North Carolina Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Are you currently in the situation the place you need to have files for sometimes business or specific functions almost every time? There are a lot of legitimate record web templates available online, but discovering types you can rely on is not effortless. US Legal Forms offers a huge number of develop web templates, just like the North Carolina Credit Agreement regarding extension of credit, that happen to be written to satisfy federal and state demands.

When you are previously informed about US Legal Forms site and have a free account, basically log in. Following that, you are able to acquire the North Carolina Credit Agreement regarding extension of credit format.

Unless you offer an profile and want to start using US Legal Forms, adopt these measures:

- Get the develop you need and make sure it is to the correct area/region.

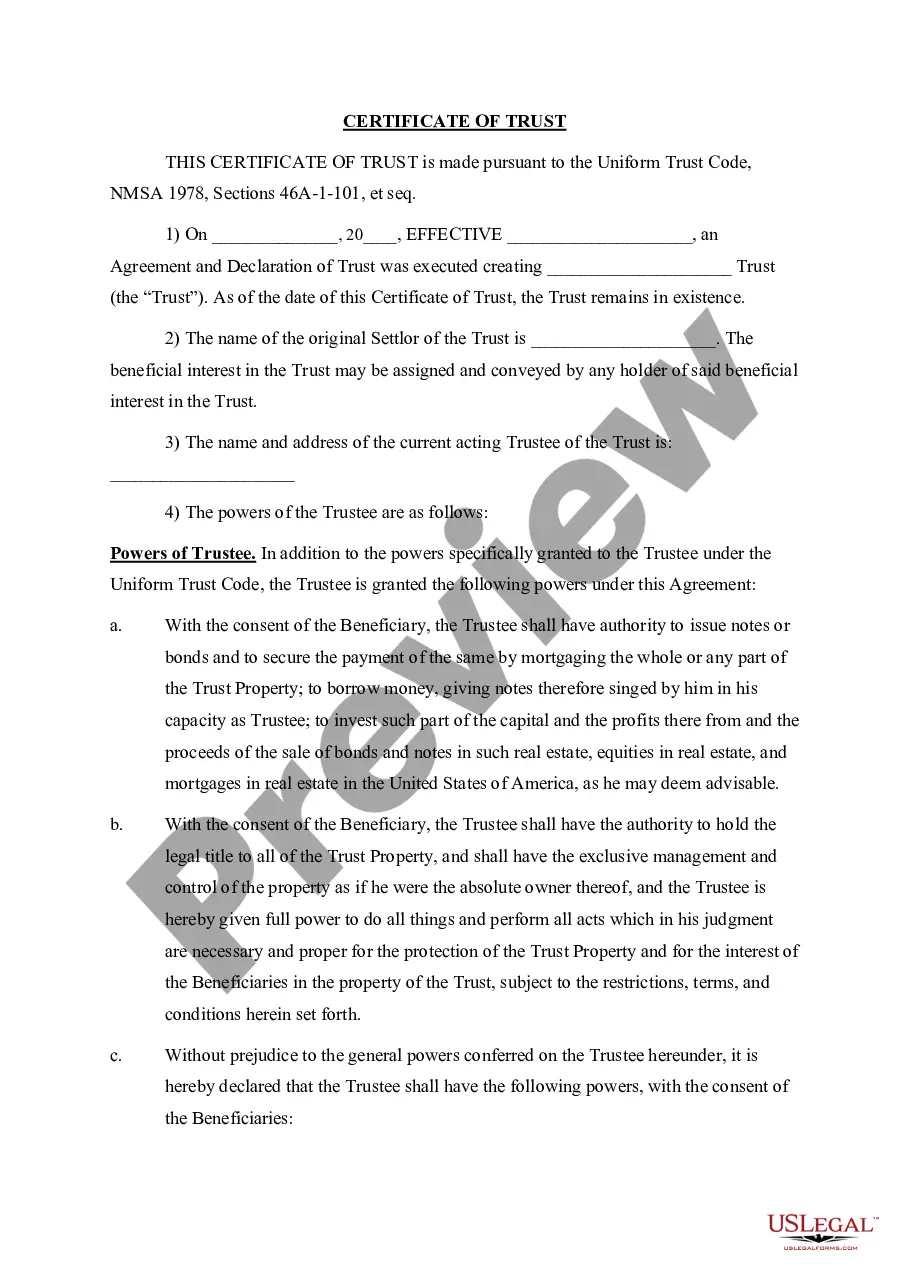

- Utilize the Review button to analyze the form.

- Read the outline to actually have selected the appropriate develop.

- When the develop is not what you`re seeking, make use of the Look for field to discover the develop that suits you and demands.

- Once you obtain the correct develop, click on Purchase now.

- Pick the pricing prepare you need, submit the specified details to create your money, and purchase the transaction using your PayPal or charge card.

- Pick a convenient document format and acquire your version.

Get all of the record web templates you have purchased in the My Forms menus. You can obtain a extra version of North Carolina Credit Agreement regarding extension of credit anytime, if needed. Just go through the needed develop to acquire or printing the record format.

Use US Legal Forms, by far the most considerable selection of legitimate types, to save time as well as steer clear of faults. The assistance offers appropriately created legitimate record web templates which can be used for a range of functions. Produce a free account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

A credit agreement is a legally binding contract between two parties in which a loan is offered. These agreements detail all the conditions of the loan and the repayment process and are signed by both the Lender and the Borrower. Credit agreements are also often referred to as loan agreements.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

In addition to pricing information, your credit card agreement will include every detail of your credit card including: The types of transactions you can make on your credit card. Your credit limit and information about how your credit card issuer can change it. Details about using your credit card in another country.

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

The NCA does not require that a credit agreement must be in writing and signed by both parties to the agreement, although this is implied throughout the Act. A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes.

Your credit agreement is drawn up by your finance provider and contains key details regarding your loan. This includes the amount borrowed, your Interest Rate and Term Length, in addition to the terms and conditions of your agreement.