Wisconsin Investment - Grade Bond Optional Redemption (with a Par Call)

Description

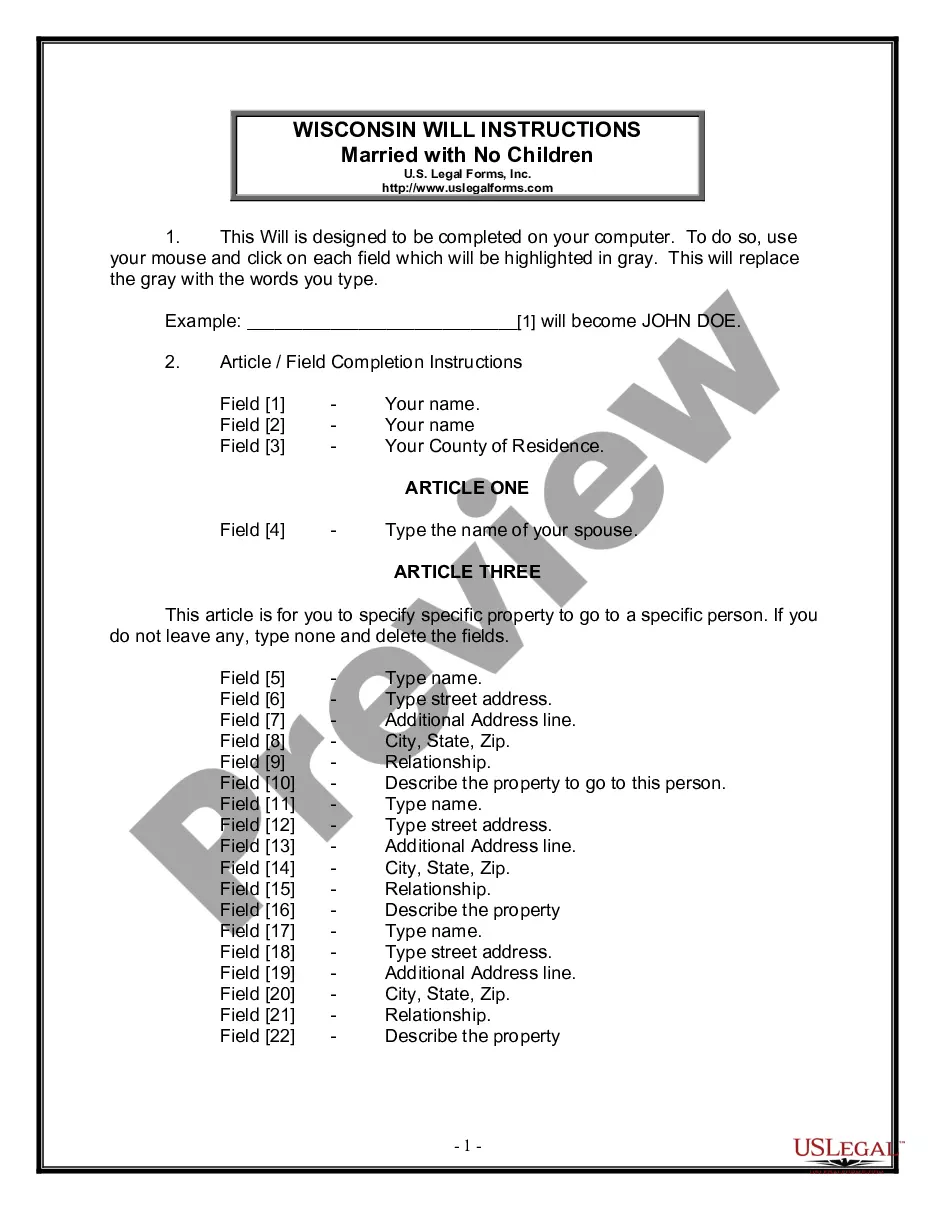

How to fill out Investment - Grade Bond Optional Redemption (with A Par Call)?

If you need to comprehensive, down load, or produce legitimate file web templates, use US Legal Forms, the largest selection of legitimate types, that can be found on the Internet. Utilize the site`s simple and practical search to get the files you need. A variety of web templates for organization and individual functions are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to get the Wisconsin Investment - Grade Bond Optional Redemption (with a Par Call) in just a number of click throughs.

When you are currently a US Legal Forms client, log in to the bank account and click on the Acquire key to obtain the Wisconsin Investment - Grade Bond Optional Redemption (with a Par Call). You can even entry types you in the past delivered electronically in the My Forms tab of your respective bank account.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for your proper town/land.

- Step 2. Utilize the Review option to look over the form`s articles. Never overlook to read the outline.

- Step 3. When you are unsatisfied using the type, take advantage of the Research area near the top of the monitor to find other models from the legitimate type web template.

- Step 4. Once you have discovered the shape you need, go through the Acquire now key. Select the rates prepare you like and add your qualifications to register to have an bank account.

- Step 5. Approach the transaction. You may use your credit card or PayPal bank account to perform the transaction.

- Step 6. Choose the formatting from the legitimate type and down load it on the device.

- Step 7. Total, change and produce or indication the Wisconsin Investment - Grade Bond Optional Redemption (with a Par Call).

Every legitimate file web template you buy is your own property eternally. You have acces to every single type you delivered electronically within your acccount. Click the My Forms area and choose a type to produce or down load yet again.

Contend and down load, and produce the Wisconsin Investment - Grade Bond Optional Redemption (with a Par Call) with US Legal Forms. There are millions of professional and condition-distinct types you can use for your organization or individual demands.

Form popularity

FAQ

There are five main types of bonds: Treasury, savings, agency, municipal, and corporate. Each type of bond has its own sellers, purposes, buyers, and levels of risk vs. return. If you want to take advantage of bonds, you can also buy securities that are based on bonds, such as bond mutual funds.

Bond redemption can be either optional or mandatory. Bond redemption is a significant event for bondholders, as it signals the end of the bond's life cycle and the return on their investment. The redemption date and price are already predetermined in the information memorandum at the time of issuance.

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

Most bonds are redeemable at par (i.e. redeemed at their face value). Some bonds are callable and can be redeemed prior to the maturity date. These types of bonds are redeemable at premium (i.e. value greater than the face value of the bond). The redemption value is stated as a percentage of face value.

There are three basic types of bonds: U.S. Treasury, municipal, and corporate.

A Callable bond is a bond for which the issuer (borrower) has an option to redeem prior to the normal maturity date. The earliest date is the call date. A Putable bond (or a put bond) is a bond for which the owner (lender) has an option to redeem prior to the normal maturity date. The earliest date is the put date.