This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

West Virginia Application for Certificate of Discharge of IRS Lien

Description

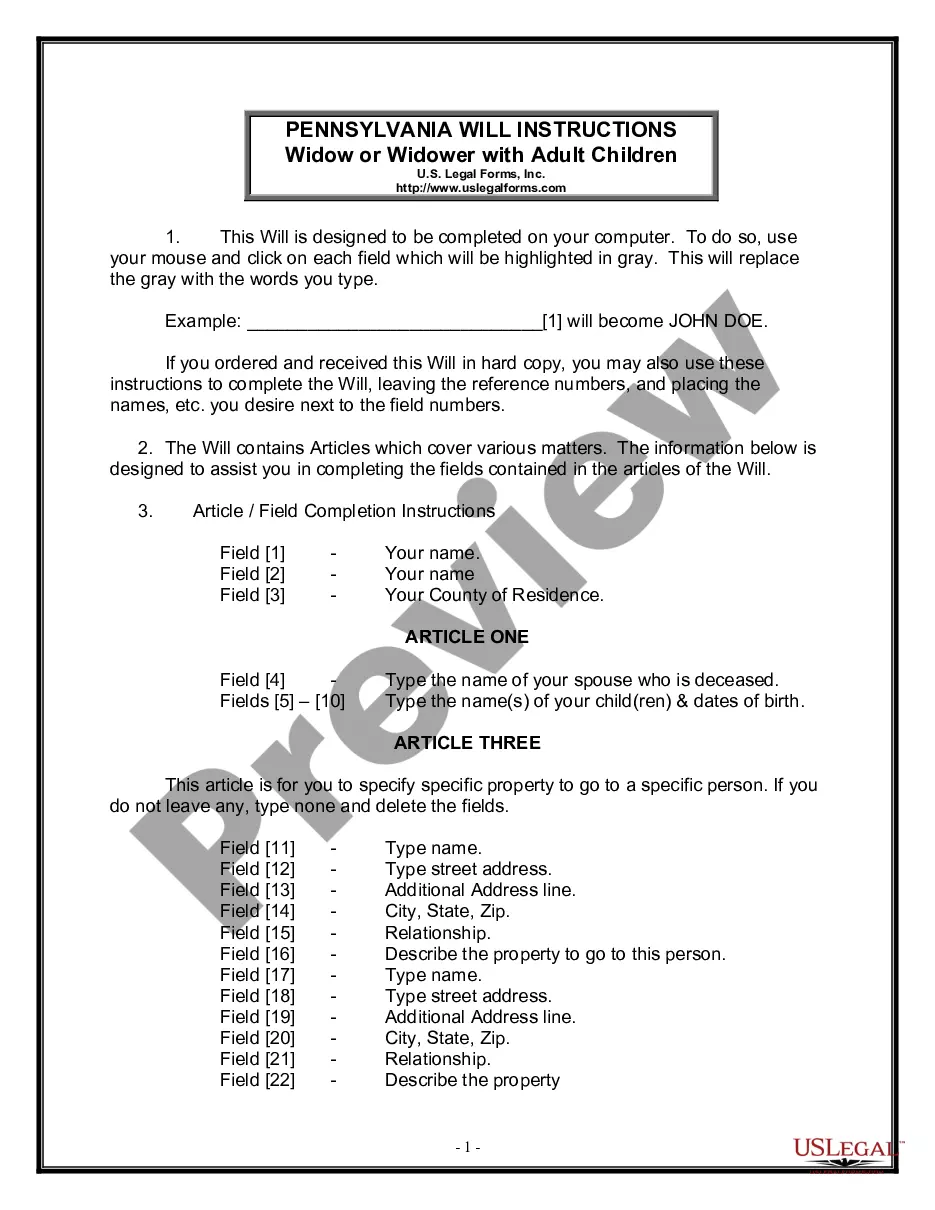

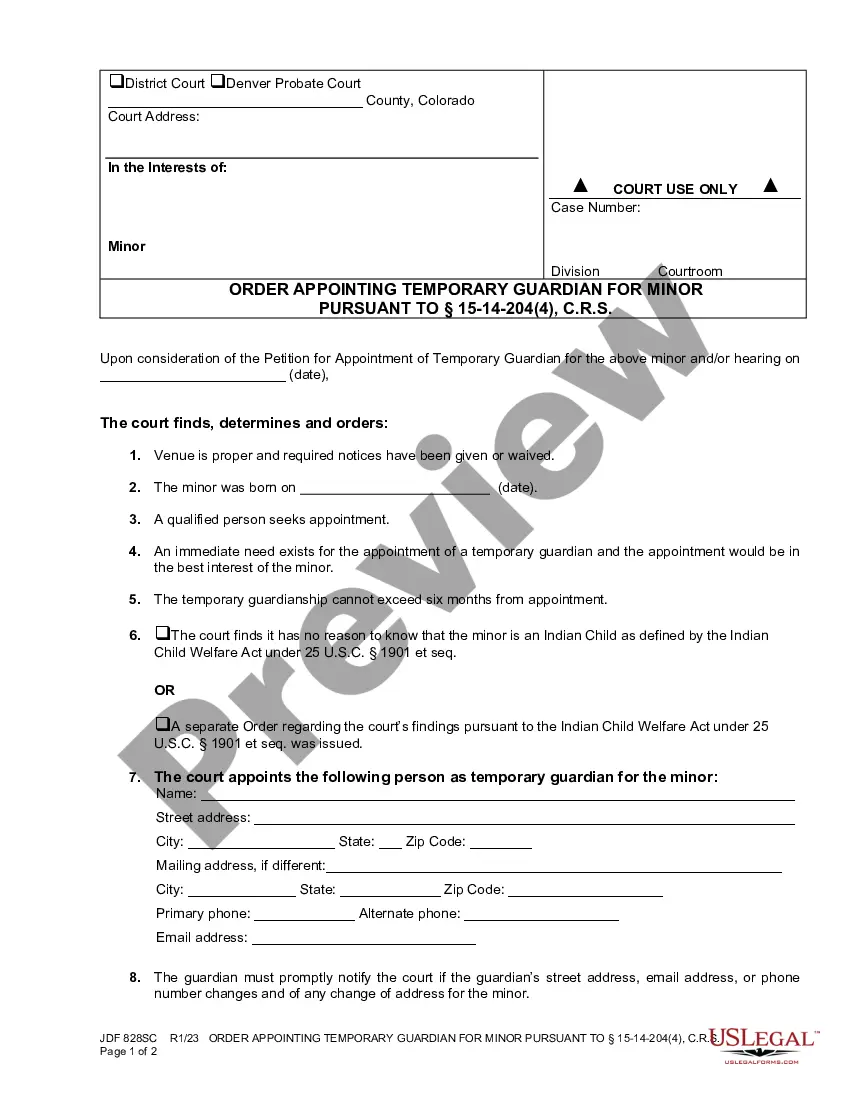

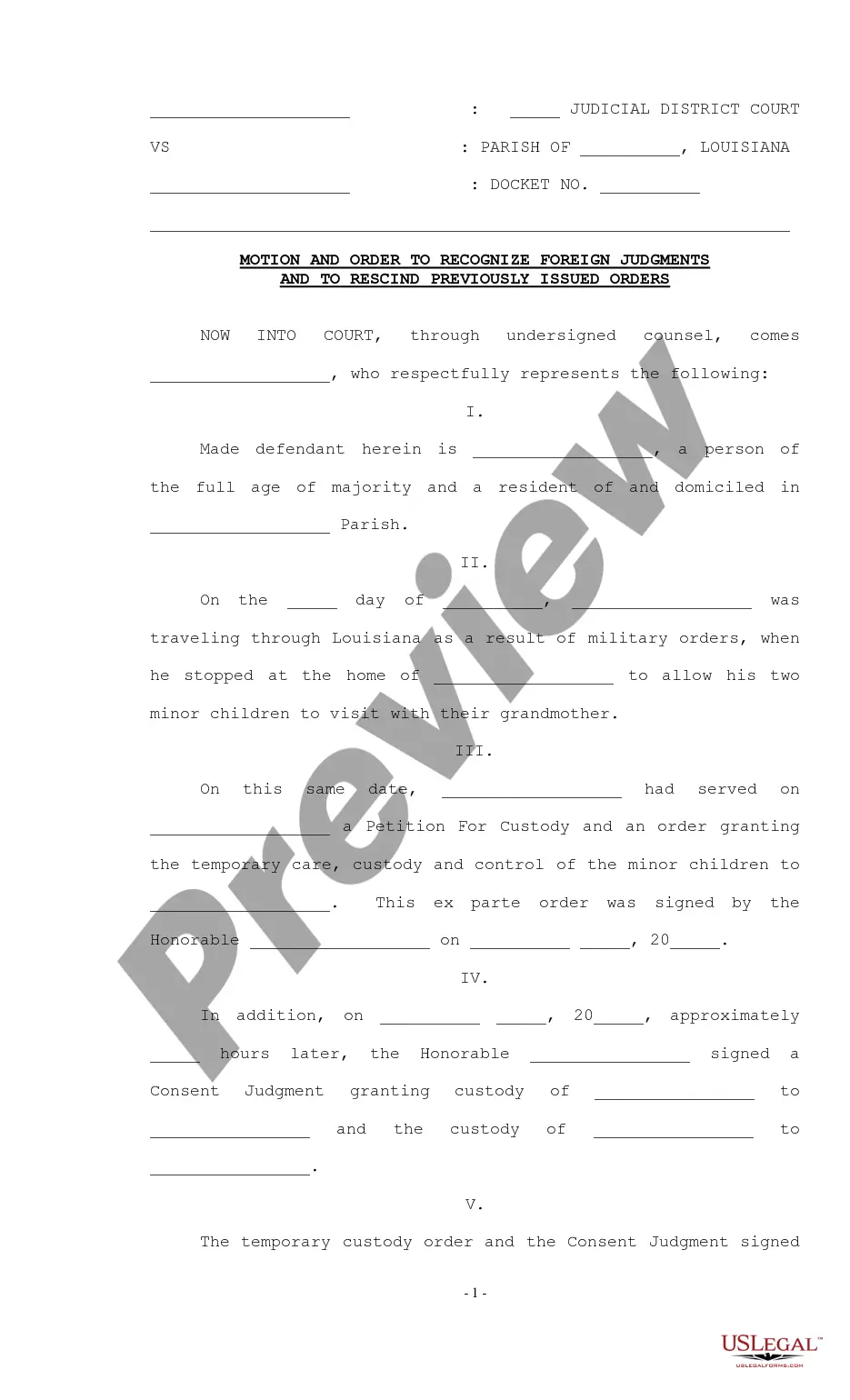

How to fill out Application For Certificate Of Discharge Of IRS Lien?

You might spend hours online searching for the legal document template that meets the state and federal requirements you desire. US Legal Forms offers thousands of legal forms that are vetted by experts.

You can download or print the West Virginia Application for Certificate of Discharge of IRS Lien from the service.

If you already have a US Legal Forms account, you can Log In and select the Download option. After that, you can fill out, modify, print, or sign the West Virginia Application for Certificate of Discharge of IRS Lien. Each legal document template you obtain is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can fill out, modify, sign, and print the West Virginia Application for Certificate of Discharge of IRS Lien. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to handle your business or personal needs.

- To acquire another copy of any downloaded form, visit the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/town of your choice. Review the form details to confirm you have selected the right one.

- If available, utilize the Preview option to view the document template as well.

- If you wish to find another version of the form, use the Lookup field to identify the template that suits your requirements.

