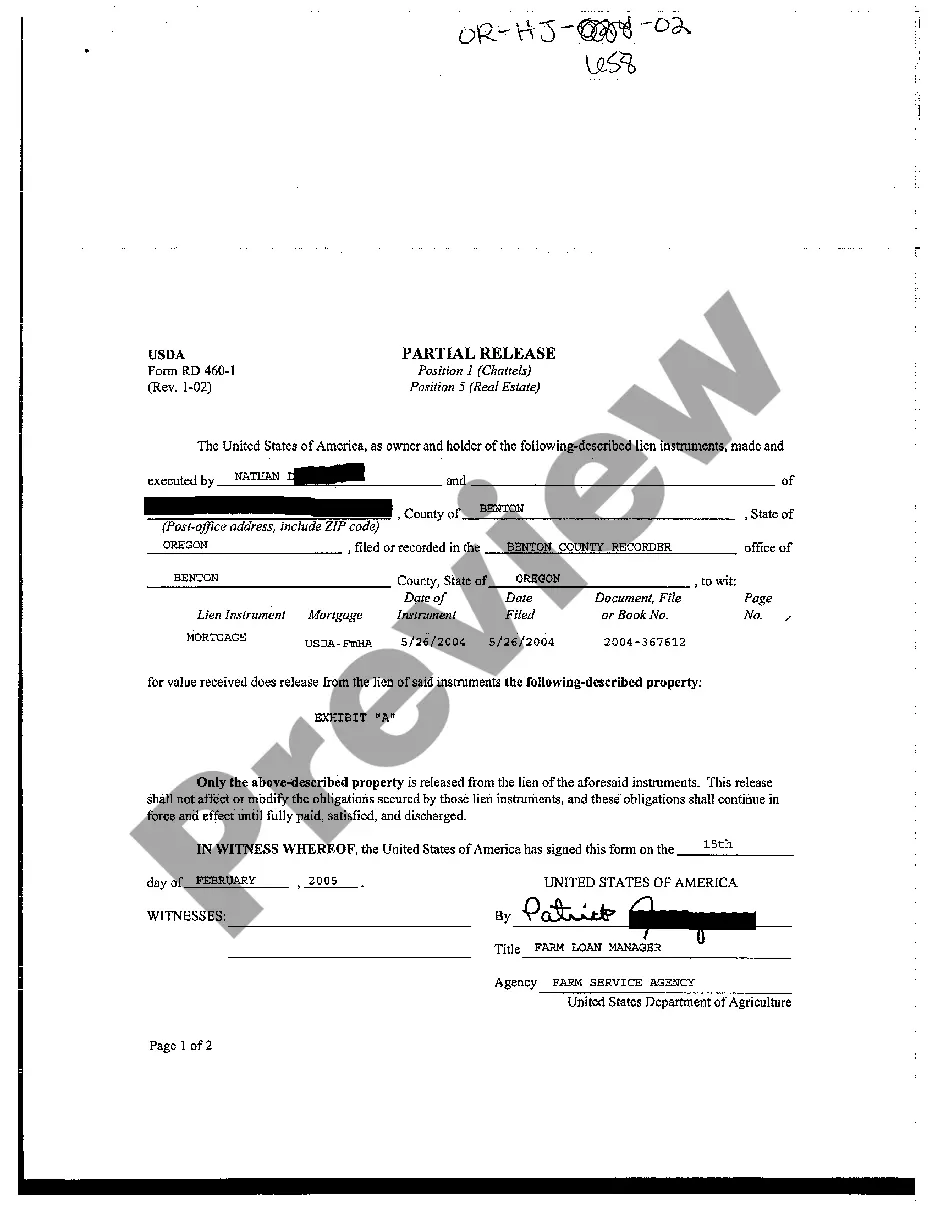

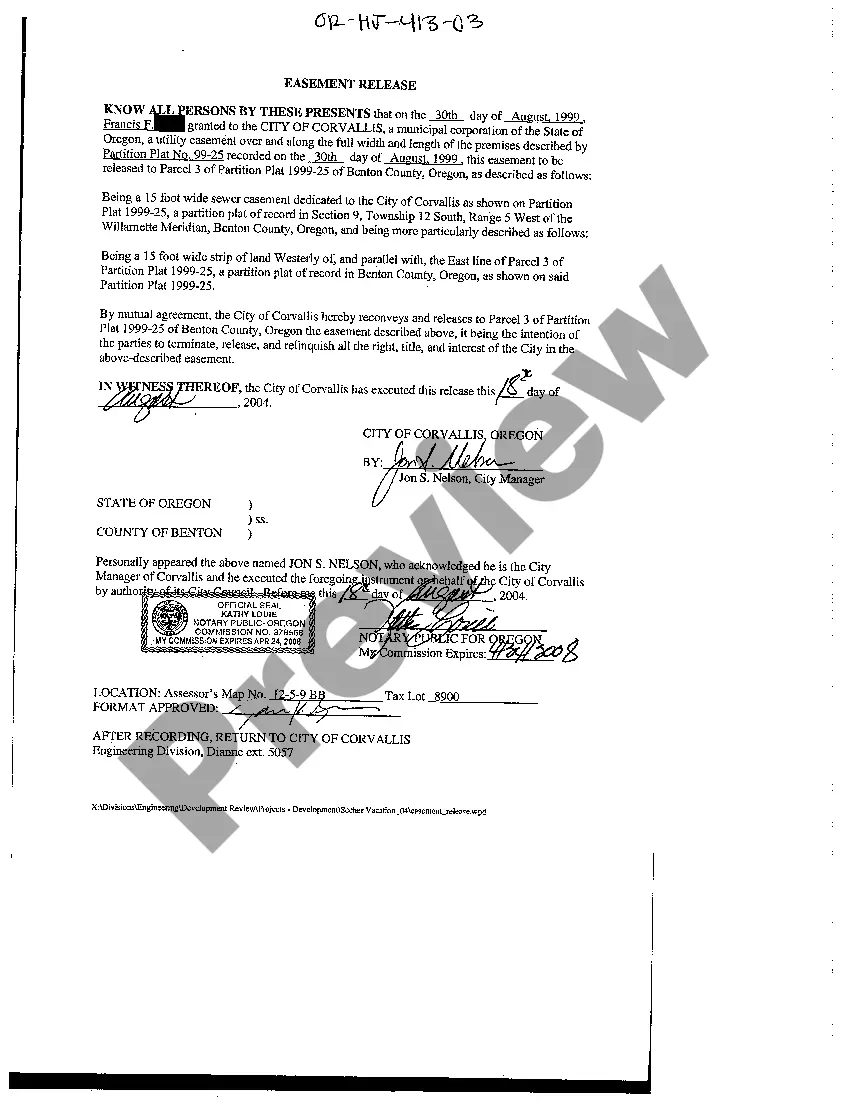

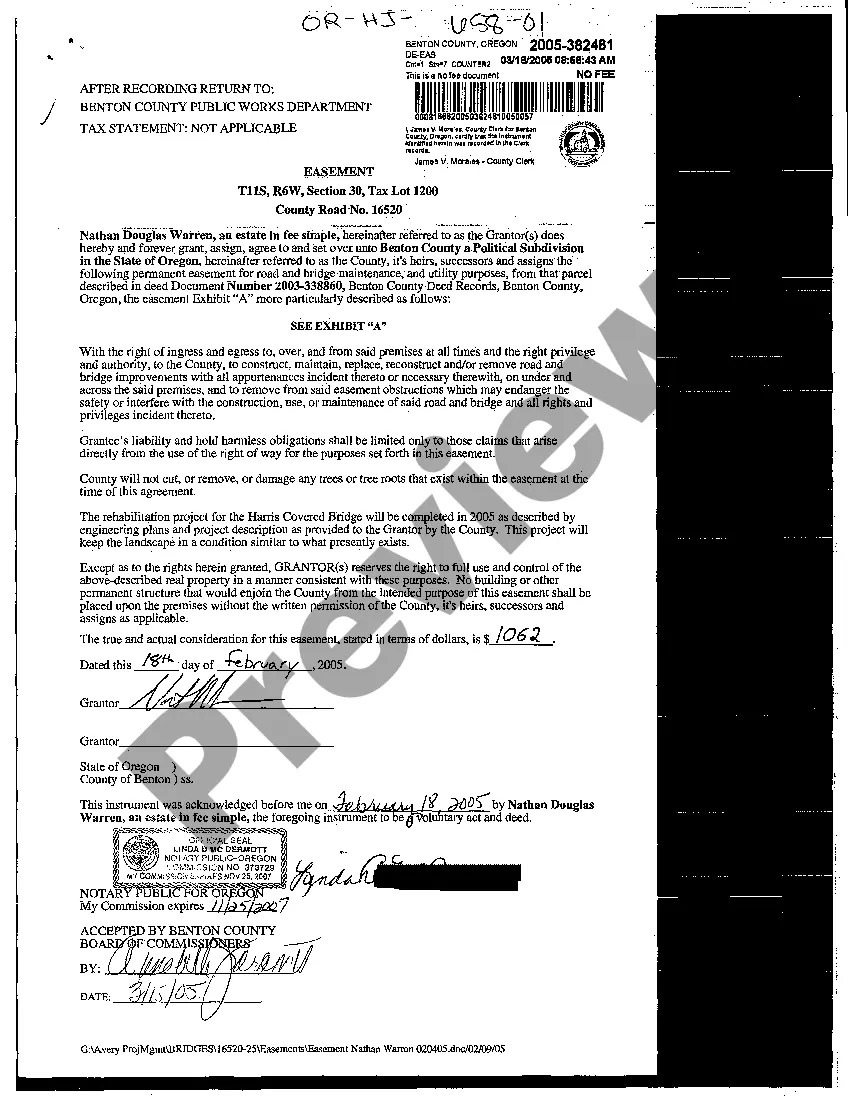

Oregon Partial Release

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Partial Release?

Creating papers isn't the most straightforward process, especially for those who almost never work with legal paperwork. That's why we recommend making use of correct Oregon Partial Release samples made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or working with formal institutions. Find the files you want on our site for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will immediately appear on the file page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users with no a subscription can quickly get an account. Utilize this simple step-by-step help guide to get the Oregon Partial Release:

- Make certain that the form you found is eligible for use in the state it’s necessary in.

- Verify the file. Utilize the Preview option or read its description (if readily available).

- Buy Now if this sample is the thing you need or use the Search field to find another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After finishing these straightforward actions, you can complete the sample in your favorite editor. Double-check filled in info and consider requesting a lawyer to review your Oregon Partial Release for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

The We The People Promissory Note form is used to document that a borrower (the maker) agrees or promises to pay back money to a lender (the holder) according to specified terms. When used with a We The People Deed of Trust, the Promissory Note is secured with a lien on the real estate listed in the Deed of Trust.

