Wisconsin Statement for Vietnam Era Veterans and / or the Disabled

Description

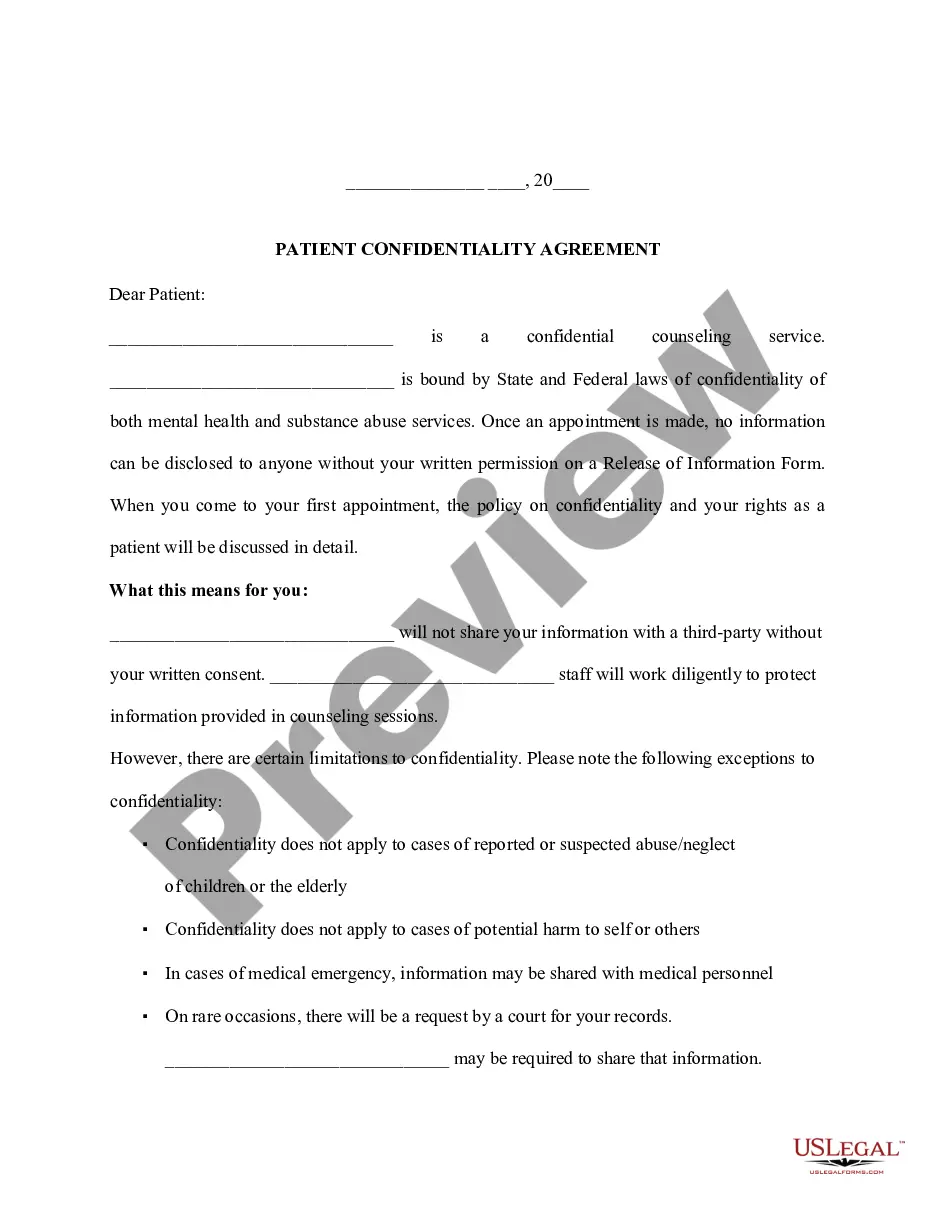

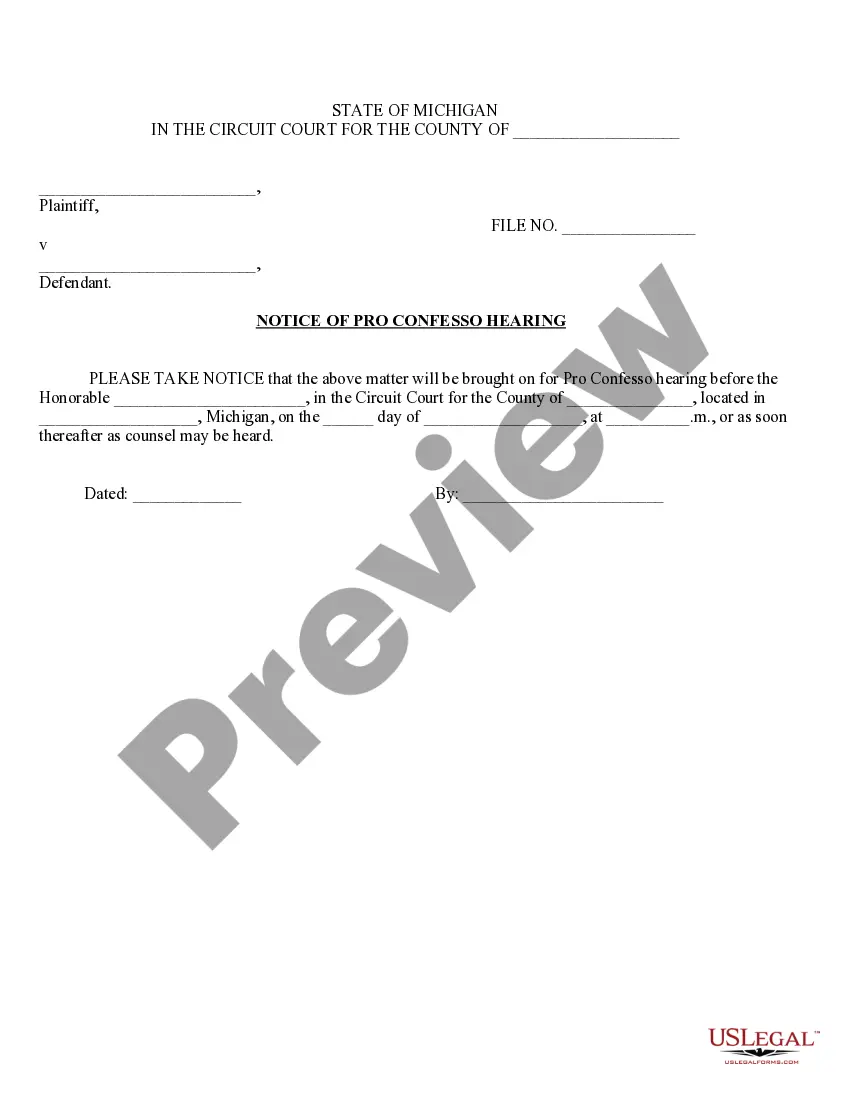

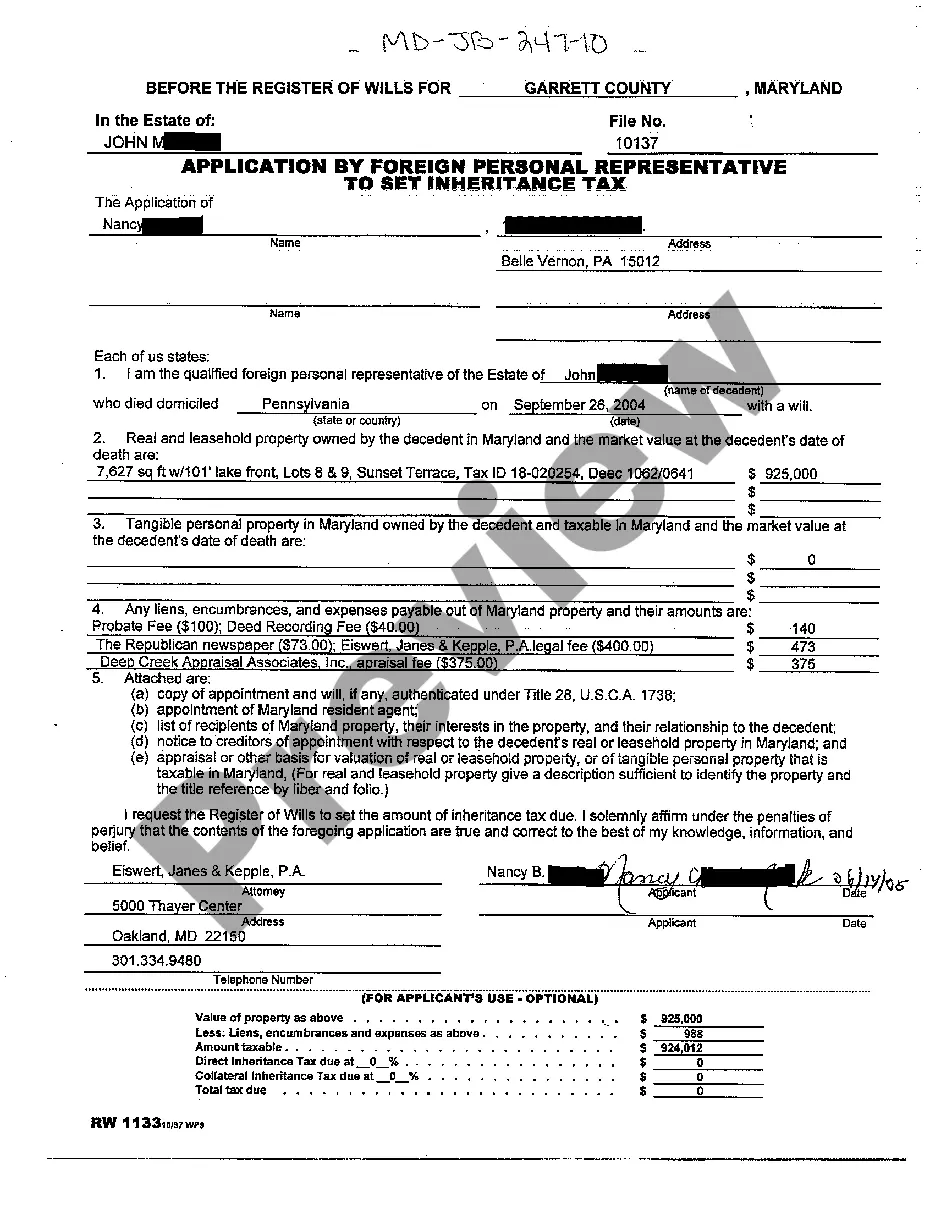

How to fill out Statement For Vietnam Era Veterans And / Or The Disabled?

In case you require to complete, acquire, or generate lawful document templates, utilize US Legal Forms, the premier selection of legal forms, available online.

Take advantage of the site's intuitive and user-friendly search function to find the documents you need. A variety of templates for business and personal use are organized by categories and states, or keywords.

Employ US Legal Forms to locate the Wisconsin Statement for Vietnam Era Veterans and/or the Disabled in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you acquired within your account. Click the My documents section and select a form to print or download again.

Compete and acquire, and print the Wisconsin Statement for Vietnam Era Veterans and/or the Disabled with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and select the Buy button to obtain the Wisconsin Statement for Vietnam Era Veterans and/or the Disabled.

