Puerto Rico Employee Grievance Form

Description

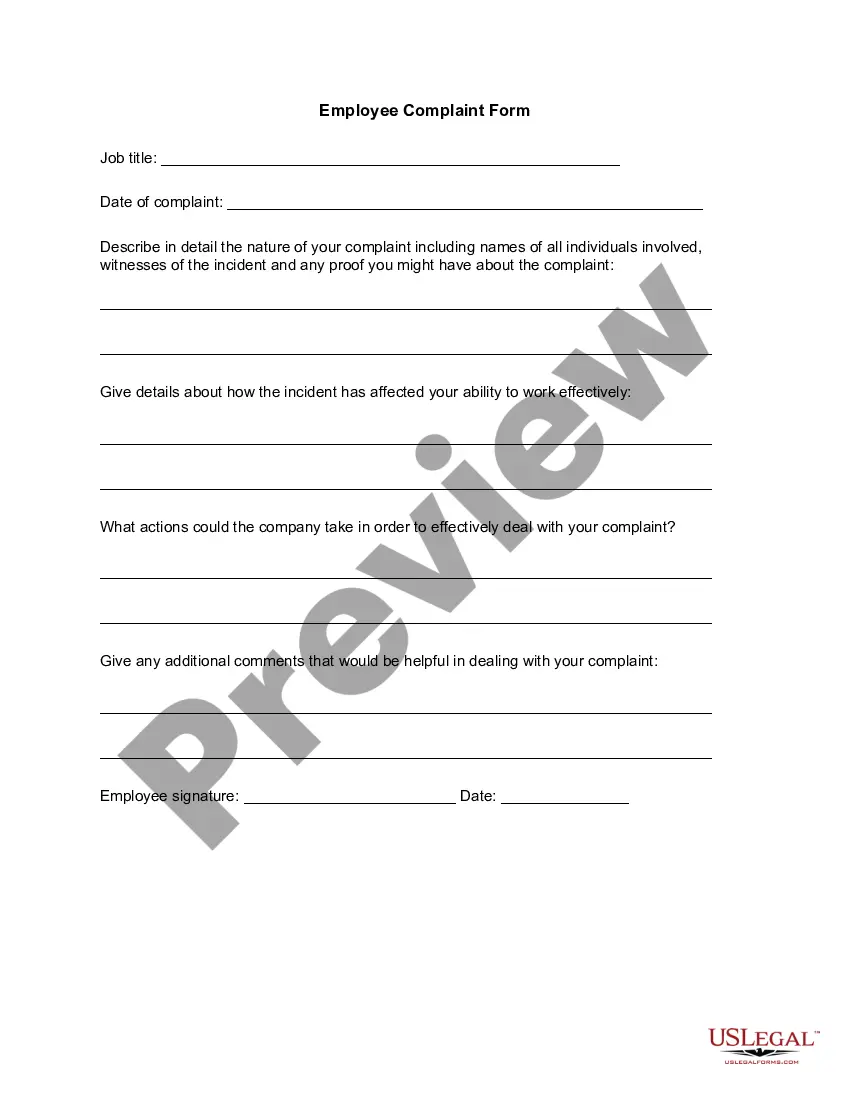

How to fill out Employee Grievance Form?

Are you presently in a situation where you need documents for various business or personal purposes almost every workday.

There is a multitude of legal document templates available online, but it isn't easy to find reliable ones.

US Legal Forms offers an extensive collection of form templates, including the Puerto Rico Employee Grievance Form, which is crafted to fulfill state and federal requirements.

If you locate the appropriate form, click Get now.

Choose the pricing plan you prefer, provide the necessary information to set up your payment, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the design of the Puerto Rico Employee Grievance Form.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your city/state.