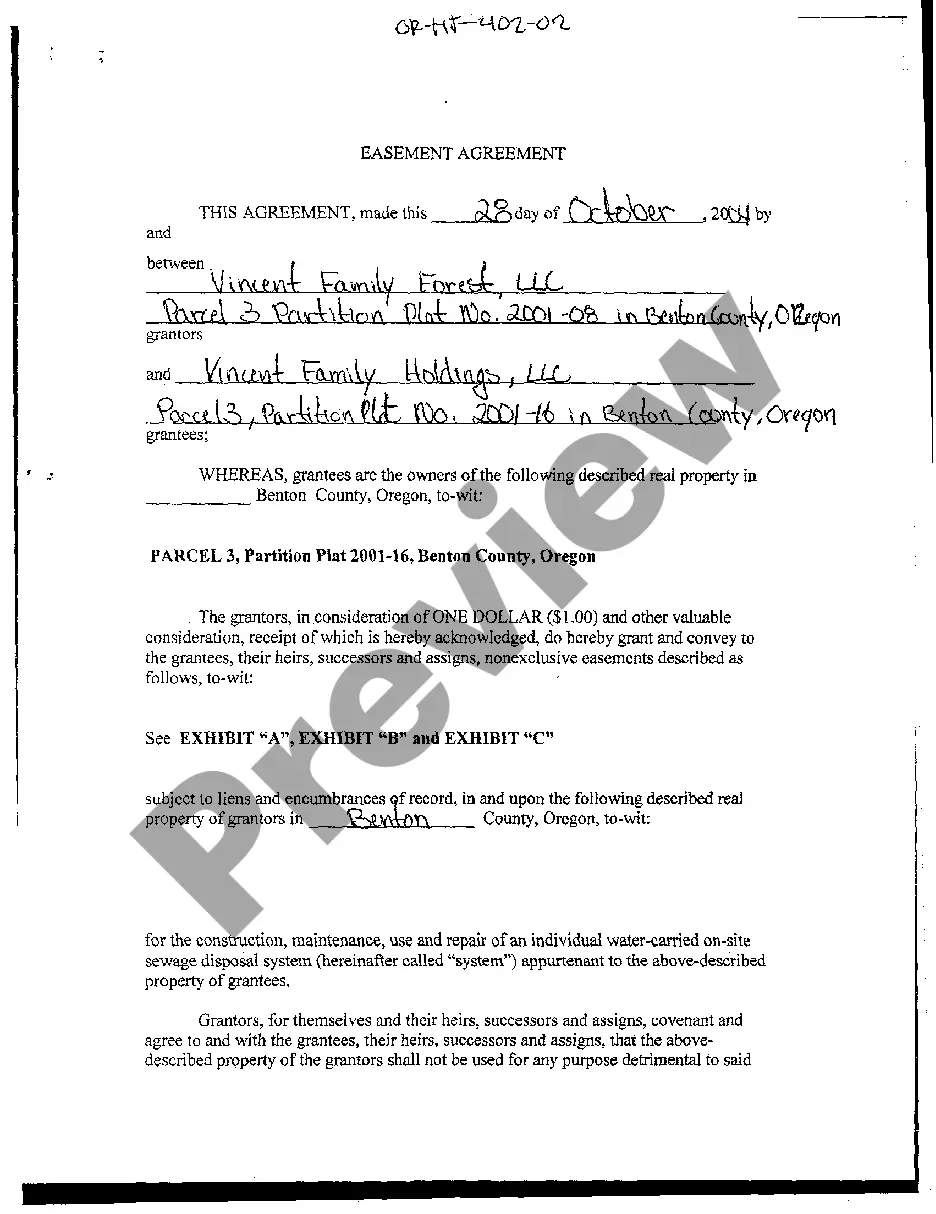

A trust deed is a real property security instrument created by statute. The relevant statute is the Oregon Trust Deed Act, ORS 86.705-86.795.When the grantor (the property owner) pays the debt owed