Maryland Software Sales Agreement

Description

How to fill out Software Sales Agreement?

If you need to gather, download, or print authentic document templates, utilize US Legal Forms, the largest selection of authentic forms available on the web.

Utilize the site's straightforward and convenient search feature to procure the documents you need.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After identifying the form you need, click the Get now button. Select the payment plan you prefer and enter your details to register for your account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to get the Maryland Software Sales Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Maryland Software Sales Agreement.

- You can also retrieve forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

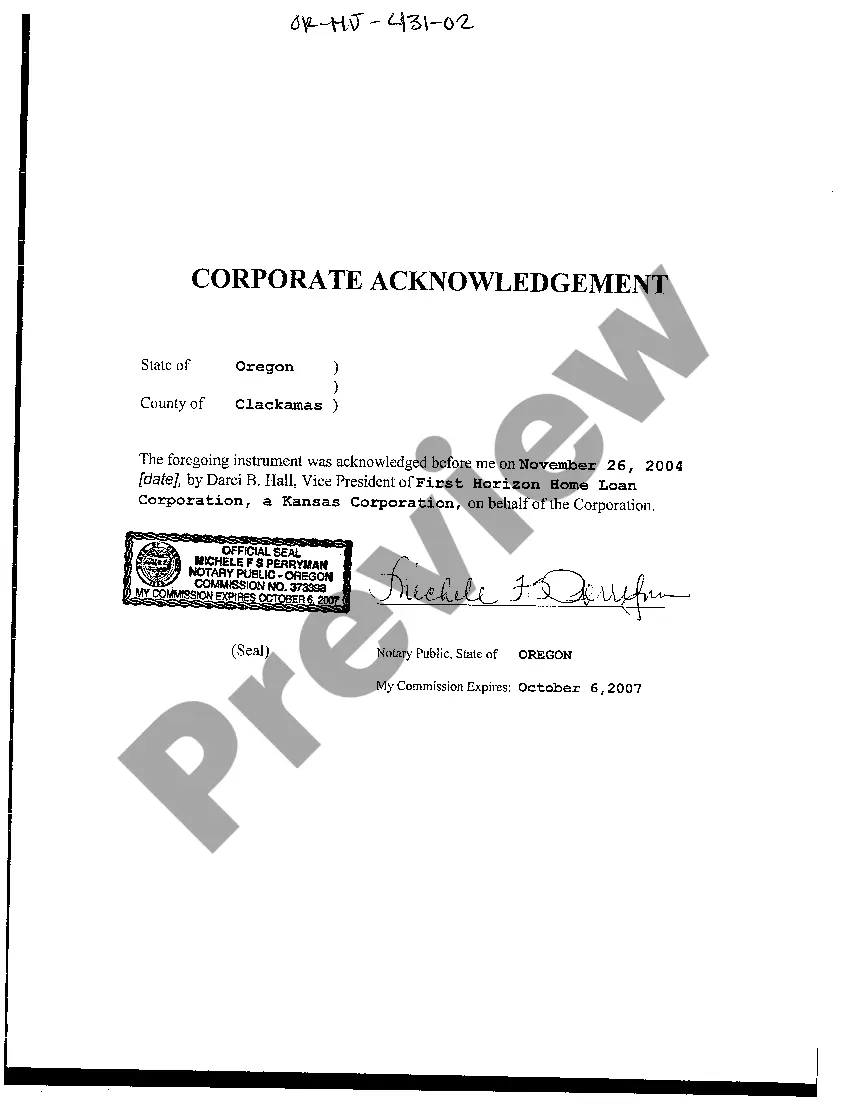

- Step 2. Utilize the Review option to examine the form’s details. Make sure to read through the information.

- Step 3. If you are not satisfied with the form, make use of the Lookup field at the top of the screen to search for other types of your legal form template.

Form popularity

FAQ

Goods - All goods are subject to sales and use tax. This includes food, clothing, jewelry, vehicles, furniture, and art. However, there are exceptions, including: Agricultural Products Items sold/bought are not taxed if they are bought by a farmer and are being used for an agricultural purpose.

Also effective March 14, 2021, the sale of canned or commercial off-the-shelf software obtained electronically is considered a digital good and is subject to Maryland sales and use tax. The sale of software as a service (SaaS) is also subject to sales and use tax.

Additionally, software subscriptions services are considered tangible property and are subject to sales and use taxes.

In the state of Maryland, the software is considered to be exempt so long as all of the transaction does not include the transfer of any tangible personal property. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maryland.

The hottest topic in the State & Local Tax community has been the emergence of tax laws surrounding the taxability of Software as a Service or more commonly known as SaaS. In March 2021, Maryland's Office of the Comptroller issued guidance on digital products and streaming tax, declaring that SaaS is taxable.

A contract to receive electronically delivered digital products, entered on December 1, 2020, is not subject to sales and use tax.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

This significant policy change likely took many businesses and consumers by surprise, though it's been on the docket for more than a year. The tax was initially enacted in March 2020 and set to take effect July 1, 2020, but was vetoed by Governor Larry Hogan in May, along with a tax on digital advertising services.

In the state of Maryland, the software is considered to be exempt so long as all of the transaction does not include the transfer of any tangible personal property. Sales of custom software - delivered on tangible media are exempt from the sales tax in Maryland.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.