West Virginia Return Authorization Form

Description

How to fill out Return Authorization Form?

Are you currently in a situation where you frequently require documents for either business or personal purposes? There are numerous legal document templates accessible online, but finding ones you can depend on is challenging.

US Legal Forms provides thousands of template options, including the West Virginia Return Authorization Form, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the West Virginia Return Authorization Form template.

Access all the document templates you have purchased in the My documents section. You can download another copy of the West Virginia Return Authorization Form at any time if needed. Simply select the form required to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors. The service offers professionally created legal document templates that can be applied for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- Locate the form you need and verify it's suitable for your specific city/region.

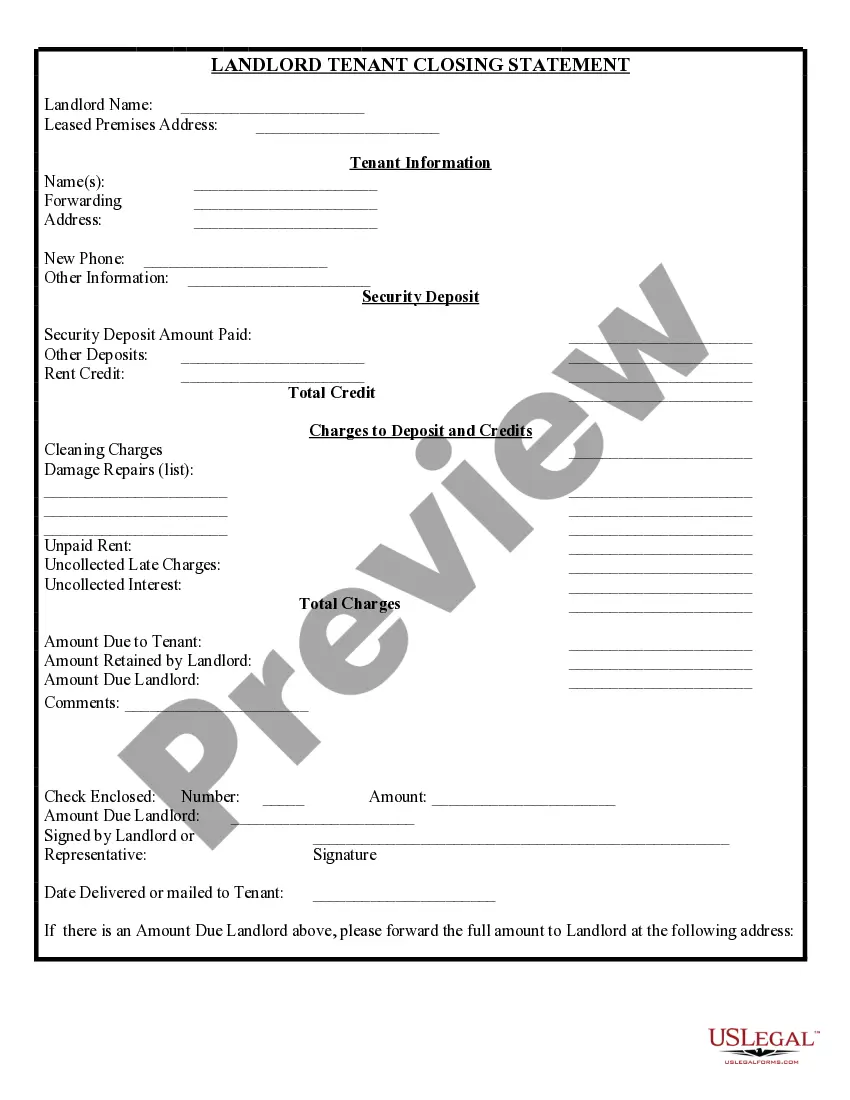

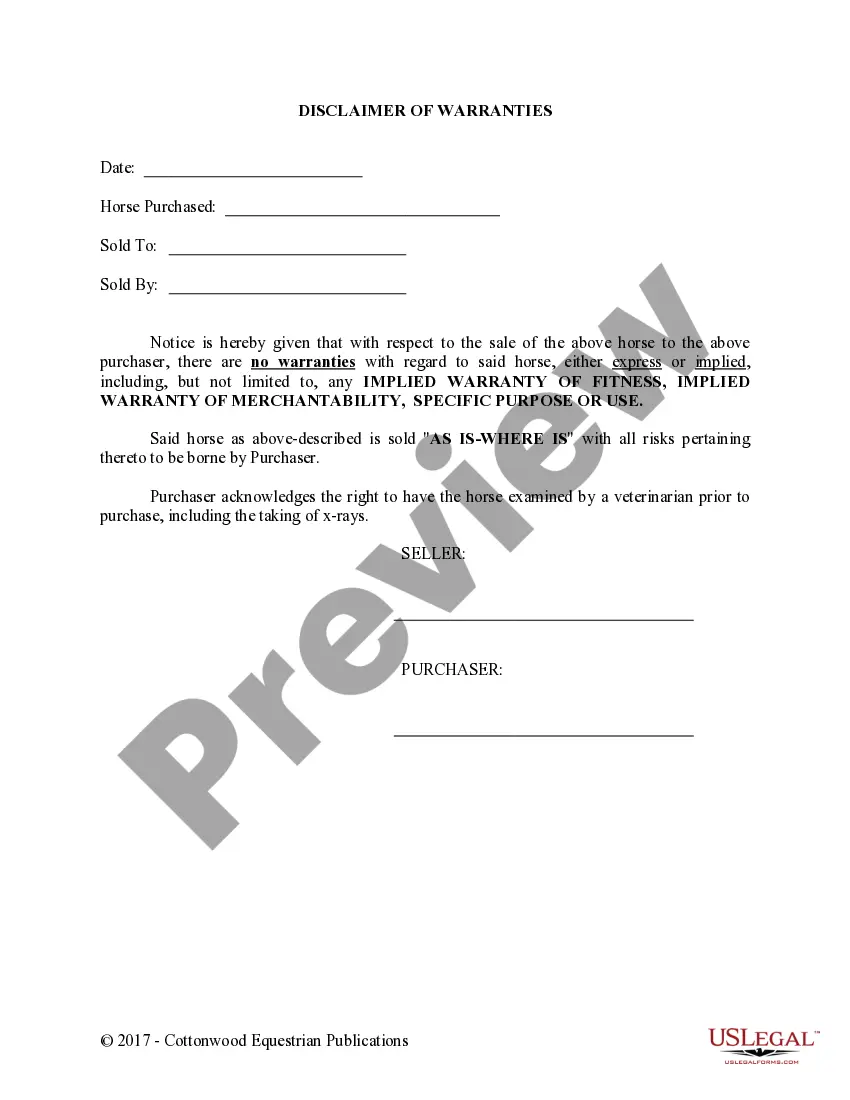

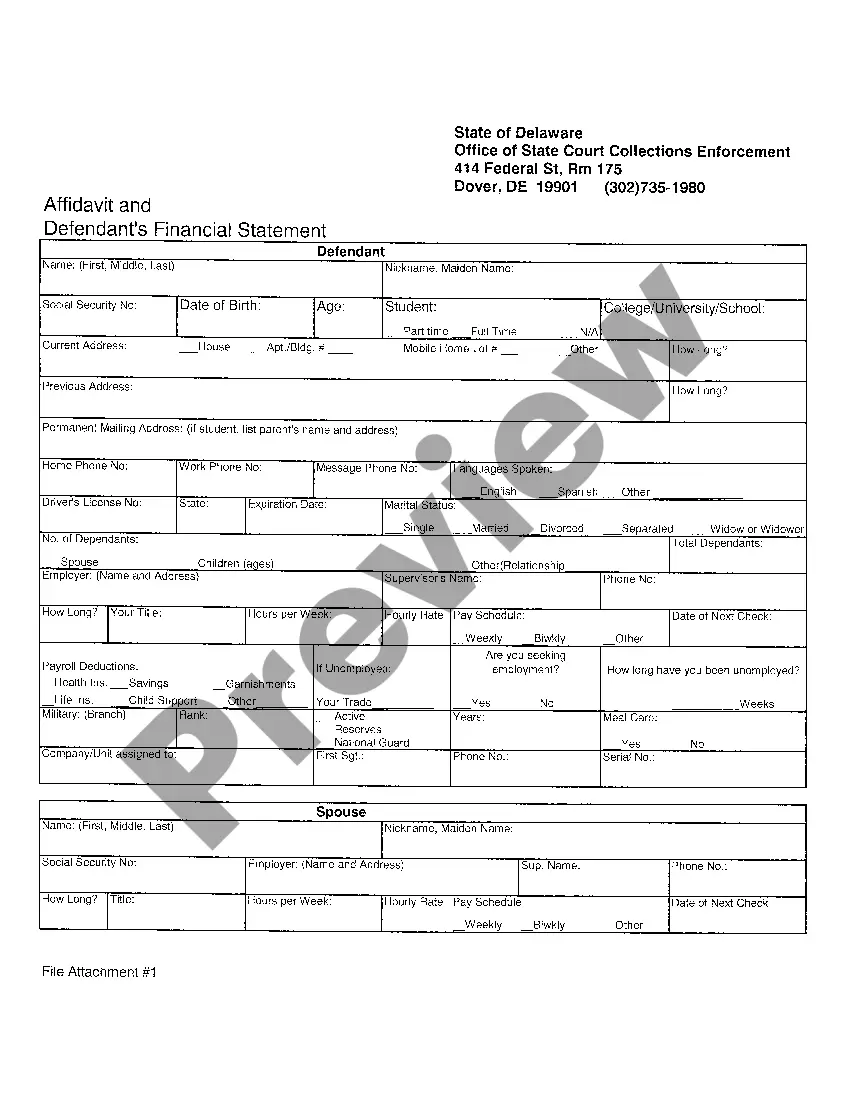

- Use the Preview button to review the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search area to find the form that meets your requirements.

- Once you obtain the appropriate form, click Get now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

In West Virginia, individuals aged 65 and older may qualify for certain property tax exemptions and programs. While they may not stop paying property taxes altogether, they could significantly reduce their financial burden through these programs. Understanding the requirements is essential, and using the West Virginia Return Authorization Form can assist in managing any applications necessary for exemptions. To navigate your options effectively, USLegalForms offers helpful resources.

