This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

West Virginia Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

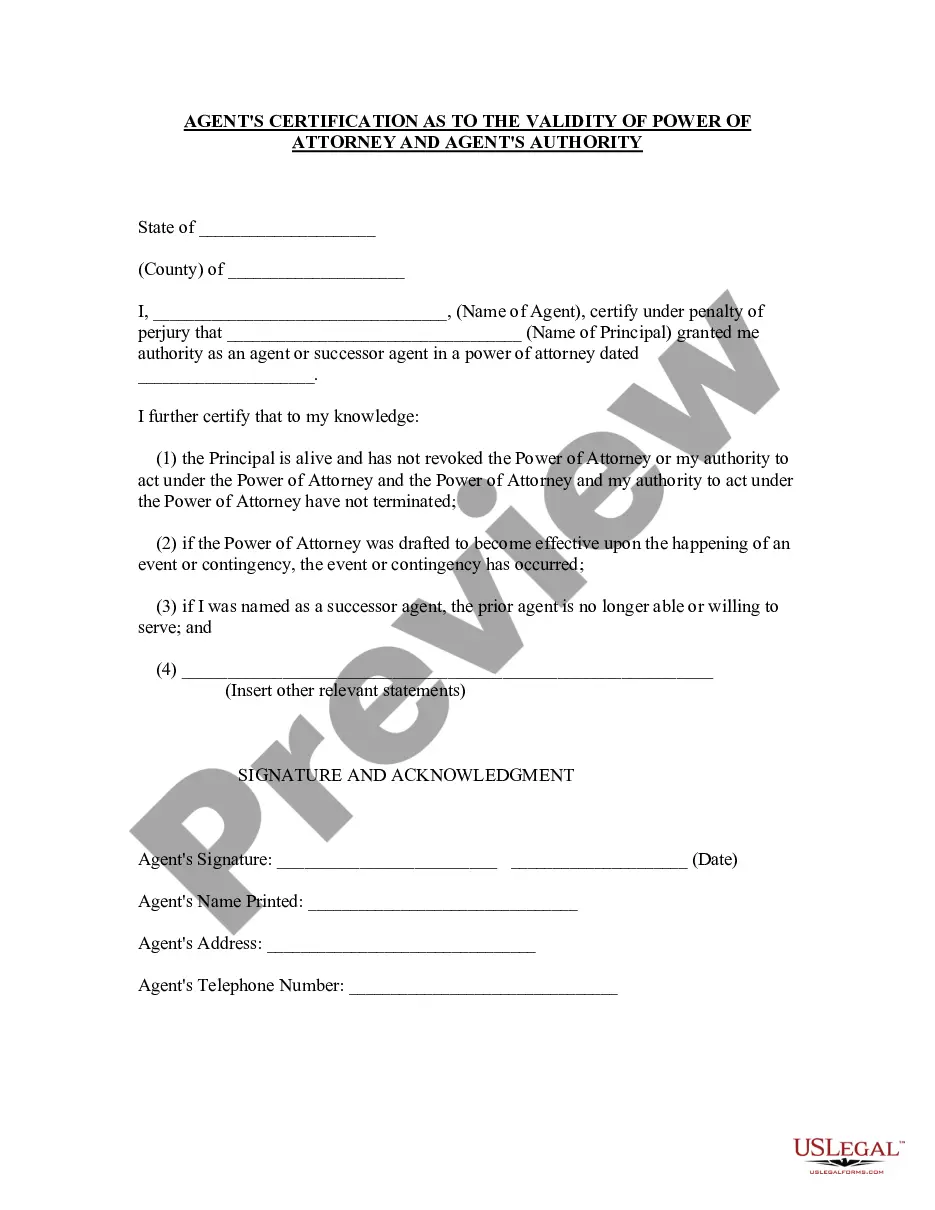

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous designs available online, but how do you obtain the legal format you require? Utilize the US Legal Forms website. The service provides a multitude of templates, such as the West Virginia Application for Release of Right to Redeem Property from IRS After Foreclosure, which you can use for business and personal purposes. All of the documents are reviewed by experts and meet state and federal requirements.

If you are currently registered, Log In to your account and click on the Download button to obtain the West Virginia Application for Release of Right to Redeem Property from IRS After Foreclosure. Use your account to access the legal documents you may have purchased previously. Navigate to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have selected the correct form for the city/state. You can browse the form using the Preview option and review the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Purchase now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, and print and sign the obtained West Virginia Application for Release of Right to Redeem Property from IRS After Foreclosure. US Legal Forms is the largest repository of legal templates where you can find various document designs. Use the service to obtain properly crafted documents that comply with state regulations.

Use the service to obtain properly crafted documents that comply with state regulations.

- Selecting the appropriate legal document template can be a challenge.

- Utilize the US Legal Forms website.

- If you are currently registered, Log In to your account.

- Navigate to the My documents section of your account.

- If you are a new user of US Legal Forms, here are simple instructions.

- US Legal Forms is the largest repository of legal templates.

Form popularity

FAQ

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

That's because a federal tax lien can be extended as long as the IRS refiles the lien 30 or more days before it expires. If this happens, the lien will renew beyond the 10-year expiration date.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Certificate of Release of Federal Tax Lien Section 6325(a) of the Internal Revenue Code directs us to release a Federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the IRS accepts a bond for payment of the liability.

Generally, a Notice of Federal Tax Lien is active for ten years and thirty days from the date the tax liability is assessed. (See ?Self-Releasing Liens? section on page 4 of this publication.)

Yes, after 10 years, the IRS forgives tax debt. After this time period, the tax debt is considered "uncollectible". However, it is important to note that there are certain circumstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.