Allonge

What this document covers

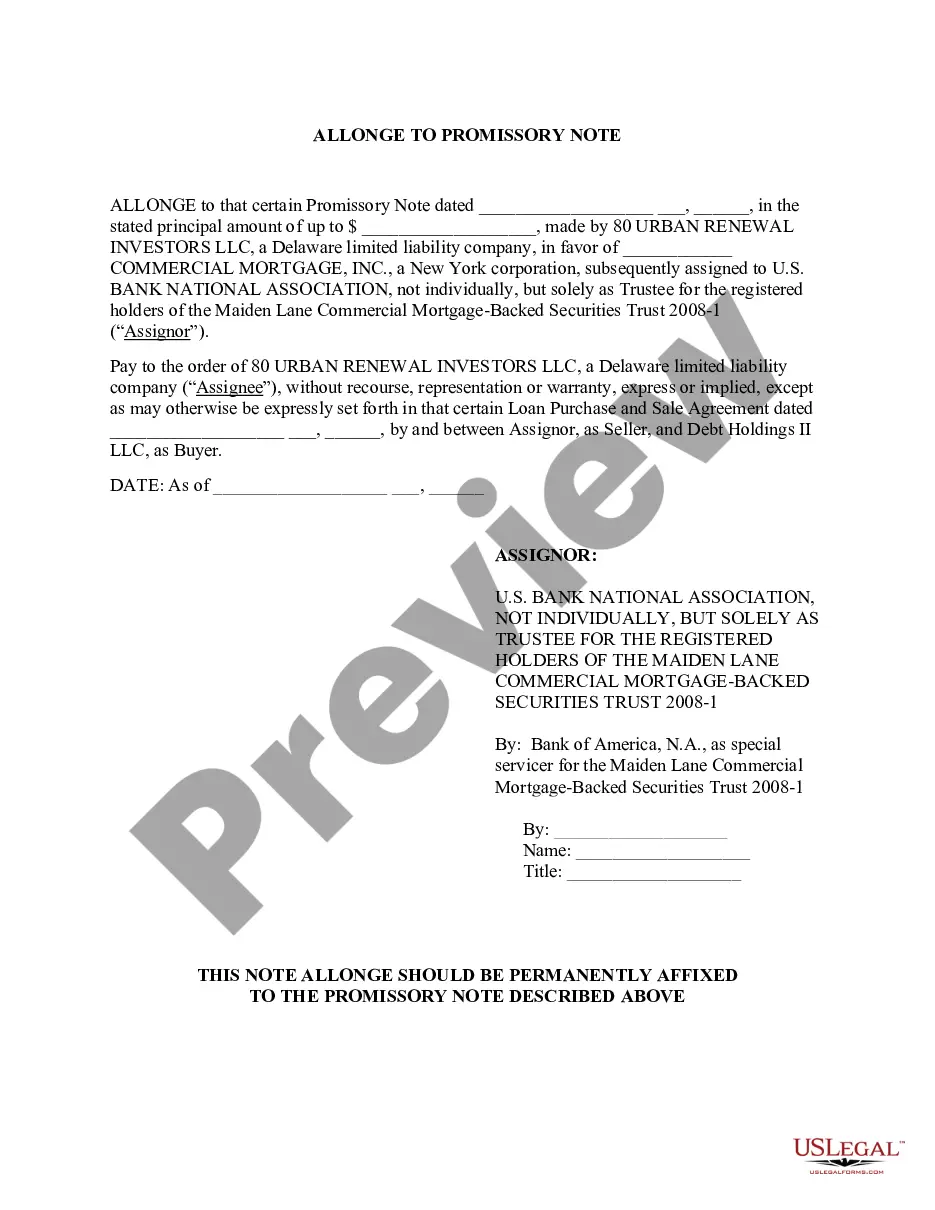

An allonge is a legal document attachment used to add additional language or signatures when the original document lacks sufficient space. Unlike other forms that may only serve a singular purpose, the allonge allows for necessary amendments, ensuring that contracts and notes remain valid and enforceable. This makes it distinct as a supplementary tool in legal transactions.

Key parts of this document

- Details of the original note, including date, parties involved, and principal amount.

- Endorsement fields specifying who the note is endorsed to, along with recourse declarations.

- Signature fields for authorized representatives, including a section for corporate seals.

- Attribution lines for attestations by company officials such as the Vice President and Secretary.

Common use cases

This form is essential when the original legal document does not have enough space to accommodate additional signatures or amendments. It is typically used in financial transactions, such as transferring interests in promissory notes or other negotiable instruments where amendments are necessary for validity.

Who can use this document

The allonge is intended for:

- Business entities and individuals engaged in financial transactions requiring formal endorsement.

- Legal professionals needing to supplement existing legal documents with additional terms.

- Parties involved in the negotiation of contracts where documentation space is limited.

Completing this form step by step

- Identify the date of the original note and the parties involved in the transaction.

- Enter the original principal amount and the name of the party to whom the note is endorsed.

- Provide all necessary signatures, ensuring authorized individuals review and sign the document.

- Include any corporate seals if required by your organization.

- Review the completed allonge for accuracy before attaching it to the original document.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all required signatures or endorsements.

- Incomplete or incorrect identification of parties involved.

- Not attaching the allonge securely to the original document.

Benefits of using this form online

- Immediate access to legal templates drafted by licensed attorneys.

- Easy editing of form fields tailored to specific transaction needs.

- Secure storage and easy retrieval of completed documents.

Looking for another form?

Form popularity

FAQ

A phrase used by an endorser (a signer other than the original maker) of a negotiable instrument (for example, a check or promissory note) to mean that if payment of the instrument is refused, the endorser will not be responsible.

So, when a loan is sold both the Promissory Note and Mortgage need to be conveyed to the new Note owner.The endorsement on the Promissory Note is called an Allonge. The endorsement on a Mortgage is called an Assignment of Mortgage.

Endorsements. When an investor purchases a loan, the previous owner will sign or endorse the note, formally indicating that the note is being transferred to a new owner. This process is called endorsement. Just as with a check, one party can transfer ownership of a note by signing it over to another party.

Endorsement of a promissory noteEndorsement consists of a mandatory signature and (optional) words qualifying that act. The payee, who is then using the note as a financial instrument, becomes the endorser and the party receiving the note is the endorsee, the new holder of the promissory note.

An allonge is a sheet of paper that is attached to a negotiable instrument, such as a bill of exchange. Its purpose is to provide space for additional endorsements when there is no longer sufficient space on the original instrument. The word allonge derives from the French word allonger, which means to lengthen."

Additional paper firmly attached to Commercial Paper, such as a promissory note, to provide room to write endorsements. An allonge is necessary when there is insufficient space on the document itself for the endorsements.

The endorsement on the Promissory Note is called an Allonge. The endorsement on a Mortgage is called an Assignment of Mortgage.The Assignment must be signed and notarized. The last document also transfers ownership, but of the note itself.

A promissory note is often referred to as a mortgage note and is the document generated and signed at closing. A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home. You may also hear a mortgage called a home loan. These terms all mean the same thing.