West Virginia Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

If you aim to obtain, acquire, or generate authentic legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's simple and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are categorized by type and state, or by keywords.

Use US Legal Forms to find the West Virginia Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose in just a few clicks.

Each legal document format you download is your property for years. You can access every form you've downloaded in your account. Check the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the West Virginia Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to locate the West Virginia Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

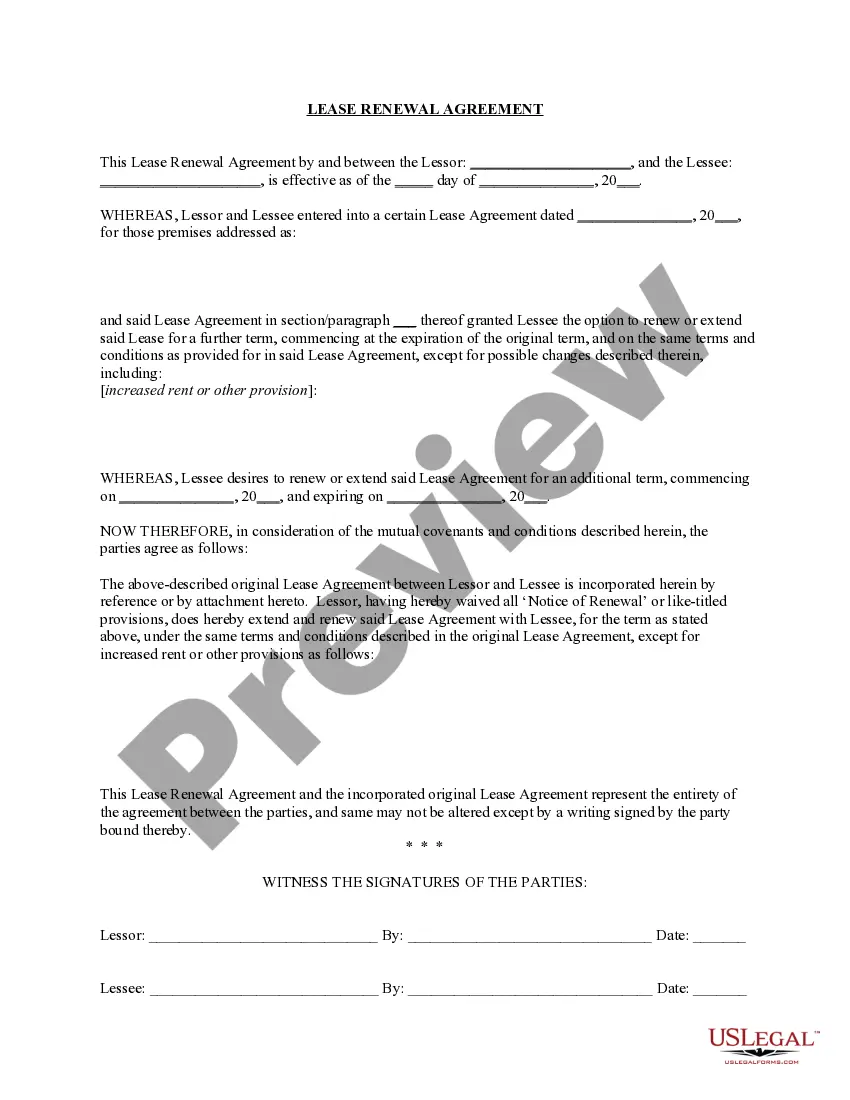

- Step 2. Utilize the Preview option to examine the content of the form. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. After finding the form you need, click the Download now button. Select the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the West Virginia Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose.

Form popularity

FAQ

Naming a charity as a life insurance beneficiary is simple: Write in the charity name and contact information when you choose or change your beneficiaries. You can name multiple beneficiaries and specify what percentage of the death benefit should go to each.

In leaving a specific bequest, it is paramount that the beneficiary and the bequest be fully described. Not only should the beneficiary's full name be expressed, but also his or her last known address at the time of the making of the will.

How (and Why) to Make a Charitable BequestChoose an organization to receive your bequest.Decide what type of bequest you will give.Decide what you will give in your bequest.Add the bequest to your will and tell people about it.Pat yourself on the back while you think about the benefits of making a charitable bequest.06-May-2019

A will typically contains provision for the distribution of a testator's deceased estate after their death. There are some instances where a testator might choose to create a testamentary trust instead of bequeathing an asset directly to a beneficiary.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

A bequest is a gift, but a gift is not necessarily a bequest. A bequest describes the act of leaving a gift to a loved one through a Will. For example, you could simply state something like I bequest my red Corvette to my son in a Will. On the other hand, a gift can be made outside of a Will.