- You can also access forms you previously acquired under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines listed below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you wish to use, click on the Buy now button. Choose your preferred pricing plan and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Wisconsin Statement for Vietnam Era Veterans and/or the Disabled.

Form popularity

FAQ

A disabled veteran or their surviving spouse in Wisconsin may receive a property tax credit on their state income tax return for his/her primary residence if the veteran is 100 percent disabled as a result of service or has a 100 percent SCD rating.

Veterans with a 100 percent disability rating receive the maximum monthly, tax-free compensation available. Depending on the circumstances, a Veteran with a 100 percent disability rating receives monthly compensation of $3,106.04.

A disabled veteran or their surviving spouse in Wisconsin may receive a property tax credit on their state income tax return for his/her primary residence if the veteran is 100 percent disabled as a result of service or has a 100 percent SCD rating.

Veterans who have a 100% disability rating also can receive state-specific property tax reduction or exemption. Along with employment, education, training assistance, free or reduced vehicle registration, survivor and dependent benefits, and of course, VA disability compensation.

A disabled veteran or their surviving spouse in Wisconsin may receive a property tax credit on their state income tax return for his/her primary residence if the veteran is 100 percent disabled as a result of service or has a 100 percent SCD rating.

Disabled Veterans Property Tax Credit Veterans who are rated 100% permanently and totally disabled and those deemed by the VA to be 100% due to individual unemployability are eligible under the Wisconsin Veterans & Surviving Spouses Property Tax Credit to escape paying taxes on their primary residence.

Personalizing your Disabled Veteran Parking plates is optional. A $15 personalized plate fee is required each year in addition to the regular annual registration fee.

The Wisconsin Veterans & Surviving Spouses Property Tax Credit provides eligible veterans and unremarried, surviving spouses a refundable property tax credit for their primary, in-state residence and up to one acre of land.

Wisconsin offers a wide-ranging list of financial tax benefits to veterans and their families. The Wisconsin Veterans and Surviving Spouses Property Tax Credit gives eligible veterans and un-remarried, surviving spouses a refundable property tax credit for their primary, in-state residence and up to one acre of land.