Form 140 is a tax form used by residents of West Virginia to report personal income and calculate tax owed for the year. It is crucial for filing accurate tax returns and ensuring compliance with state tax laws. Completing the West Virginia Return Authorization Form may also be necessary when submitting your Form 140, particularly if you need to authorize another party to handle your tax matters. Accessing these forms through USLegalForms simplifies the process, making it easier for you.

Currently, West Virginia does tax Social Security benefits. However, there are discussions and proposals regarding changes to this tax policy. Residents should keep informed about any legislative updates that may affect their tax obligations. If you are looking for guidance on tax-related forms, including the West Virginia Return Authorization Form, USLegalForms can help streamline your process.

West Virginia tax form 140 is a special form for non-residents and part-year residents to report income earned in the state. It serves to ensure that all income subject to taxation is reported accurately. When completing the filing process, you might also need the West Virginia Return Authorization Form for proper submission.

Failing to file a West Virginia state tax return can lead to penalties, interest on unpaid taxes, and potential legal consequences. The state actively pursues unfiled returns, making it crucial to stay compliant. To protect yourself, use the West Virginia Return Authorization Form to navigate the filing process correctly.

As of now, there are no confirmed plans for West Virginia to eliminate state income tax. Ongoing discussions occur at the legislative level, but changes would require careful consideration. For accurate information on filing and compliance, download the West Virginia Return Authorization Form from USLegalForms.

The IT-40 form is the individual income tax return form for West Virginia residents. It allows taxpayers to report their income and calculate taxes owed to the state. For a seamless experience, consider using the West Virginia Return Authorization Form, easily accessible on the USLegalForms platform.

Whether you need to file a West Virginia state tax return depends on your income level and tax situation. Individuals earning over a specific amount during the tax year must file. If you're unsure, using the West Virginia Return Authorization Form can clarify your responsibilities and guide you through any necessary steps.

Residents of West Virginia who earn a certain income threshold must file a tax return. This includes all full-time and part-time employees, as well as those with income from other sources. Utilizing the West Virginia Return Authorization Form is crucial for those fulfilling tax obligations and helps streamline the process efficiently.

The West Virginia state income tax return form, commonly called the IT-40 form, is essential for reporting your income. It allows residents to calculate their state tax liability and claim any deductions or credits. If you need to submit a West Virginia Return Authorization Form, you can find it on reliable platforms like USLegalForms, ensuring you meet all requirements.