Wisconsin General Home Repair Services Contract - Long Form - Self-Employed

Description

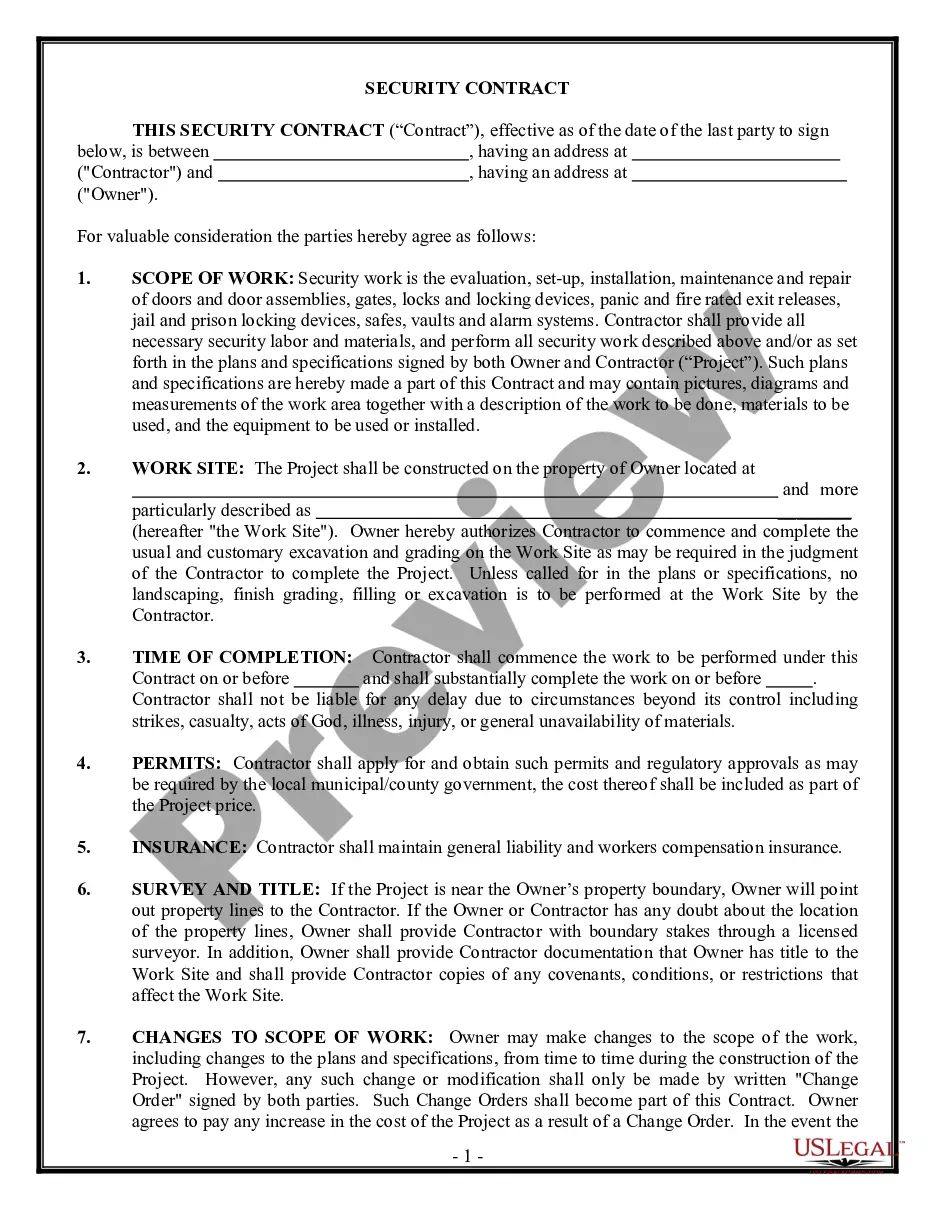

How to fill out General Home Repair Services Contract - Long Form - Self-Employed?

Are you in a circumstance where you need documents for either business or particular purposes almost every day.

There are numerous reliable document templates available online, but finding those you can trust isn’t simple.

US Legal Forms offers thousands of template documents, such as the Wisconsin General Home Repair Services Contract - Long Form - Self-Employed, designed to meet state and federal requirements.

Once you find the correct document, click Acquire now.

Choose the pricing plan you want, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin General Home Repair Services Contract - Long Form - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for your specific city/county.

- Use the Preview button to review the form.

- Check the description to ensure you’ve selected the correct template.

- If the template isn’t what you’re looking for, use the Lookup field to find the document that meets your needs.

Form popularity

FAQ

Yes, contract labor is generally taxable in Wisconsin. When you engage independent contractors for services, be aware that these payments typically incur sales tax unless specifically exempted. Utilizing the Wisconsin General Home Repair Services Contract - Long Form - Self-Employed can assist in clarifying your obligations and ensuring compliance.

Maintenance contracts typically fall under taxable services in Wisconsin. However, certain aspects might be exempt based on the specifics outlined in the Wisconsin General Home Repair Services Contract - Long Form - Self-Employed. It's a good idea to be clear about all contract terms to avoid unexpected tax liabilities.

In Wisconsin, alimony is considered taxable income for the recipient. Since alimony payments can significantly impact financial statements, it is advisable to account for them when drafting contracts or agreements. Using a Wisconsin General Home Repair Services Contract - Long Form - Self-Employed allows you to ensure all financial details are accurately reflected.

Independent contractors in Wisconsin usually need to fill out Form W-9 to provide their taxpayer identification information. Additionally, if they are self-employed, they may need to file a Schedule C along with their federal tax return. Utilizing a Wisconsin General Home Repair Services Contract - Long Form - Self-Employed can simplify the process and help ensure that all proper documentation is in order.

Yes, in Wisconsin, general contractors typically require a license to operate legally. Specific requirements can vary, so being aware of the details when creating a Wisconsin General Home Repair Services Contract - Long Form - Self-Employed is crucial. Licensing ensures compliance with statewide regulations and helps maintain quality and safety in home repair services.

Maintenance agreements are generally considered taxable in Wisconsin. However, if the agreement covers services that qualify as exempt under the Wisconsin General Home Repair Services Contract - Long Form - Self-Employed, those specific services may not incur sales tax. Always consult with a tax expert or use reliable forms to determine the tax implications for your specific contracts.

In Wisconsin, certain services are exempt from sales tax, including some repairs and improvements to real property, subject to specific guidelines. The Wisconsin General Home Repair Services Contract - Long Form - Self-Employed, can help clarify which services fall under this exemption. It's essential to distinguish between repair services and other taxable services, as not all home improvements qualify for tax exemption.

The Wisconsin Home Improvement Practices Act is a law designed to protect homeowners engaged in home improvement projects. This act establishes guidelines that contractors, including those who utilize a Wisconsin General Home Repair Services Contract - Long Form - Self-Employed, must follow to ensure fair practices. The law covers areas such as contractor registration, compliance with safety standards, and dispute resolution. Consider uslegalforms as a helpful resource to ensure your projects align with this act.

In Wisconsin, you generally have three business days to back out of a contract. This period allows you to reconsider your decision without any penalty. Make sure to review the terms of your Wisconsin General Home Repair Services Contract - Long Form - Self-Employed, as certain clauses may dictate specific cancellation policies. Utilizing resources from uslegalforms can help you understand your rights and obligations.