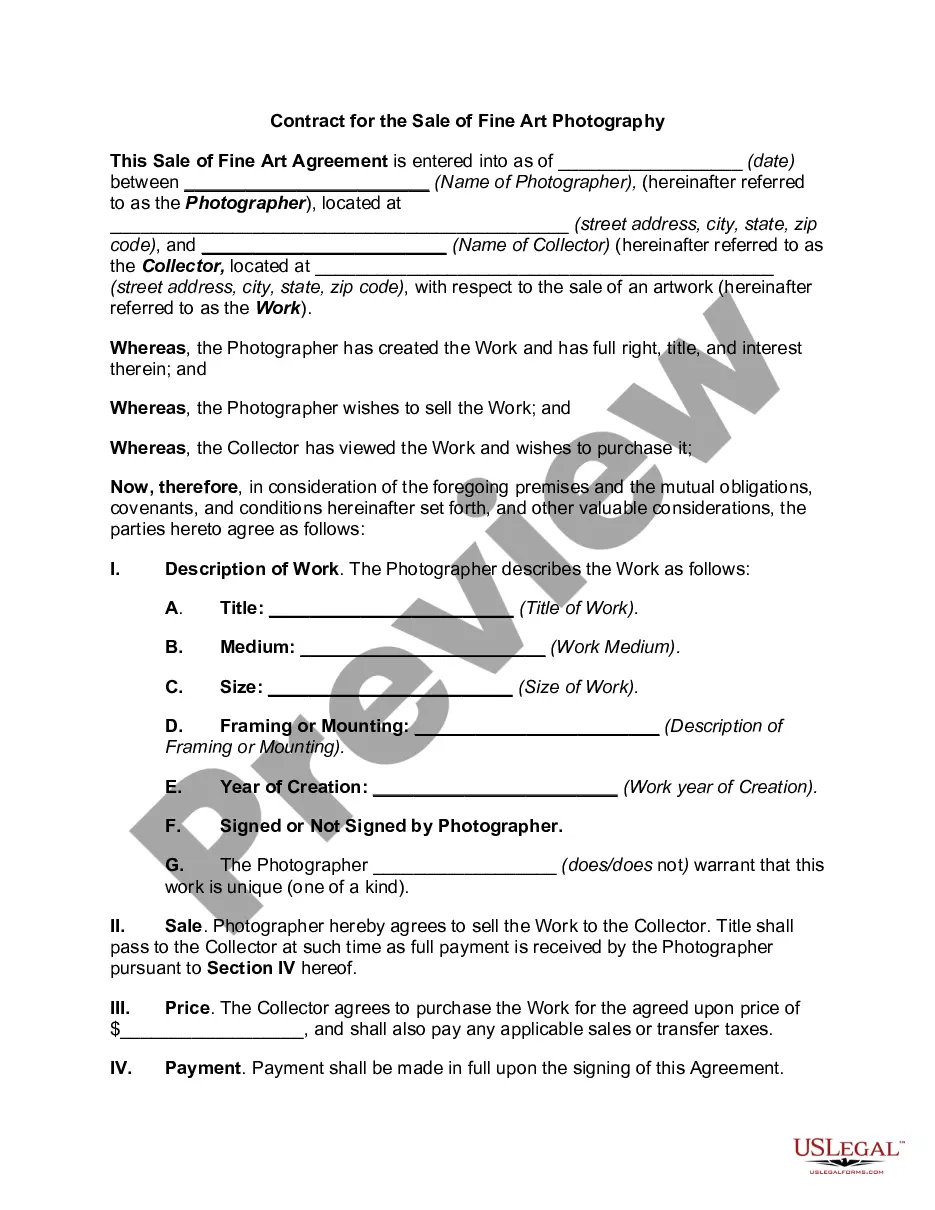

How to fill out Material Return Record?

You can spend hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that have been evaluated by professionals.

You can download or print the West Virginia Material Return Form from the service.

If available, use the Preview option to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download option.

- After that, you can complete, modify, print, or sign the West Virginia Material Return Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/town of your choice.

- Review the form summary to ensure you have selected the right form.

Form popularity

FAQ

Goods that are subject to sales tax in West Virginia include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt.

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Where do I mail my forms?If you are getting a Refund: West Virginia State Tax Department, PO Box 1071, Charleston WV 25324-1071.If you have a Balance Due: West Virginia State Tax Department, PO Box 3694, Charleston WV 25336-3694.

(WSAZ) - Back-to-school shoppers can enjoy some tax-free purchases this weekend in West Virginia. The Sales Tax Holiday exempts certain school supplies like clothing, paper, pencils, markers, school instructional materials, laptops, tablets and sports equipment.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ and Virginia Schedule CR.

Completing your ReturnIf handwritten, use black or blue ink only. Do not staple or attach your check, W-2s or any other documents to your return. Submit proper documentation (schedules, statements and supporting documentation, including W-2s, other states' tax returns, or necessary federal returns and schedules).

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Tax Exempt ItemsFood for human consumption.Manufacturing machinery.Raw materials for manufacturing.Utilities and fuel used in manufacturing.Medical devices and services.

Adding staples to your document is regarded as a time-wasting activity that slows down the tax return process. You're advised to stop stapling your documents henceforth. On the contrary, you can use paper clips, binder clips or rubber bands to fasten your tax documents together.