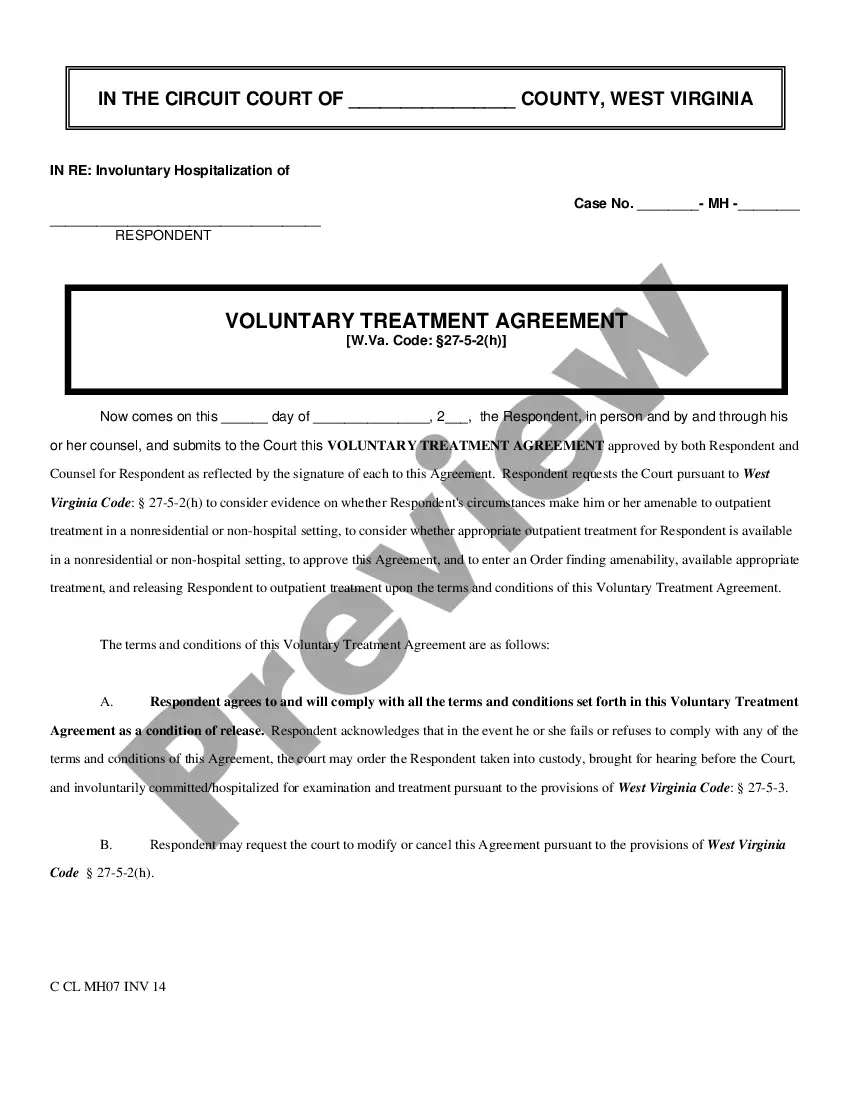

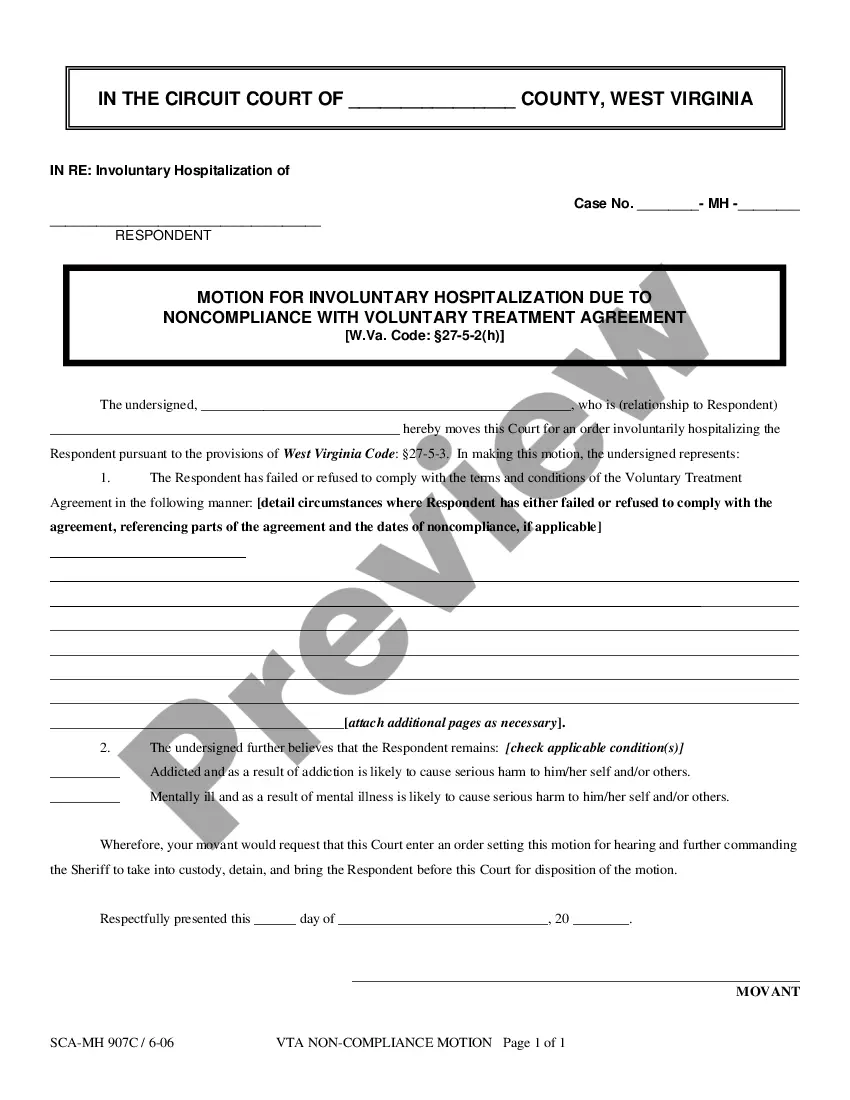

West Virginia Motion for Cancellation Or Modification of Voluntary Treatment Agreement

Description

How to fill out West Virginia Motion For Cancellation Or Modification Of Voluntary Treatment Agreement?

Out of the great number of platforms that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates before purchasing them. Its comprehensive catalogue of 85,000 samples is grouped by state and use for efficiency. All of the forms available on the service have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, press Download and access your Form name from the My Forms; the My Forms tab keeps all of your downloaded documents.

Stick to the guidelines listed below to obtain the document:

- Once you find a Form name, make sure it is the one for the state you really need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Search for a new template using the Search field if the one you’ve already found is not appropriate.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any document you add to your My Forms tab can be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our platform provides quick and easy access to samples that suit both attorneys and their customers.

Form popularity

FAQ

Homeowners go through the process of a loan modification to stay afloat in times that their mortgage payments are becoming too difficult to maintain. It is possible to refinance the loan again in the future, but do not expect it to come without challenges.

Conventional mortgage loan guidelines require that when trying to finance a new property you will need to have 12 months of payment history on the modification. So if you got a modification 12 months ago and have stayed current with every payment you are okay to apply for a loan on a new home.

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

If you've been denied a loan modification for illegal reasons, you have rights. A foreclosure by a bank after a wrongful denial of a loan modification can lead to a counterclaim lawsuit against the bank.

Either way, it stays on your report for seven years.

Yes, it is possible to get a second loan modification though statistically it's obvious that you are less likely to get a second modification if you've had a first, and a third if you were lucky enough to get a second.

If your modification is temporary, you'll likely need to return to the original terms of your mortgage and repay the amount that was deferred before you can qualify for a new purchase or refinance loan.

There is a 12-24 month waiting period before you can refinance under most post-loan modification options. To refinance a loan's interest rate and repayment terms, the refinance lender requires you to have stable income and total monthly expenses within 40 percent of your gross monthly income.

Technically, a loan modification should not have any negative impact on your credit score.If that's the case, those the Consumer Data Industry Association missed or partial payments will damage your credit, but the loan modification itself will not.