West Virginia Sample Letter for New Discount

Description

How to fill out Sample Letter For New Discount?

Locating the appropriate legal document template can be a challenge. Clearly, there are numerous formats available online, but how can you identify the legal form you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the West Virginia Sample Letter for New Discount, which you can utilize for both business and personal purposes.

All documents are verified by professionals and comply with federal and state regulations.

US Legal Forms is the largest repository of legal forms, providing a wide range of document templates. Leverage the service to download professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the West Virginia Sample Letter for New Discount.

- Use your account to browse through the legal documents you previously purchased.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your locale.

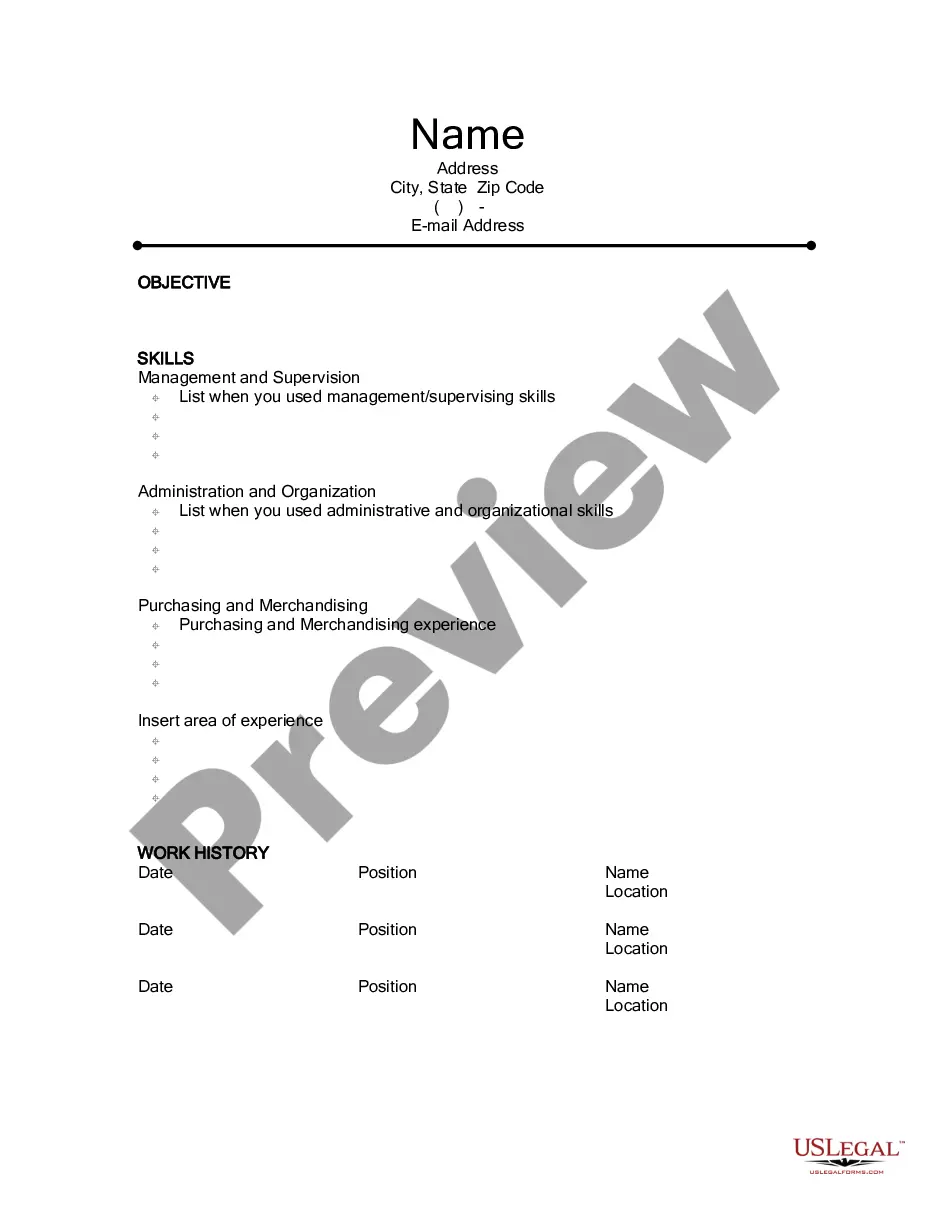

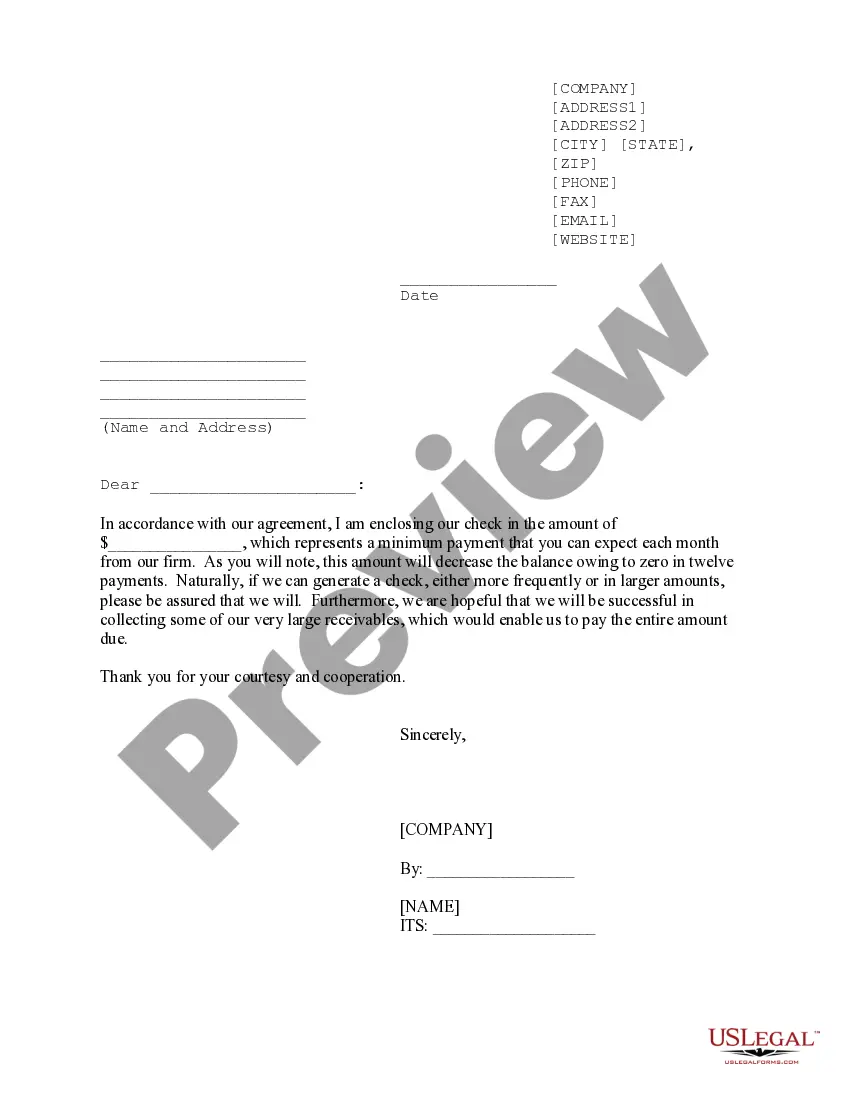

- You can preview the form using the Review button and read the form description to confirm it is the right one for you.

- If the form does not meet your needs, utilize the Search bar to find the appropriate form.

- When you are certain the form is correct, click the Purchase now button to acquire the form.

- Select the pricing plan you prefer and enter the necessary details.

- Create your account and complete the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the acquired West Virginia Sample Letter for New Discount.

Form popularity

FAQ

If you earn income in West Virginia, you are required to file a state tax return, even if you are a part-time resident. This obligation helps ensure that all taxable income is reported. Utilizing a West Virginia Sample Letter for New Discount may also assist in clarifying your residency for tax purposes.

To prove residency in West Virginia, you can provide several documents, including utility bills, lease agreements, or a state-issued ID. Additionally, a West Virginia Sample Letter for New Discount can validate your residency by confirming your address and intent to stay in the state. Having a variety of documents prepared will help you establish residency effectively.

Establishing residency in West Virginia may take a year or longer, depending on your circumstances. You need to show consistent physical presence and intent to make West Virginia your home. A West Virginia Sample Letter for New Discount can serve as proof of your commitment and help simplify the process.

