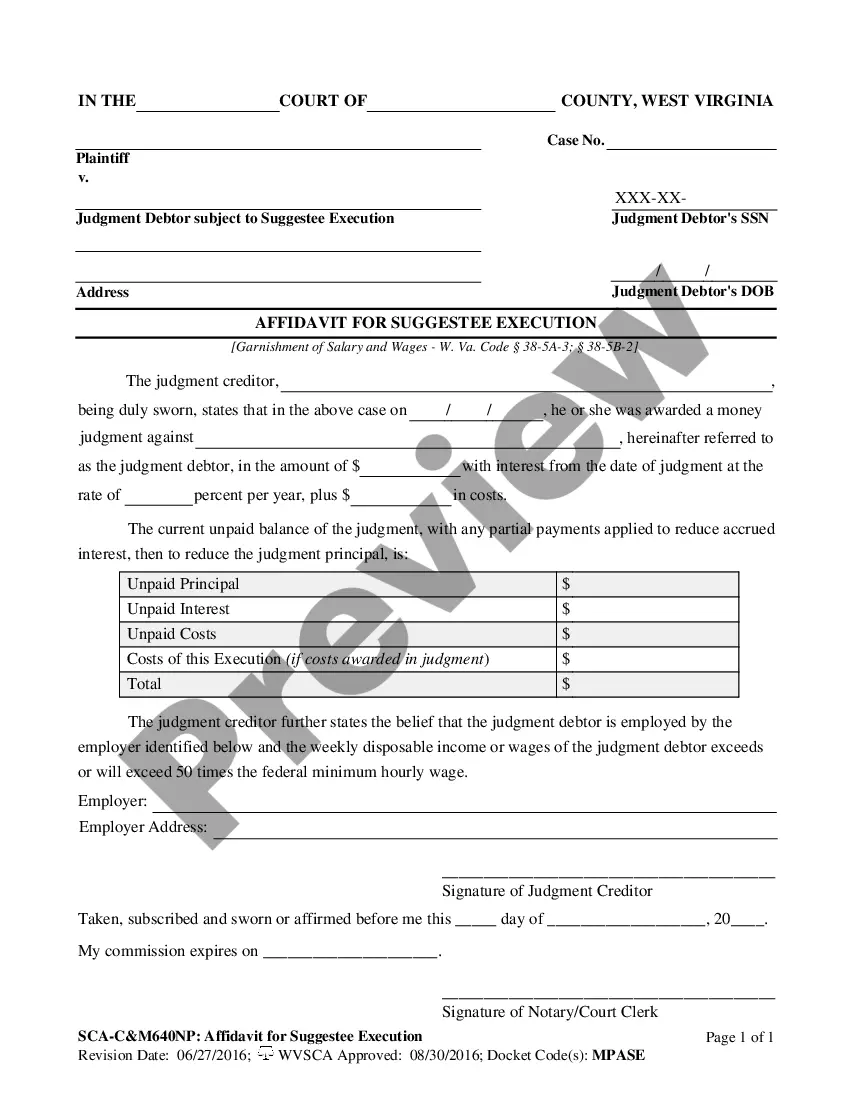

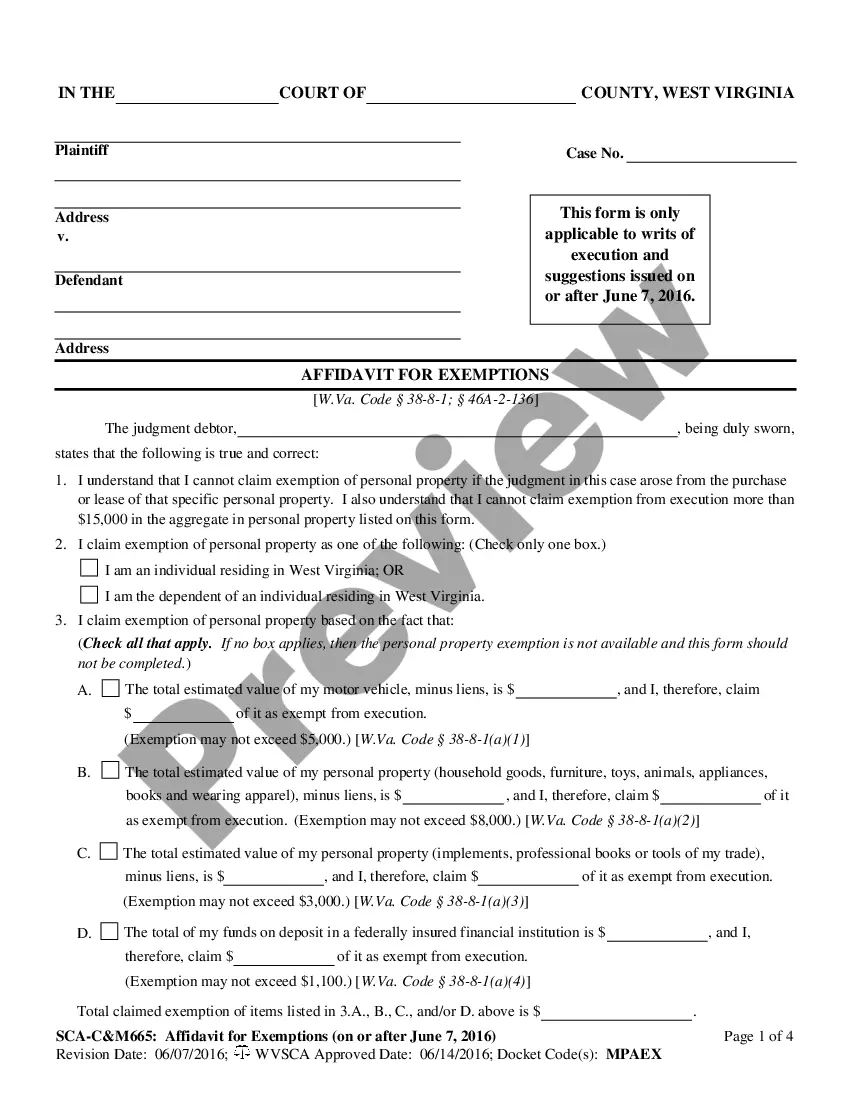

A West Virginia Affidavit for Exemptions — (for writs of execution and suggestions) is a document that is used when filing a writ of execution or suggestion in the state of West Virginia. The affidavit is used to claim any exemptions from the writ that the debtor may be entitled to. The debtor must provide detailed information about their income, assets and other financial information so that the court can determine if any exemptions apply. There are two types of West Virginia Affidavit for Exemptions — (for writs of execution and suggestions): the West Virginia Exemptions Affidavit for Wages and the West Virginia Exemptions Affidavit for Bank Accounts. The Wages Exemptions Affidavit is used to protect the debtor’s wages from being garnished and the Bank Accounts Exemptions Affidavit is used to protect the debtor’s bank accounts from being frozen.

West Virginia Affidavit for Exemptions - (for writs of execution and suggestions)

Description

How to fill out West Virginia Affidavit For Exemptions - (for Writs Of Execution And Suggestions)?

How much time and resources do you normally spend on drafting formal documentation? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for a suitable template. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, like the West Virginia Affidavit for Exemptions - (for writs of execution and suggestions).

To obtain and complete a suitable West Virginia Affidavit for Exemptions - (for writs of execution and suggestions) template, adhere to these simple instructions:

- Examine the form content to make sure it meets your state laws. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the West Virginia Affidavit for Exemptions - (for writs of execution and suggestions). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your West Virginia Affidavit for Exemptions - (for writs of execution and suggestions) on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

How can I obtain information about personal property taxes? You can call the Personal Property Tax Division at (804) 501-4263 or visit the Department of Finance website .

Below is a representative, nonexclusive list of property that may be exempt from property tax: The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt.

How can I find how much I owe? Either call our office at 357-0210 or you may look your taxes up online by clicking on the 'Tax Inquiry' link.

West Virginia accepts ACH Credits, ACH Debits and Credit Cards. ACH Credits ? Payments are initiated by your financial institution. You can Apply Online for Electronic Funds Transfer, or you can complete and submit a WV/EFT-5 Electronic Funds Transfer Application.

To apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. We are not able to take applications over the phone or online at this time. If you have any questions or need additional information, you can contact our Real Estate Office at (304) 574-4240.

West Virginia has some of the lowest property tax rates in the country. Its average effective property tax rate of 0.55% is the 10th-lowest state rate in the U.S., as comes in at about half of the national average.