Wisconsin Merchandise Return Sheet

Description

How to fill out Merchandise Return Sheet?

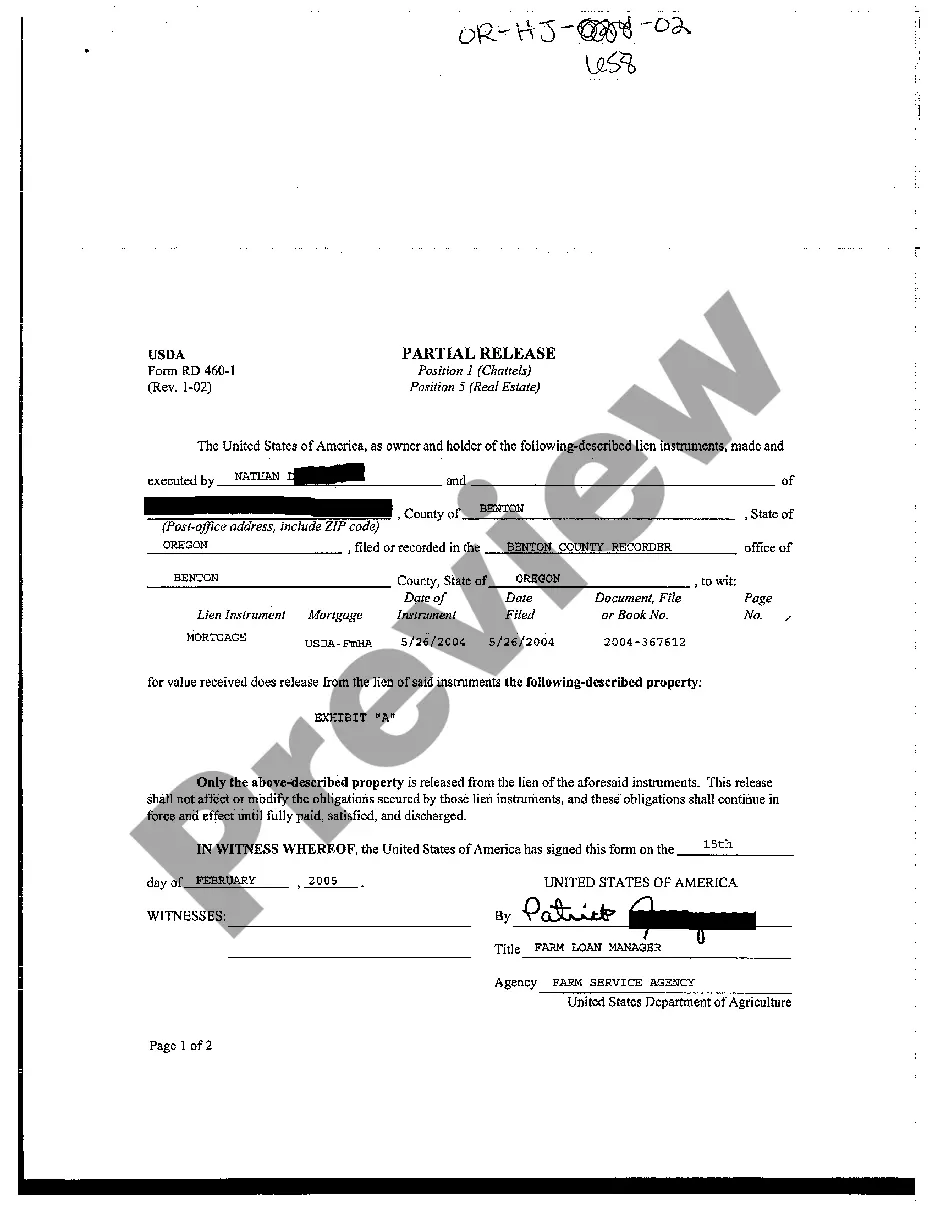

Selecting the appropriate legal document format can be challenging. Of course, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website. The service provides a vast selection of templates, including the Wisconsin Merchandise Return Sheet, suitable for both business and personal purposes. All forms have been reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Merchandise Return Sheet. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to acquire another copy of the documents you require.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: Initially, ensure that you have selected the appropriate form for your area/region. You can preview the form using the Preview button and read the form description to confirm that it is suitable for you.

US Legal Forms is the largest repository of legal forms where you can access various document templates. Take advantage of the service to download professionally crafted paperwork that adheres to state requirements.

- If the form does not meet your needs, use the Search field to find the correct document.

- Once you are confident that the form is appropriate, click on the Download Now button to obtain the form.

- Select the pricing plan that you prefer and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

- Choose the format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Wisconsin Merchandise Return Sheet.

Form popularity

FAQ

You'll need to attach any IRS form or schedule used to prepare your return to your 1040 form before mailing your tax return off. All the forms and schedules used in preparation create your entire return, and the IRS needs these in order to process your tax return and the items you report.

TeleFile is a quick and easy method to file your sales tax return. In order to get started all you need is a touch tone telephone and your sales tax information.

If you are filing Wisconsin Form 1, send your return to the Wisconsin Department of Revenue at:If refund or no tax due. PO Box 59. Madison, WI 53785-0001.If refund or no tax due. PO Box 59. Madison, WI 53785-0001.If tax is due or submitting Schedule CC to request a closing certificate: PO Box 8918. Madison, WI 53708-8918.

Why Is Telefile No Longer Available? In the eight years the IRS allowed telefiling, it was presented as a convenient service for taxpayers with simple tax returns. The Telefile service worked by letting taxpayers dial the numbers on their tax return directly into the phone to report their income.

YES. State of Wisconsin requires it.

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Completing your Return If handwritten, use black or blue ink only. Do not staple or attach your check, W-2s or any other documents to your return. Submit proper documentation (schedules, statements and supporting documentation, including W-2s, other states' tax returns, or necessary federal returns and schedules).

Copies of appropriate Wisconsin schedules and supporting documents. Legible withholding tax statements (Forms W-2, W-2G, K-1, and/or 1099). If the state copy of the withholding tax statement is not legible, please attach a photocopy of the original page of the statement.

Yes. Wisconsin requires a complete copy of your federal return.

Visit the Ohio Business Gateway. Access TeleFile by calling (800) 697-0440.