- Once you have located the template you want, click on Purchase now to proceed.

- Select the payment plan you prefer, enter your information, and register for your account on US Legal Forms.

Form popularity

FAQ

A lien discharge and a lien release both serve to remove an IRS lien from your record, but they differ in context. A lien discharge, specifically referenced in the West Virginia Application for Certificate of Discharge of IRS Lien, occurs when the IRS agrees to remove a lien against a specific property. In contrast, a lien release is a broader term that indicates that the IRS has released its claim on your assets after your debt has been satisfied. Understanding these differences can help you navigate the process more effectively, and using US Legal Forms can streamline your application for the certificate.

To obtain a federal tax lien payoff, you need to contact the IRS and request a payoff amount for your tax lien. This figure will include the total amount you owe, including any interest or penalties. After settling the debt, you can then proceed with the West Virginia Application for Certificate of Discharge of IRS Lien to have the lien removed.

Applying for a certificate of discharge from a federal tax lien involves submitting a West Virginia Application for Certificate of Discharge of IRS Lien. This application requires detailed information about your tax situation and proof that the lien can be discharged. Be thorough in your submission to enhance your chances of approval.

To request a lien release from the IRS, you must submit Form 668(Z), also known as the Notice of Federal Tax Lien, along with your payment or proof of payment. Ensure you follow the correct procedures to avoid delays. Utilizing the West Virginia Application for Certificate of Discharge of IRS Lien can also help facilitate this process.

You can obtain a copy of a federal tax lien by contacting the IRS directly or checking your local recorder's office where the lien was filed. The IRS can provide you with the necessary documentation regarding the lien. If you need further assistance, consider using resources like the West Virginia Application for Certificate of Discharge of IRS Lien to manage your tax issues.

The IRS form for lien withdrawal is Form 12277, which is used to request the withdrawal of a federal tax lien. If you have resolved your tax debt, you can submit this form to the IRS. Additionally, applying for a West Virginia Application for Certificate of Discharge of IRS Lien may help clarify your tax standing.

To apply for a federal tax lien discharge, you need to complete the West Virginia Application for Certificate of Discharge of IRS Lien. This application requires you to provide specific details about your tax situation and the property affected by the lien. Ensure to follow the IRS guidelines closely to increase your chances of a successful discharge.

You should file IRS Form 14135 with the appropriate IRS office based on your location. For residents of West Virginia, it's crucial to check the IRS guidelines to determine the correct mailing address. Completing the West Virginia Application for Certificate of Discharge of IRS Lien accurately can help streamline your filing process.