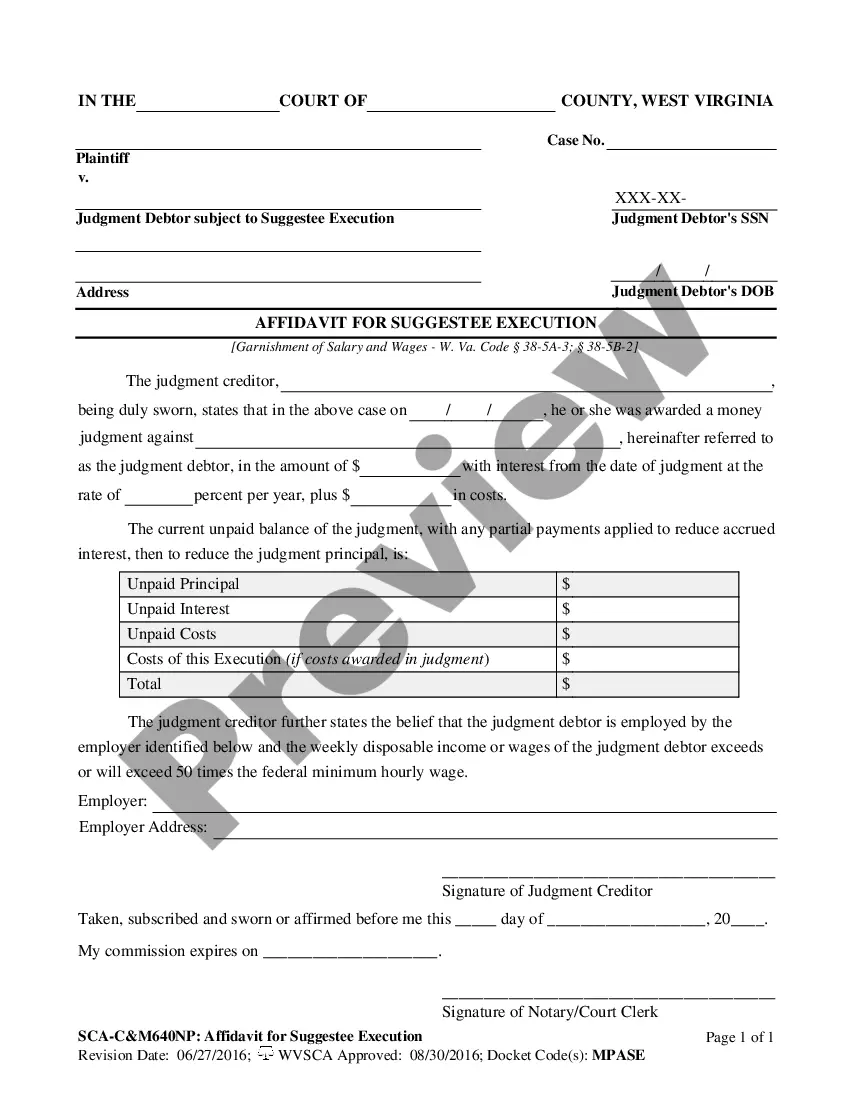

West Virginia Affidavit for Suggested Execution is a document used in West Virginia to allow a person (the suggested) to act on behalf of another party (the suggester). This document is used to prove that the suggested has the authority to make decisions in the suggester's name, and it is typically used in legal proceedings, such as real estate transactions or business transactions. The suggested must sign the affidavit in the presence of a notary public in order to be valid. There are two main types of West Virginia Affidavit for Suggested Execution: General Affidavit for Suggested Execution and Limited Affidavit for Suggested Execution. The General Affidavit for Suggested Execution allows the suggested to make decisions in all matters related to the suggester's name. The Limited Affidavit for Suggested Execution, on the other hand, limits the suggested's authority to certain matters that are specified in the document. Both types of affidavits must be signed in the presence of a notary public in order for them to be valid.

West Virginia Affidavit for Suggestee Execution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out West Virginia Affidavit For Suggestee Execution?

How much time and resources do you usually spend on drafting formal paperwork? There’s a better opportunity to get such forms than hiring legal specialists or wasting hours searching the web for a suitable blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the West Virginia Affidavit for Suggestee Execution.

To obtain and complete a suitable West Virginia Affidavit for Suggestee Execution blank, adhere to these easy steps:

- Examine the form content to make sure it meets your state requirements. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the West Virginia Affidavit for Suggestee Execution. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally secure for that.

- Download your West Virginia Affidavit for Suggestee Execution on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us today!

Form popularity

FAQ

When a West Virginia state employee has been overpaid, the employee may voluntarily authorize a written assignment or order for future wages to repay the overpayment in an amount not to exceed ?three-fourths? of his or her periodical earnings or wages.

A writ of fieri facias or execution shall create a lien, from the time it is delivered to the sheriff or other officer to be executed, upon all of the personal property, or the estate or interest therein, owned by the judgment debtor at the time of such delivery of the writ, or which he may acquire on or before the

In the West Virginia Code, wage garnishment is limited to the lesser of: 20% of your disposable earnings for a week, or. The amount your weekly wages exceed 50 times the federal minimum wage. This is currently $7.25, so 50 times that is $362.50.

To get a wage garnishment, the creditor first has to win a court case proving that you do in fact owe money to the creditor. If the creditor proves that you do owe money, then the court will issue a ?judgment? order. The judgment order simply states the exact amount of money that is owed as of that date.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.