West Virginia Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

If you desire to be thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms available online.

Make the most of the site’s straightforward and effortless search feature to find the documents you require.

Different templates for commercial and personal purposes are categorized by groups and regions, or keywords.

Step 4. After finding the form you need, click the Acquire now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the West Virginia Revocable Trust for Estate Planning.

Every legal document format you obtain is yours permanently. You have access to every form you downloaded through your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive by downloading and printing the West Virginia Revocable Trust for Estate Planning with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to retrieve the West Virginia Revocable Trust for Estate Planning with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to acquire the West Virginia Revocable Trust for Estate Planning.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, consult the following instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

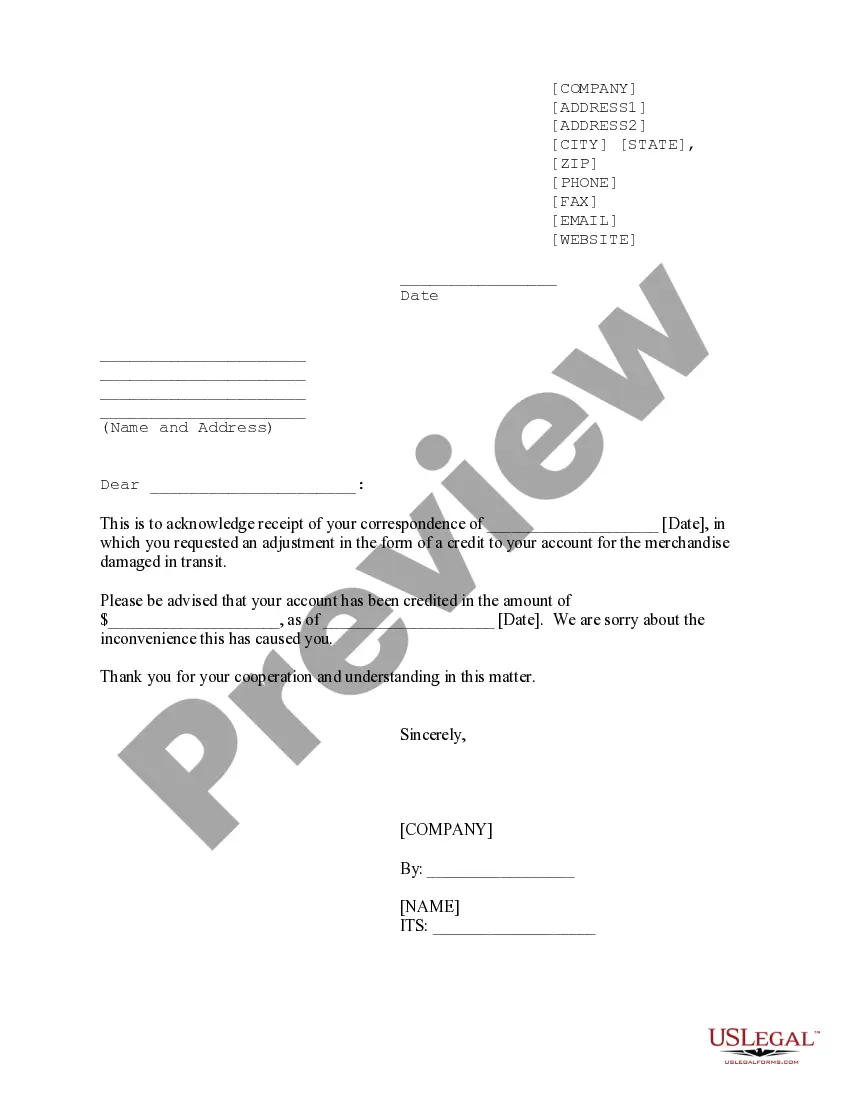

- Step 2. Utilize the Preview option to review the details of the form. Remember to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form format.

Form popularity

FAQ

To set up a trust in West Virginia, you first need to decide on the type of trust that meets your needs, such as a revocable trust. Next, you can draft a trust agreement, which outlines the terms and beneficiaries. Utilizing a platform like uslegalforms can simplify this process, providing you with templates and guidance to create a West Virginia Revocable Trust for Estate Planning effectively.

The greatest advantage of a revocable trust is its flexibility. With a West Virginia Revocable Trust for Estate Planning, you can change the terms, add or remove assets, or even dissolve the trust entirely during your lifetime. This control allows you to adapt your estate plan as your circumstances change.

A revocable trust is often considered the best option to avoid probate. Specifically, a West Virginia Revocable Trust for Estate Planning allows you to retain control over your assets while ensuring they are transferred seamlessly to your beneficiaries upon your death. This not only saves time but can also reduce the costs associated with the probate process.

The least expensive way to set up a trust often includes using online services or templates available at platforms like uslegalforms. These resources provide guidance on creating a West Virginia Revocable Trust for Estate Planning without the high costs associated with hiring a lawyer. While saving on costs, it’s important to ensure you understand all the legal requirements and implications.

The minimum amount to set up a trust varies based on your specific goals and the chosen type of trust. Generally, with a West Virginia Revocable Trust for Estate Planning, you can establish one with a minimal amount, sometimes starting as low as a few thousand dollars. However, it's wise to consider your total estate value and the assets you wish to put in the trust for optimal benefit.

Yes, you can write your own will in West Virginia. However, it’s essential to ensure that your will meets the legal requirements set by the state. To create a comprehensive estate plan, consider using a West Virginia Revocable Trust for Estate Planning, as this can provide additional benefits, such as avoiding probate and providing flexibility in managing your assets. If you are unsure about the process, platforms like uslegalforms can guide you in drafting a legally compliant will or revocable trust.

Although your focus might be on the West Virginia Revocable Trust for Estate Planning, understanding common mistakes elsewhere can be beneficial. In the UK, a common error parents make is neglecting to consider tax implications associated with trust funds. This oversight can result in unexpected tax liabilities, emphasizing the importance of consulting with a knowledgeable advisor when setting up a trust.

While trusts offer many benefits, they also have potential downsides. A West Virginia Revocable Trust for Estate Planning might incur ongoing maintenance costs and legal fees. Additionally, some individuals perceive trusts as complicated or cumbersome, potentially deterring them from using this effective estate planning tool.

The biggest mistake parents often make when setting up a trust fund is not clearly communicating their intentions to their children. Without transparency, heirs may not understand the rationale behind the trust, leading to confusion or conflict. It’s essential to include discussions about the trust as part of your West Virginia Revocable Trust for Estate Planning.

Setting up a trust, including a West Virginia Revocable Trust for Estate Planning, can have pitfalls. Common issues include improper funding of the trust, which may leave your intended assets out of its protections and benefits. Additionally, failing to regularly update the trust as your circumstances change can lead to misalignment with your estate planning goals.