West Virginia Merchandise Return Sheet

Description

How to fill out Merchandise Return Sheet?

Are you currently in a situation where you require documentation for various business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms presents a vast array of form templates, such as the West Virginia Merchandise Return Sheet, which are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the payment plan you prefer, complete the required information to create your account, and place an order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the West Virginia Merchandise Return Sheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm that it corresponds to the correct city/region.

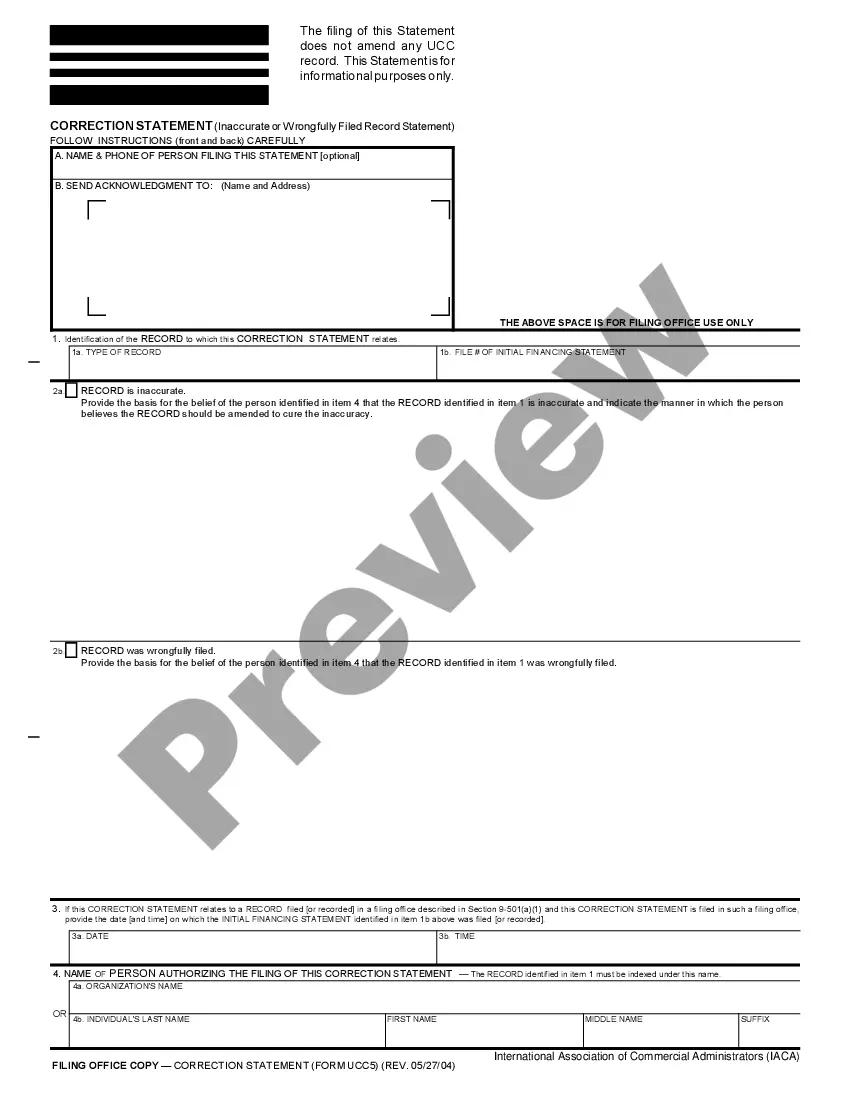

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn't what you're looking for, use the Search field to find the form that fulfills your needs and requirements.

Form popularity

FAQ

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ and Virginia Schedule CR.

Completing your ReturnIf handwritten, use black or blue ink only. Do not staple or attach your check, W-2s or any other documents to your return. Submit proper documentation (schedules, statements and supporting documentation, including W-2s, other states' tax returns, or necessary federal returns and schedules).

To request the SS-4 forms to obtain a taxpayer identification number from the Internal Revenue Service, call 1-800-829-4933. You may apply for your FEIN by mail or by calling the 800 number above or by visiting the website .

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

Adding staples to your document is regarded as a time-wasting activity that slows down the tax return process. You're advised to stop stapling your documents henceforth. On the contrary, you can use paper clips, binder clips or rubber bands to fasten your tax documents together.

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

To protect taxpayer confidential identification number(s), an account number has been assigned to each tax type that the taxpayer is responsible for filing. The new WV tax account number is eight digits, specific to each individual tax type (account) and is on all documentation issued from the department.

The general rule is that the transaction is sourced to the location where the purchaser receives the tangible personal property purchased or makes first use of the service purchased. The hierarchy of sourcing rules is found in West Virginia Code § 11-15B-15(a).

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards All major credit cards accepted. You can visit the Credit Card Payments page for more information.