This office lease provision states that the parties desire to allocate certain risks of personal injury, bodily injury or property damage, and risks of loss of real or personal property by reason of fire, explosion or other casualty, and to provide for the responsibility for insuring those risks permitted by law.

Wisconsin Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant

Description

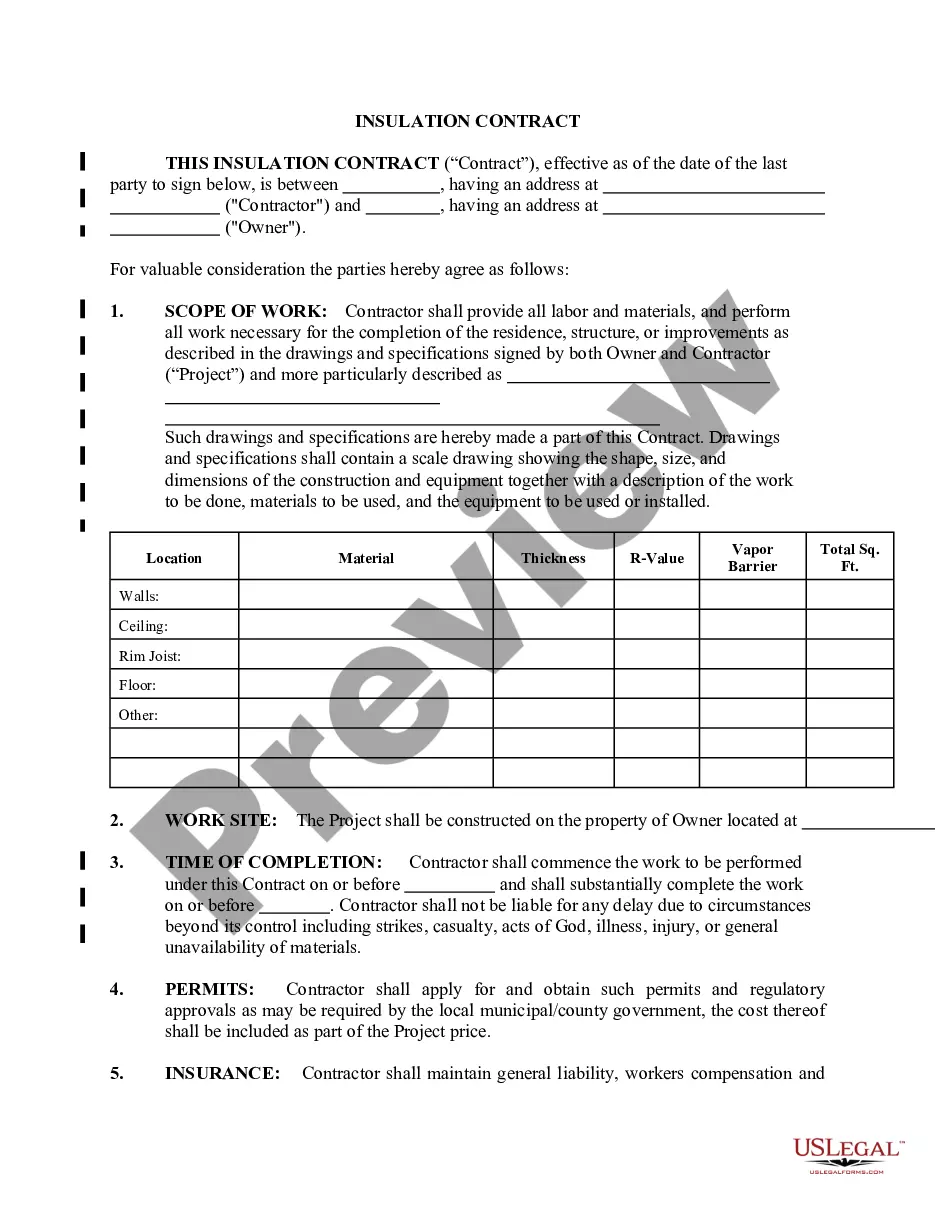

How to fill out Provision Allocation Risks And Setting Forth Insurance Obligations Of Both The Landlord And The Tenant?

Have you been in the placement that you need to have documents for possibly business or specific reasons nearly every day? There are a lot of authorized document themes available on the Internet, but discovering ones you can rely is not simple. US Legal Forms provides 1000s of form themes, like the Wisconsin Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant, which are created to fulfill state and federal needs.

In case you are already informed about US Legal Forms site and possess an account, basically log in. After that, it is possible to down load the Wisconsin Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant template.

Should you not offer an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for your correct town/area.

- Use the Review option to check the shape.

- Read the explanation to ensure that you have selected the right form.

- When the form is not what you are looking for, use the Research industry to find the form that suits you and needs.

- Once you obtain the correct form, click Buy now.

- Opt for the rates strategy you would like, fill out the specified information and facts to generate your money, and purchase an order using your PayPal or credit card.

- Decide on a convenient document formatting and down load your backup.

Find all the document themes you may have bought in the My Forms menus. You can get a further backup of Wisconsin Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landlord and the Tenant whenever, if needed. Just go through the needed form to down load or print out the document template.

Use US Legal Forms, probably the most considerable variety of authorized forms, to save time as well as stay away from blunders. The assistance provides skillfully produced authorized document themes that can be used for a selection of reasons. Create an account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

704.08 Check?in sheet. The landlord is not required to provide the check?in sheet to a tenant upon renewal of a rental agreement. This section does not apply to the rental of a plot of ground on which a manufactured home, as defined in s. 704.05 (5) (b) 1.

704.01 Definitions. In this chapter, unless the context indicates otherwise: (1) ?Lease" means an agreement, whether oral or written, for transfer of possession of real property, or both real and personal property, for a definite period of time.

A Wisconsin Lease Termination Letter Form (28-Day Notice) is a legal document that may be used by a landlord or tenant to provide at least twenty-eight (28) days advance notice for their intention to cancel a month to month lease.

At least 28 days' notice must be given except in the following cases: If rent is payable on a basis less than monthly, notice at least equal to the rent-paying period is sufficient; all agricultural tenancies from year-to-year require at least 90 days' notice.

The Wisconsin 14-day notice to quit for non-payment is a notice that a landlord will serve tenants who have failed to pay rent on time twice within a year to communicate that they must vacate the property within fourteen (14) days or face an eviction suit in court.

The landlord is responsible for making any repairs that are necessary to comply with local housing codes and to keep the premises safe. If the landlord refuses to repair major building defects, you may report the defect to your local building or health inspector. The landlord may not retaliate by evicting you.

Removal from premises The landlord may not confiscate your personal belongings, turn off your utilities, lock you out of your apartment, or use force to remove you. If the small claims court judge rules in the landlord's favor, the judge may issue a court order requiring you to leave the property.

If a tenant remains in possession without consent of the tenant's landlord after termination of the tenant's tenancy, the landlord may in every case proceed in any manner permitted by law to remove the tenant and recover damages for such holding over.