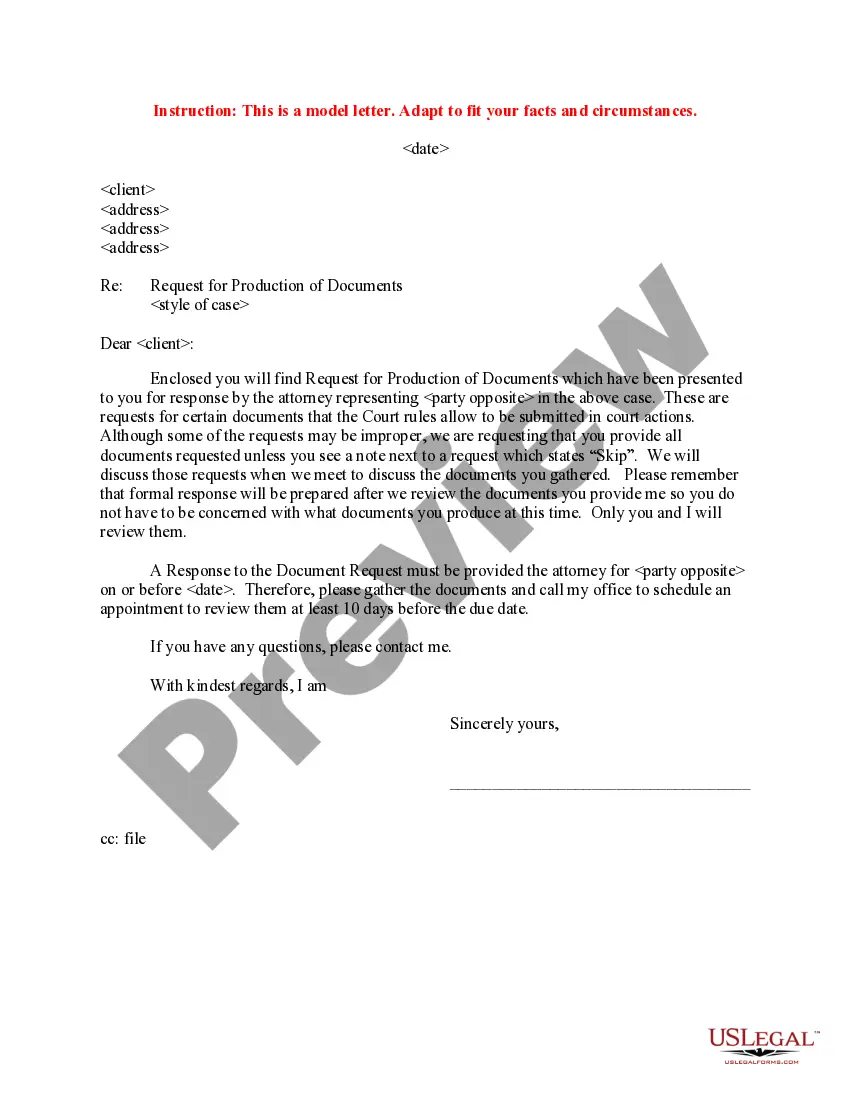

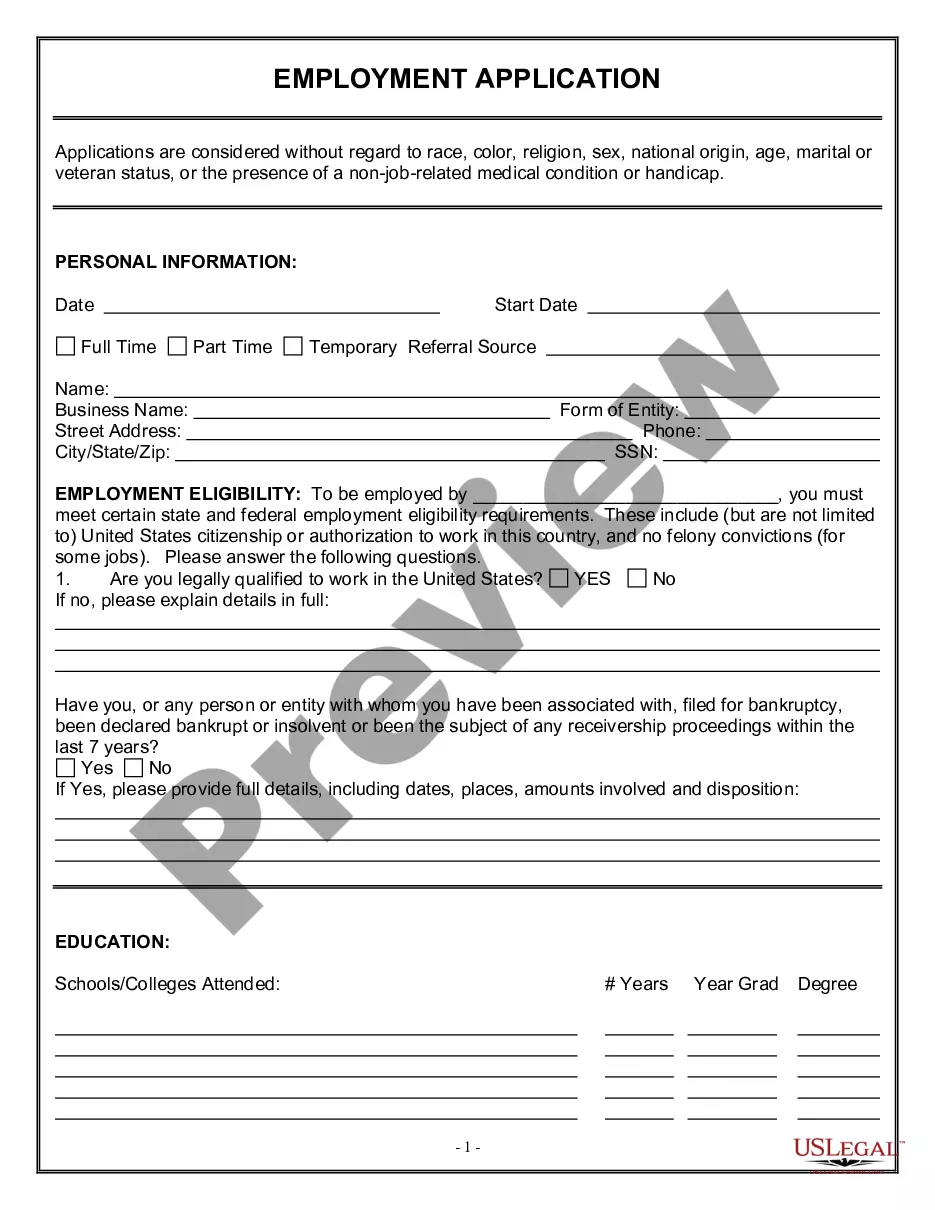

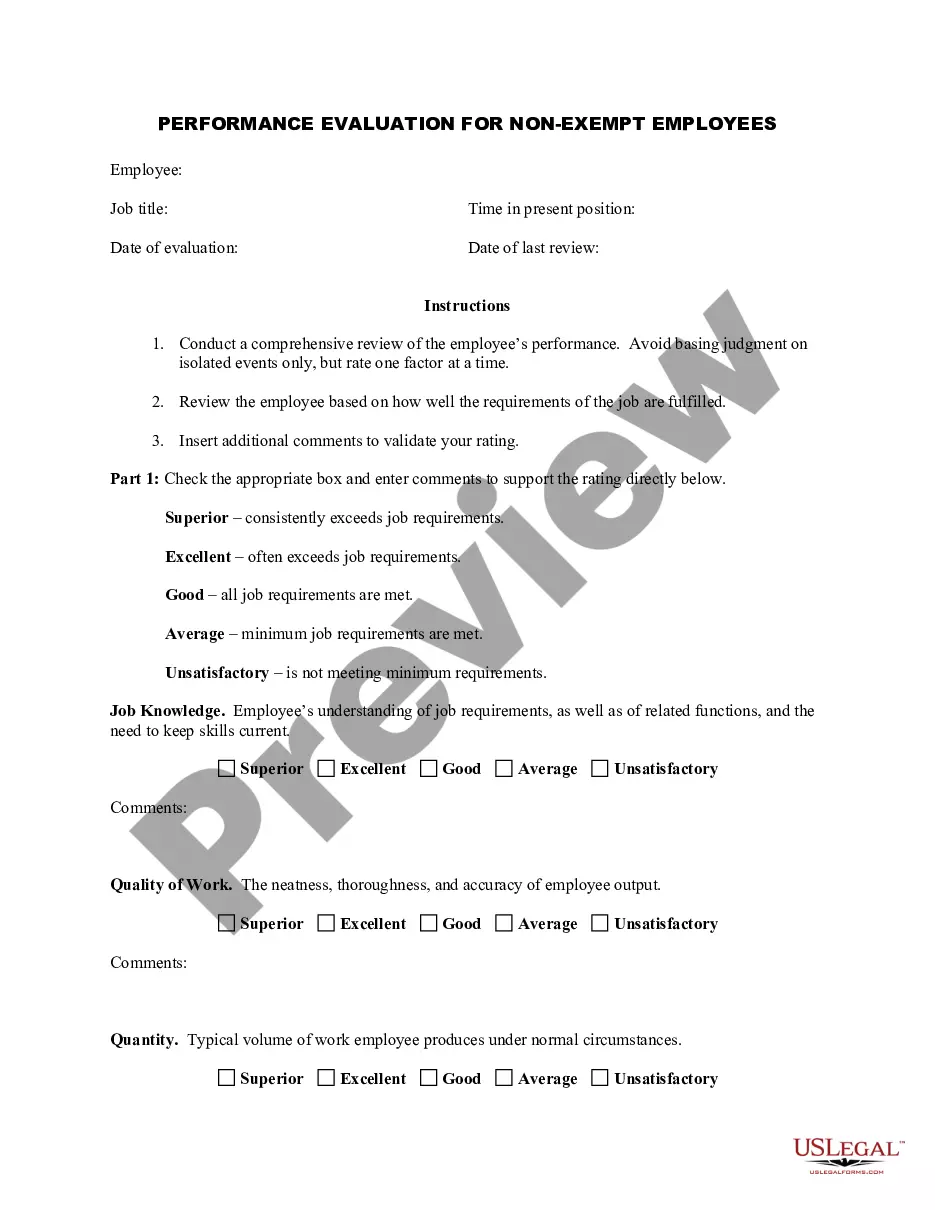

- Use the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search section to find the form that suits your requirements.

Form popularity

FAQ

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

No. You don't even need a passport. For U.S. citizens, traveling to and working in Puerto Rico is like traveling to or working in another state. U.S. citizens only need a valid driver's license to travel to and work from Puerto Rico.

2.3 Working Hours. According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Wage and hour coverage in Puerto Rico for non-exempt employees is governed by the US Fair Labor Standards Act (FLSA) as well as local laws.

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.