In general, to claim residency in West Virginia, you should live there for a minimum of 12 months. This period helps demonstrate your commitment to establishing roots in the state. Using a West Virginia Sample Letter for New Discount can strengthen your position by outlining your residency intentions.

Typically, you need to reside in West Virginia for at least 12 consecutive months to be designated as a resident. However, factors such as your legal ties and intent to make the state your permanent home also play roles. Each case may vary, so it is best to prepare a West Virginia Sample Letter for New Discount to clarify your status when needed.

West Virginia residency laws require individuals to establish a permanent home in the state. This means you must intend to live there indefinitely and be physically present. Additionally, residency may affect eligibility for various benefits, including discounts. Providing a West Virginia Sample Letter for New Discount can be an effective way to confirm your residency.

Yes, West Virginia provides various state tax forms for individuals and businesses. These forms are necessary for filing income tax and ensuring compliance with state tax regulations. If you seek clarity in your tax obligations, consider using a West Virginia Sample Letter for New Discount, which might help in organizing your documentation.

In West Virginia, most tangible goods and some services are subject to sales tax. This includes items like clothing, electronics, and certain taxable services. By knowing what is taxable, you can organize your purchases wisely, and a West Virginia Sample Letter for New Discount could be beneficial in addressing any applicable tax concerns.

To obtain tax-exempt status in West Virginia, you must apply for a certificate with the state tax department. Certain organizations, like non-profits and educational institutions, often qualify for this exemption. Utilizing a West Virginia Sample Letter for New Discount can provide a clear request format, making your application process easier.

Several categories of items are exempt from sales tax in West Virginia. Common exemptions include certain food products, medical equipment, and educational materials. Understanding these exemptions helps in financial planning, and you might find a West Virginia Sample Letter for New Discount useful in preparing your tax documentation.