to the beneficiary (the lender), the trustee re-conveys the property back to the grantor.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

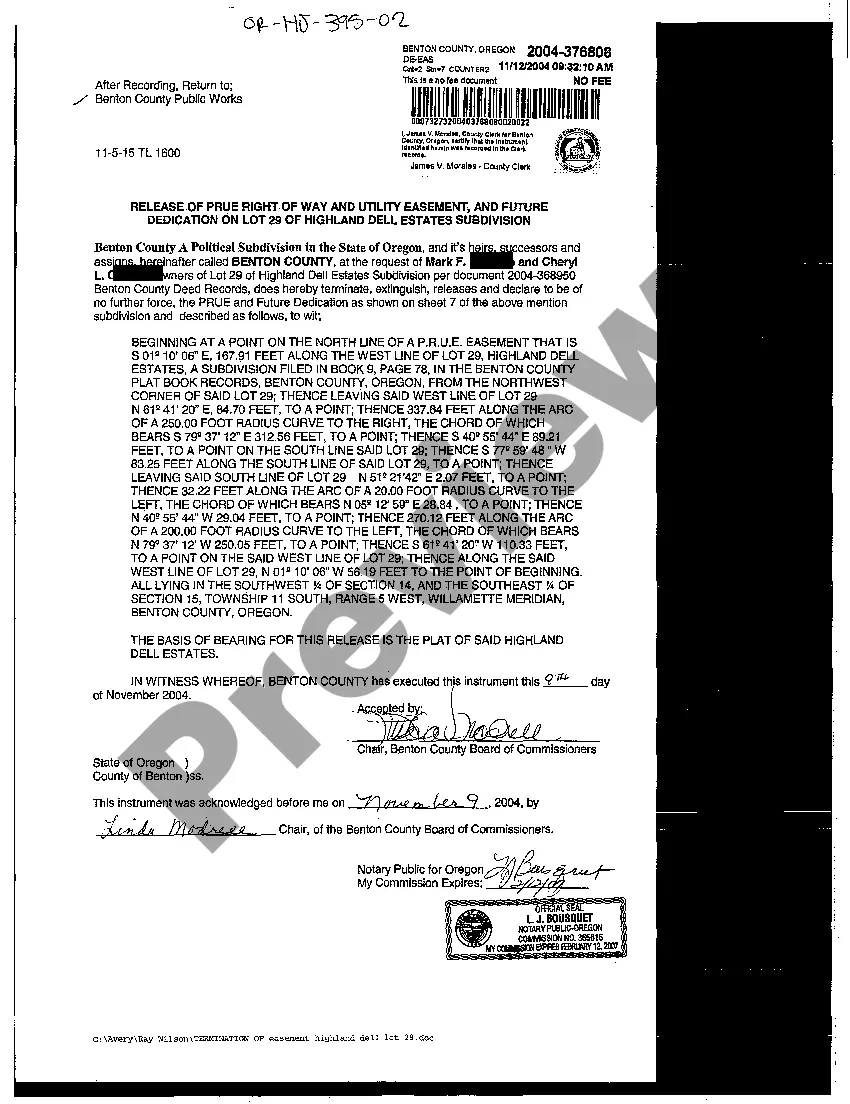

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.