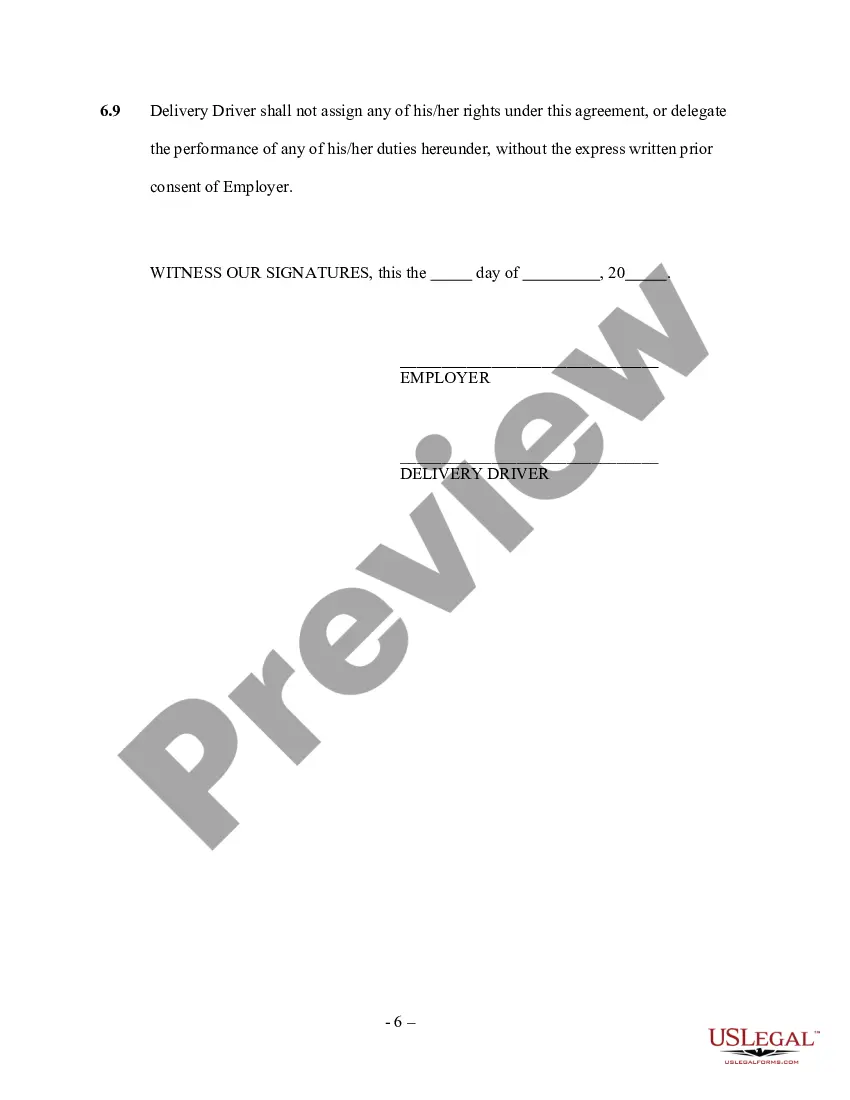

Wisconsin Delivery Driver Services Contract - Self-Employed

Description

How to fill out Delivery Driver Services Contract - Self-Employed?

Are you currently in a situation where you need documents for both business or personal reasons every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of form templates, such as the Wisconsin Delivery Driver Services Contract - Self-Employed, designed to meet state and federal requirements.

Choose the pricing plan you want, enter the required information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Delivery Driver Services Contract - Self-Employed template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it’s for the appropriate city/area.

- Utilize the Preview feature to review the document.

- Check the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs and specifications.

- When you locate the correct form, click Acquire now.

Form popularity

FAQ

To obtain a delivery driver contract, you can start by exploring templates specifically designed for this purpose. Platforms like US Legal Forms offer various resources, including a Wisconsin Delivery Driver Services Contract - Self-Employed that you can customize. This contract will help you define your terms clearly while establishing a professional relationship with your clients.

Yes, DoorDash drivers are generally classified as independent contractors. This setup permits them to choose their work hours and manage their delivery schedules without direct employer oversight. If you want to start your own delivery service or work similarly, a Wisconsin Delivery Driver Services Contract - Self-Employed can provide clear guidelines on your independent status and responsibilities.

Absolutely, a delivery driver can be an independent contractor. This arrangement allows drivers to enjoy various benefits, such as working at their own pace and retaining a larger share of their earnings. Utilizing a Wisconsin Delivery Driver Services Contract - Self-Employed can help define your role, outline payment schedules, and clarify liability issues with clients effectively.

Many delivery drivers work as independent contractors. This status grants them the freedom to manage their time and choose which deliveries to accept. When you enter into a Wisconsin Delivery Driver Services Contract - Self-Employed, you formalize your status as an independent contractor, ensuring both parties understand expectations regarding work and compensation.

Yes, you can definitely be a self-employed delivery driver. Many drivers operate independently, allowing them flexibility in their work hours and delivery routes. By signing a Wisconsin Delivery Driver Services Contract - Self-Employed, you establish your relationship with clients while clarifying responsibilities and payment terms. This contract enables you to run your business on your own terms.

Writing a self-employed contract involves outlining your services, payment methods, and timelines. Start by detailing your responsibilities and any deliverables. Ensure you integrate the terms of the Wisconsin Delivery Driver Services Contract - Self-Employed, which can guide you through essential legal obligations. This clarity fosters trust and professionalism in your working relationships.

Yes, you can write your own legally binding contract as long as it meets specific legal requirements. Focus on clarity and specificity in your terms, including payment, services, and duration. By using the Wisconsin Delivery Driver Services Contract - Self-Employed as a reference, you can shape your contract to be compliant and effective. This empowers you in your self-employment journey.

To write a self-employment contract, begin by clearly defining the services you offer and the terms of engagement. Specify the payment structure, including rates and frequency. Refer to the Wisconsin Delivery Driver Services Contract - Self-Employed to ensure consistency and legal soundness. This contract protects your rights and sets clear expectations for your clients.

Writing a simple employment contract starts with stating the parties involved and their roles. Include essential details such as the expected hours, payment structure, and job responsibilities. While a Wisconsin Delivery Driver Services Contract - Self-Employed is suited for freelancers, ensuring that all information is clear and concise is key. This approach helps maintain a positive working relationship.

To write a contract for a 1099 employee, start by drafting a clear outline of the job responsibilities and expectations. Specify payment details, such as rates per delivery or hourly wages. Include references to the Wisconsin Delivery Driver Services Contract - Self-Employed to ensure compliance with relevant tax regulations. This clarity minimizes misunderstandings and protects both parties' interests.