Wisconsin General Home Repair Services Contract - Short Form - Self-Employed

Description

How to fill out General Home Repair Services Contract - Short Form - Self-Employed?

Selecting the appropriate legal document template can be quite a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed, which can be utilized for business and personal purposes. All of the documents are verified by professionals and adhere to state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to obtain the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed. Use your account to access the legal documents you may have purchased previously. Navigate to the My documents tab of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the received Wisconsin General Home Repair Services Contract - Short Form - Self-Employed. US Legal Forms is the largest repository of legal templates where you can find numerous document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

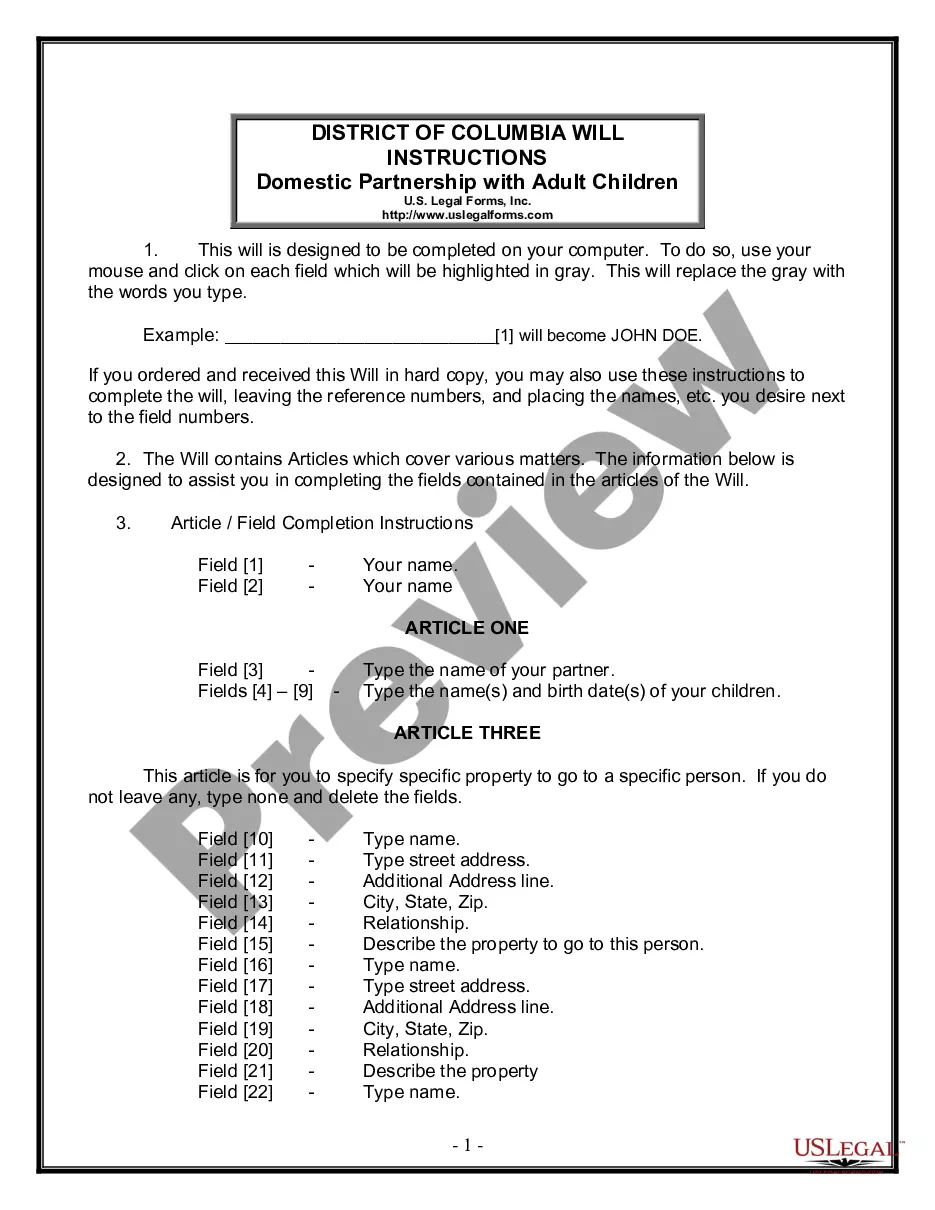

- First, ensure you have selected the correct form for your specific city/region. You can review the form using the Review button and explore the form outline to confirm it is the right one for you.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are certain that the form is suitable, click the Purchase now button to obtain the form.

- Select the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

Form popularity

FAQ

Yes, as an independent contractor in Wisconsin, you may need to add sales tax to your invoice for applicable services. If your work falls under the scope of taxable services defined by the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed, ensure to include the correct amount for tax. Doing so not only complies with tax regulations but also maintains transparency with your clients.

Independent contractors in Wisconsin typically need to fill out a W-9 form to provide their Taxpayer Identification Number to clients. Additionally, when working under a Wisconsin General Home Repair Services Contract - Short Form - Self-Employed, you may also need to keep thorough records for tax reporting and compliance. Accurate documentation helps streamline the tax process.

Certain services are exempt from sales tax in Wisconsin, including most personal and professional services. However, services related to tangible property, such as repairs, often require you to use a Wisconsin General Home Repair Services Contract - Short Form - Self-Employed. It is essential to review state regulations to identify any applicable exemptions.

In Wisconsin, alimony is taxable income for the recipient and tax-deductible for the payer. This means if you are receiving alimony, it impacts your overall income and could affect your obligations under a Wisconsin General Home Repair Services Contract - Short Form - Self-Employed. Always consult a tax professional to understand how alimony interacts with your earnings.

In Wisconsin, maintenance contracts are generally subject to sales tax unless specific exemptions apply. This means if you are using a Wisconsin General Home Repair Services Contract - Short Form - Self-Employed, you may need to consider the tax implications. It is crucial to keep track of all terms and conditions stated in your contract to ensure compliance with state regulations.

In Wisconsin, you can conduct up to $1,000 worth of work without needing a contractor's license, according to local laws. This means you can undertake smaller projects without the complexities of licensing. However, for larger jobs, the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed emphasizes the importance of compliance with licensing requirements. Always consider verifying with local authorities before starting any significant project.

In Wisconsin, a handyman can perform a variety of tasks under the framework of the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed. This typically includes minor electrical, plumbing, carpentry, and painting jobs. However, it's crucial to note that extensive renovations often require a licensed contractor. Always check local regulations to confirm what type of work you can legally conduct.

To fill out the Wisconsin General Home Repair Services Contract - Short Form - Self-Employed, begin by entering your name and contact information. Next, specify the scope of work you plan to undertake and include a detailed description of the services. Be sure to clarify payment terms, including total costs and payment schedules, to avoid future disputes. Always review your completed contract carefully before presenting it to your client.

Yes, you can be your own general contractor in Wisconsin. This means you can manage your own home repair projects without hiring a licensed contractor. However, it's essential to understand the legal requirements and liabilities involved. Utilizing a Wisconsin General Home Repair Services Contract - Short Form - Self-Employed can help simplify the process, ensuring you have the necessary documentation to protect your interests.